Disclaimer: This forecast is based on an interpretation of the provided astrological and cycle data and its potential correlation with market behavior. It is for informational and educational purposes only and should not be considered financial advice. All trading involves significant risk.

General Astrological Theme for Precious Metals

This week, the price action in Gold and Silver will be largely driven by the “risk-on” vs. “risk-off” sentiment dictated by the challenging aspects affecting the general markets. The narrative for precious metals is the inverse of the equity markets: they are likely to find significant strength during the mid-week turmoil and may face some profit-taking when equities attempt to recover.

-

The Setup (Monday): The week begins with powerful turning point indicators (Solar Eclipse Degree date, Moon at Farthest South declination). This suggests Gold and Silver will establish a key low or high that will serve as a critical pivot for the rest of the week.

-

The Safe-Haven Bid (Wednesday): The cluster of overwhelmingly negative aspects for equities (Moon-Pluto, Moon-Jupiter, Mercury-Jupiter) is a powerful bullish catalyst for precious metals. As fear and negative news hit the general markets, capital is expected to flow into the safety of Gold and Silver.

-

The Test of Strength (Thursday-Friday): The powerful reversal signature for equities on Thursday, particularly Bayer Rule 8’s indication of “ups,” could create a temporary headwind for metals. As risk appetite returns to the broader market, Gold and Silver may experience profit-taking or a consolidation of their mid-week gains.

The highest probability outcome is a week where Gold and Silver find a key turning point on Monday, experience a strong rally mid-week fueled by a flight to safety, and then consolidate or see a minor pullback into the weekly close.

For Day by Day Forecast Please watch the below video

MCX GOLD Gann Angle Chart

Gold continued with its rally and now heading for important 29 Sep 2025 Gann Cycle.

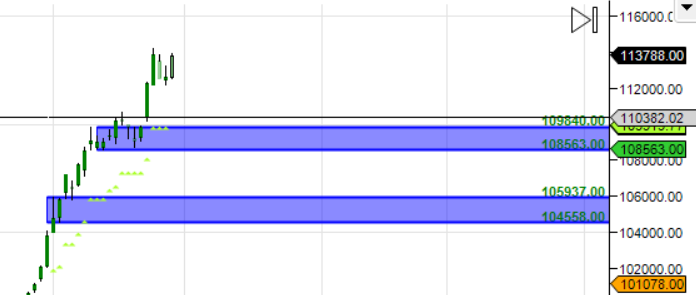

MCX GOLD Supply Demand Zone

MCX GOLD Supply Demand Chart : Demand in range of 109840-111000 , Supply in range of 114000-114025

MCX GOLD Harmonic Analysis

Price is approaching PRZ zone of ABCD Harmonic Pattern.

MCX GOLD Weekly

Price has formed weekly Bullish pattern

MCX GOLD Monthly

115384 Monthly Resistance and 112432 Monthly Support.

GOLD Astro/Gann Trend Change Date

Key Pivot Dates: Watch 29 September

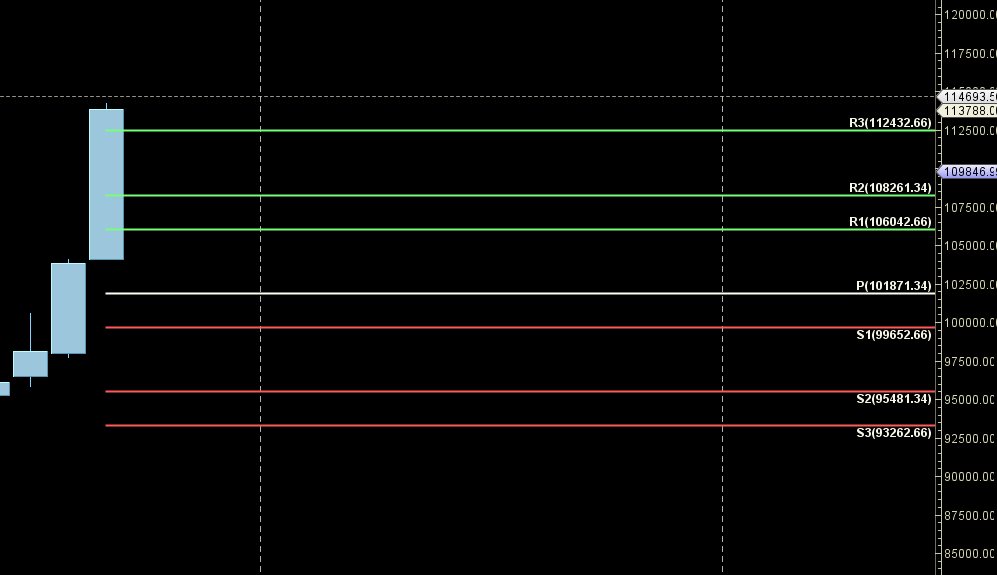

GOLD Weekly Levels

Weekly Trend Change Level:114029

Weekly Resistance:114705,115384,116064,116746

Weekly Support: 113355,112682,112012,111343,110677

Levels Mentioned are for Current Month Future

Learn More:

W.D. Gann Trading Strategies – Learn how to decode markets using price, time, and geometry.

Trading Using Financial Astrology – Discover how planetary motion impacts market behavior and how to trade it effectively.

Ready to Trade Like a Time-Master?

Join our one-on-one mentorship to master astro-timing, Gann analysis, and institutional-grade setups.