A Declaration of War: FIIs Launch Massive Bearish Assault in a High-Stakes Showdown

On December 2, 2025, the Nifty Index Futures market transformed into a major battleground. Foreign Institutional Investors (FIIs) unleashed a torrent of high-conviction selling, dumping a staggering 11,809 contracts worth ₹2,277.71 crore. This was not a tentative hedge or a slight adjustment; it was a full-scale, strategic bearish assault.

The definitive proof that this was an escalation of conflict, not an exhaustion of a trend, is the session’s most critical data point: a colossal surge in net Open Interest (OI) of 7,715 contracts. This signals that a massive infusion of new capital has entered the market to take sides in a monumental standoff, building immense potential energy for a violent directional move.

Decoding the Data: Two Armies on a Collision Course

The granular data reveals two powerful forces taking diametrically opposed positions with extreme conviction.

1. The FIIs: A Calculated, All-Out Attack

The FIIs’ actions were a masterclass in bearish aggression. They executed a devastating two-pronged attack to maximize their bearish footprint:

-

They liquidated 3,052 long contracts, demonstrating a complete abandonment of any upside scenario.

-

Simultaneously, they initiated a massive 9,637 brand-new short contracts, aggressively positioning for a significant market decline.

This has left their positioning at an extremely bearish 19% long versus 81% short (ratio 0.18). This is not a defensive posture; it is a high-stakes, offensive bet on a major market downturn.

2. The Clients: The Unflinching Bullish Brigade

In a perfect mirror image, the retail client segment met this institutional wall of selling with a wave of peak optimism. Their actions were unequivocally bullish:

-

They fearlessly added 8,138 new long contracts, absorbing the FIIs’ huge supply.

-

In a move of supreme confidence, they also covered 9,214 short contracts, effectively removing their downside protection and going “all-in” on the long side.

This leaves them in a highly bullish, and highly exposed, position at 69% long versus 31% short.

Key Implications for the Market

-

An Unstable, High-Stakes Standoff: The market is now at a point of maximum possible divergence. “Smart Money” (FIIs) and “Retail Money” (Clients) have taken colossal, diametrically opposed positions. This is an inherently unstable situation that cannot last.

-

Building Energy, Not Exhaustion: The huge surge in Open Interest is the most critical takeaway. This is not a tired market; it is a market that is actively “loading the cannon” for a major directional move. The tension is building, not dissipating.

-

A Massive Base of “Trapped Fuel”: The huge number of client long positions represents a massive reservoir of potential “fuel” for a market decline. A break below key support levels could trigger a catastrophic wave of panic selling from this large, exposed group—a scenario the FIIs appear to be explicitly positioned for.

-

The Ultimate Contrarian Red Flag: A divergence of this magnitude is a classic, high-alert contrarian signal. Historically, when positioning becomes this polarized, the eventual, painful resolution is almost always in the direction of the institutional players.

Conclusion

The Nifty is now in a state of extreme tension. Forget the small daily price wiggles; the real story is the colossal battle being waged in the underlying market structure. The FIIs have declared war, and the retail clients have accepted the challenge. A period of calm consolidation is now the least likely outcome. Prepare for a major, high-velocity market event that will resolve this conflict, proving one side spectacularly right and the other spectacularly wrong.

Last Analysis can be read here

The market has unfolded with the precision of a celestial clock. As forecast in the weekly analysis, the potent and pre-calculated bearish pressure from the “Bayer Rule 14” concerning Venus and the disruptive energy of the “Double Station” has exerted its full influence. This provided the catalyst for the two-day decline, a period of sustained selling that has now guided the Nifty down to its first major and most critical battleground.

The downward phase, driven by the astrological cycles, is now over. The next phase, a battle between that residual bearish momentum and a formidable support structure, is about to begin.

The Decisive Battleground: The 26,000 – 26,032 Support Fortress

The Nifty is now testing the all-important support zone of 26,000 – 26,032. This is not merely a minor price level; it is the bulls’ primary line of defense. It represents a confluence of psychological support (the round number of 26,000) and technical support. The entire market’s short-term fate now hinges on the outcome of the battle at this very zone.

The two clear, conflicting scenarios are:

1. The Bullish Scenario: The Successful Defense

The bulls’ mission is now clear and singular: they must hold this support zone. If they can absorb the selling pressure here and prevent a decisive close below 26,000, it would signal that the bearish pressure from the astro cycles has been successfully weathered.

-

The Outcome: A successful defense of this zone would be a major victory for the bulls. It would indicate that the recent two-day fall was a corrective, not an impulsive, move. This would set the stage for a significant relief rally back towards the primary upside target of 26,200 – 26,245, as the market seeks to reclaim the ground it has lost.

2. The Bearish Scenario: The Breakdown

A failure to hold this support would be a profoundly bearish signal. It would mean that the downward force from the cyclical drivers is not yet exhausted and is strong enough to overwhelm a major technical support level. This would indicate that the market is in for a much deeper correction.

