A Market on the Brink of War: FIIs Unleash Historic Bearish Assault Against a Wall of Retail Bullishness

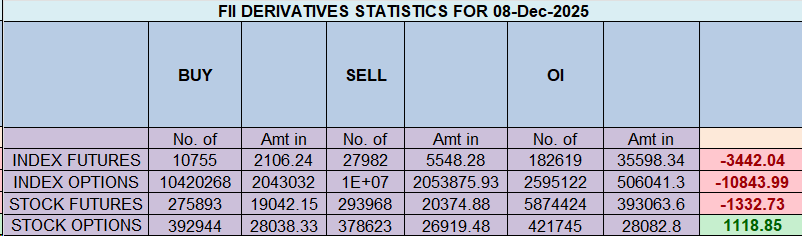

On December 8, 2025, the Nifty Index Futures market transformed into a high-stakes arena for a colossal and direct confrontation between institutional and retail forces. Foreign Institutional Investors (FIIs) did not just lean bearish; they launched one of the most aggressive, one-sided assaults seen in recent times, net shorting a massive 8,908 contracts worth ₹1,718 crore.

This institutional onslaught was met head-on by an equally determined retail segment, resulting in an explosive surge in net Open Interest (OI) of 10,956 contracts. This is the definitive and unmistakable signal of a market that is not drifting but is actively building up a massive amount of potential energy for a violent, trend-defining move.

Decoding the Data: Two Armies Building for a Decisive Battle

This is a textbook case of a market at maximum polarization, where two powerful forces are placing huge, diametrically opposed bets.

1. The FIIs’ “All-In” Bearish Campaign:

The FIIs’ actions were a masterclass in extreme, high-conviction bearishness. Their strategy was two-pronged and utterly brutal:

-

They aggressively initiated a staggering 16,276 new short contracts, an all-out bet on a market decline.

-

Simultaneously, they dumped what was left of their long exposure (covering 951 contracts), signaling a complete loss of faith in any upside potential.

This has pushed their positioning to a historic extreme of 14% long versus 86% short. A long-short ratio of 0.15 is at the floor, indicating they are positioned with maximum conviction for a significant market drop.

2. The Clients’ Wall of Optimism:

On the other side of this institutional selling frenzy stood the retail client, who showed unwavering bullish resolve.

-

They courageously added 8,293 new long contracts, completely absorbing a large portion of the FIIs’ selling pressure.

-

Interestingly, they also added a significant number of short contracts (5,851), suggesting the first signs of fracturing in the retail consensus, with some beginning to hedge or turn bearish. However, the dominant force remains defiantly bullish.

Their aggregate positioning stands at a highly optimistic 68% long versus 32% short, in total opposition to the institutional view.

Key Implications for the Market

-

An Impending Volatility Explosion: The colossal surge in open interest is the market screaming that this is not a quiet consolidation. It is a massive buildup of new, leveraged positions on both sides. This level of stored energy is unsustainable and almost always resolves in a violent, high-velocity price move.

-

A Historic and Unstable Divergence: The positioning gap between FIIs (maximum pessimism) and Clients (high optimism) is now at a breaking point. The market cannot prove both sides right, and such extreme polarization is often the direct precursor to a major market turn.

-

The Ultimate Contrarian Signal: This is a classic “smart money vs. dumb money” scenario at its most extreme. The historical precedent is overwhelming: such divergences are almost always resolved in favor of the institutional players, making this an enormous red flag for the bullish retail crowd.

Conclusion

Disregard the daily price noise. The only story that matters right now is the monumental buildup of opposing forces, confirmed by the explosion in open interest. The FIIs have declared war on the market’s current valuation, and retail has defiantly accepted the challenge. This is not a healthy trend; it is a market coiling with an immense amount of tension. A major, violent, and trend-defining resolution is no longer a possibility; it is an imminent probability.

Last Analysis can be read here

The market is unfolding with the precision of a well-oiled machine. As forecast, the powerful confluence of the Bayer Rule 27 and the Gann lunar date provided the high-energy window for a major reversal, and the technical breakdown below 26,110 was the definitive trigger. The resulting sharp decline was a testament to the power of a combined astro-technical approach, allowing traders to capture a significant move.

After this initial victory, the bears have pushed the Nifty down to its next and most formidable line of defense: the crucial support zone of 25,900-25,888. This is no ordinary support; it is a Gann master level, a point of high structural and psychological significance. The market is currently holding at this level, taking a pause as bulls and bears fight for control at this critical fulcrum.

