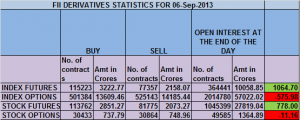

- FIIs bought 37866 contracts of Index Future (Bought 24525 long contract and 13341 shorts were liquidated) worth 778 cores with net Open Interest increasing by 11184 contracts.So FII have covered 81K contract of NF and BNF shorts in past 3 trading sessions and added 25.6K contract of fresh longs in NF and BNF suggesting short covering done and now follow up buying await to push index higher.

- Nifty is approaching its crucial 50 DMA@5705 tomorrow, Any close above it will propel nifty further towards 200 DMA as discussed in weekly analysis. Unable to close above 50 DMA and trading below 5686 short term pullback till 5605 can be seen in next 2 days.

- Nifty Future Sep Open Interest Volume is at 1.840cores with addition of 3 lakhs in Open Interest, so longs are getting back to system with rise in cost of carry.

- Total Future & Option trading volume at 1.35 lakh with total contract traded at 3.6 lakh ,PCR (Put to Call Ratio) at 1.03. VIX consolidating in range of 28-31 for time being.

- 5700 Nifty CE is having highest OI at 43.1 lakhs with addition of 2.2 lakhs in OI. 5500 CE liquidated 2.5 lakh in OI will be strong support in short term.As per FII analysis,17.5 K long were entered in Calls, 5.9 K contract were written. 5300-5800 CE liquidated 4.1 lakh in OI.

- 5300 PE OI at 68 lakh remain the highest OI, remains the firm support for time being. 5400/5500 and 5600 PE together added 21.5 lakh in OI, suggesting strong support of Nifty at lower levels . As per FII data liquidated 5.8 K contract of PE and wrote 29.4 K contract FII options data analysis shows a bullish picture with Huge PE writing and Call Buying.5300-5800 PE added huge 30 lakh in OI.

- FIIs bought in Equity in tune of 800 cores ,and DII sold 238 cores in cash segment.INR closed at 65.2. Has Indian Rupee made Short term Top, Weekly Analysis

- Nifty Futures Trend Deciding level is 5661(For Intraday Traders). NF Trend Changer Level (Positional Traders) 5487 and BNF Trend Changer Level (Positional Traders) 9182.How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .

Buy above 5689 Tgt 5705,5720 and 5750(Nifty Spot Levels)

Sell below 5645 Tgt 5626, 5605 and 5585(Nifty Spot Levels)

I have been getting lots of mail to share performance of positional calls based on new trading course we have launched , Readers can see the performance http://positionalcallsperformance.blogspot.in/

Live Nifty A/D charts Click on the Link

Traders who use Pivot and Camarilla can use the following 2 sites for Hourly values and EOD values

http://camarillapivotpoints.blogspot.com/

http://niftystockpivot.blogspot.in/

You can LIKE Facebook page by clicking on the below link and get timely update.http://www.facebook.com/pages/Brameshs-Tech/140117182685863