Conclusion

The market is at a perfect and precarious inflection point. The predictable downward pressure from the Venus and Double Station cycles has successfully pushed the Nifty to its first major test. The battle is now on. The zone of 26,000 – 26,032 is the fulcrum upon which the market’s next move will pivot. A hold here puts the bulls back in control with a clear path towards 26,245. A break would signal a significant escalation of the bearish trend. Watch this support zone with absolute focus; the outcome here will likely determine the market’s direction for the remainder of the week.

Nifty Trade Plan for Positional Trade ,Bulls will get active above 26082 for a move towards 26163/26244. Bears will get active below 25995 for a move towards 25920/25839

Traders may watch out for potential intraday reversals at 09:15,10:07,11:09,12:26,01:39 How to Find and Trade Intraday Reversal Times

Nifty Dec Futures Open Interest Volume stood at 1.45 lakh cr , witnessing addition of 4.9 Lakh contracts. Additionally, the increase in Cost of Carry implies that there was addition of SHORT positions today.

Nifty Advance Decline Ratio at 14:36 and Nifty Rollover Cost is @26320 closed below it.

In the cash segment, Foreign Institutional Investors (FII) sold 3642 cr , while Domestic Institutional Investors (DII) bought 4645 cr.

For Positional Traders, The Nifty Futures’ Trend Change Level is At 26301 . Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 26232 , Which Acts As An Intraday Trend Change Level.

Nifty Intraday Trading Levels

Buy Above 26055 Tgt 26092, 26136 and 26199 ( Nifty Spot Levels)

Sell Below 25995 Tgt 25955, 25914 and 25866 (Nifty Spot Levels)

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.

► Join Youtube channel : Click here

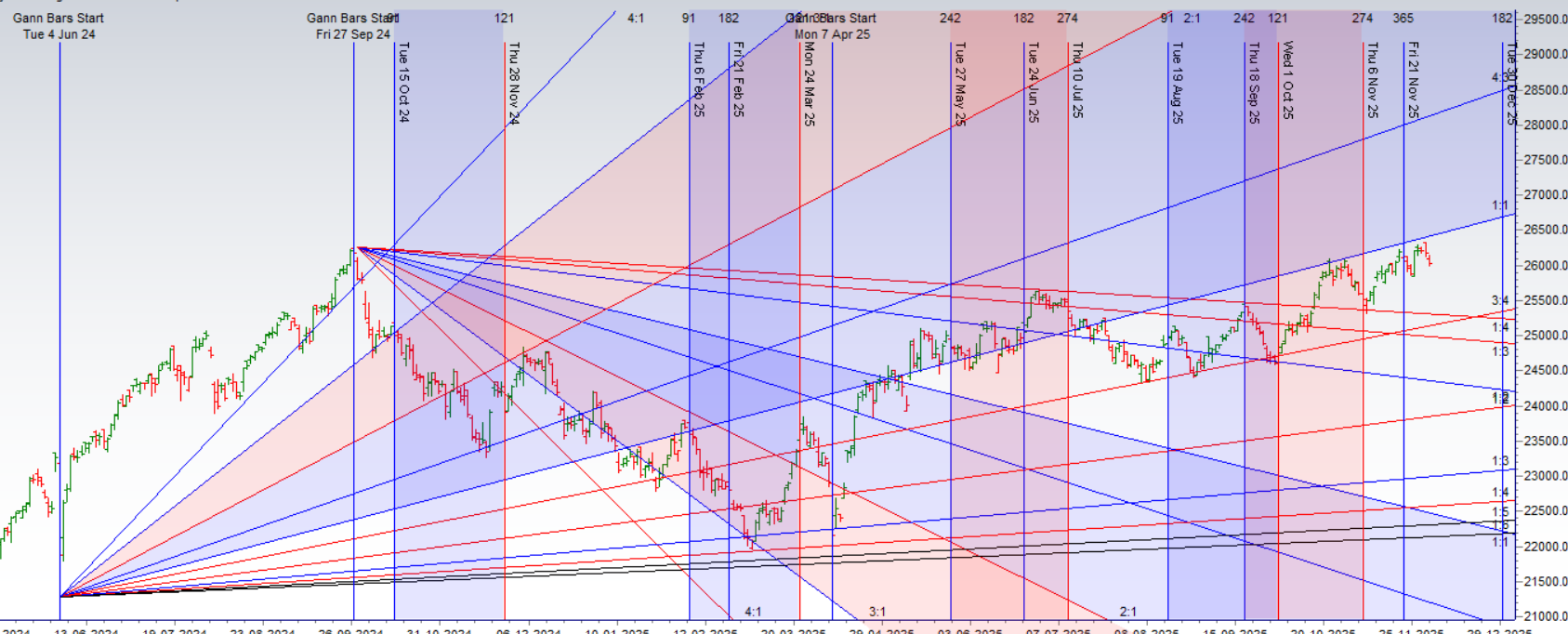

► Check out Gann Course Details: W.D. Gann Trading Strategies

► Check out Financial Astrology Course Details: Trading Using Financial Astrology

► Check out Gann Astro Indicators Details: Gann Astro Indicators