The Bearish Path: The Next Wave of Selling Awaits

The trend is now firmly in the bears’ control, and their next objective is clear. The current pause at the master level is just that—a pause. The high-probability scenario is a continuation of the downtrend.

-

The Breakdown Trigger: A definitive break and close below the 25,888 support would be the trigger for the next wave of selling. It would signify that the bulls’ last major defense has failed.

-

The Target: A breach of this support is expected to unlock the path for a quick, accelerated fall towards the next major support zone of 25,729-25,700.

The Bullish Counter-Offensive: A Steep Climb Back to Control

For the bulls, the situation is now defensive. They have lost control of the trend and are now fighting a rearguard action at a key support level. To turn the tide and invalidate the powerful bearish signals, their task is steep.

-

The Invalidation Level: The bulls will only get a chance to regain the upper hand if they can engineer a powerful recovery and reclaim the major psychological and structural resistance at 26,000. Until and unless this level is breached, every rally attempt will be viewed as a potential selling opportunity for the bears.

Conclusion

The market has spoken, and it has respected our cyclical and technical map with precision. Now, it stands at a critical juncture, testing a major Gann master level support. The bears have the clear advantage, with a breakdown below 25,888 expected to trigger a swift move lower. The bulls are on the defensive and must reclaim 26,000 to have any chance of reversing the current bearish momentum. The levels are clear, and the market is poised for its next major move.

Nifty Trade Plan for Positional Trade ,Bulls will get active above 26040 for a move towards 26121/26202. Bears will get active below 25878 for a move towards 25797/25717

Traders may watch out for potential intraday reversals at 09:43,11:02,12:30,01:22,02:13 How to Find and Trade Intraday Reversal Times

Nifty Dec Futures Open Interest Volume stood at 1.59 lakh cr , witnessing ADDITION of 12.5 Lakh contracts. Additionally, the increase in Cost of Carry implies that there was addition of SHORT positions today.

Nifty Advance Decline Ratio at 04:46 and Nifty Rollover Cost is @26320 closed below it.

In the cash segment, Foreign Institutional Investors (FII) sold 655 cr , while Domestic Institutional Investors (DII) bought 2542 cr.

The Nifty options data reveals a market gripped by extreme fear and overwhelmingly bearish pressure. The Put-Call Ratio (PCR) has collapsed to a deeply negative 0.47, one of the lowest readings in recent times. This indicates a massive and lopsided build-up on the call side, signaling that sellers are dominating the market with exceptional force and conviction, while faith in any downside support has all but evaporated.

The Option Chain chart provides a stark visual of this imbalance, showing a colossal “Great Wall of Calls” beginning at the 26,000 strike. This level, which is also the Max Pain point, represents a seemingly impenetrable ceiling of supply that will cap any attempted rally. Further significant resistance is visible at every subsequent strike higher. In stark contrast, the support structure below the market appears fragile and thin.

The most damning evidence comes from the participant activity. There was a mass exodus from put options, with both retail and FIIs covering their positions on a massive scale. This represents a collective vote of no confidence in the market’s floor; participants are abandoning their bullish bets and are no longer willing to write puts to support the market. At the same time, FIIs were huge net buyers of calls, likely as a hedge for their enormous futures short position—a sign that they are preparing for extreme volatility.

Key Levels:

-

Resistance: An immense wall stands at 26,000, with further heavy resistance at 26,150 and 26,250.

-

Support: Immediate, fragile support is at 25,900. The only substantial structural support is much lower at the 25,750 strike.

In conclusion, the options data shows a profoundly weak and vulnerable market. The path of least resistance is firmly down, and any rally will be met with overwhelming selling pressure from the colossal wall of call writers.

For Positional Traders, The Nifty Futures’ Trend Change Level is At 26251 . Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 26156 , Which Acts As An Intraday Trend Change Level.

Nifty Expiry Range

Upper End of Expiry : 26000

Lower End of Expiry : 25742

Nifty Intraday Trading Levels

Buy Above 25900 Tgt 25945, 25972 and 26016 ( Nifty Spot Levels)

Sell Below 25850 Tgt 25816, 25777 and 25729 (Nifty Spot Levels)

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.

► Join Youtube channel : Click here

► Check out Gann Course Details: W.D. Gann Trading Strategies

► Check out Financial Astrology Course Details: Trading Using Financial Astrology

► Check out Gann Astro Indicators Details: Gann Astro Indicators