A Masterclass in Deception: FIIs Stage a Bull Trap While Retail Capitulates

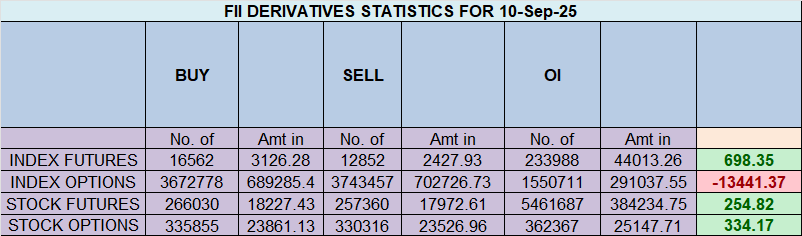

On the surface, the trading session of 10th September 2025 looked like a victory for the bulls. Foreign Institutional Investors (FIIs) executed a significant net purchase of 2,236 Nifty Index Futures contracts, injecting a substantial ₹420 crores. This buying was accompanied by a massive surge in net open interest of 4,762 contracts, indicating that a significant amount of fresh, aggressive positions were built. However, to interpret this headline number as a genuine shift to a bullish stance would be a grave mistake. A deeper analysis reveals a classic “smart money” maneuver designed to trap unsuspecting bulls while their own bearish conviction remains firmly intact.

The Anatomy of the Trap

The breakdown of FII activity is revealing. While they added an impressive 3,906 long contracts, they also continued to add 196 short contracts. More importantly, this daily buying activity did little to alter their catastrophic bearish positioning. The FII Long/Short ratio has barely budged, moving from 0.09 to a still overwhelmingly bearish 0.11. This translates to a strategic posture of being 90% short and only 10% long.

This tactical buying, in the face of such a massive short position, serves two potential purposes. Firstly, it allows FIIs to defend crucial price levels, preventing a rally that could threaten their highly profitable shorts. Secondly, and more cynically, it creates a facade of strength designed to lure in retail participants on the long side, creating more liquidity (i.e., more buyers) from whom they can eventually sell to, initiating the next leg down.

The Retail Exodus

In a stark and telling contrast, the Client (retail) segment showed clear signs of panic and capitulation. Clients were seen rushing for the exits, covering a massive 6,617 long contracts. This is a classic sign of “weak hands” being shaken out of the market. The minor rally was not seen as an opportunity but as a chance to escape, suggesting that the recent volatility has shattered their confidence. They sold their long positions directly into the hands of the FIIs. Simultaneously, they covered 878 short contracts, indicating confusion and a general de-leveraging.

The Unmistakable Divergence

The current market structure presents one of the most dangerous setups for retail traders. The FIIs, or “smart money,” are positioned 90% short, betting heavily on a market decline. The Clients, despite their recent selling, are still positioned 71% long, holding a fundamentally bullish view.

This extreme divergence is unsustainable. The massive pool of vulnerable retail long positions represents the “fuel” for a potential market fire. If key support levels break, the forced selling from these retail accounts will likely trigger a cascade, allowing FIIs to cover their huge short positions at much lower prices, resulting in maximum profit.

Conclusion

Do not be fooled by the headline buying figure. The FIIs’ strategic intent, as shown by their 10:90 Long/Short positioning, remains unequivocally bearish. The buying on September 10th was a tactical play within a larger bearish strategy, expertly executed to shake out weak holders and potentially set the stage for a significant bull trap. The risk remains heavily skewed to the downside, and any rally should be treated with extreme suspicion until there is a fundamental and drastic improvement in the FII’s net positioning.

Last Analysis can be read here

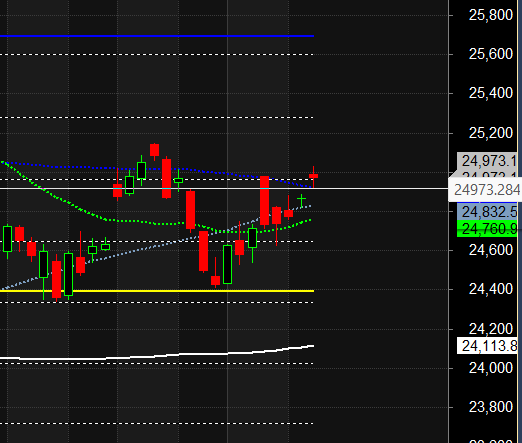

The Nifty index continued its upward momentum today, fueled by a gap-up opening on the back of positive geopolitical news. Comments from former President Trump suggesting that the long-awaited India-US trade deal is back on the table provided the initial catalyst, sparking a wave of optimism at the opening bell.

However, the early excitement quickly fizzled out. For the second consecutive session, the index struggled to conquer the formidable psychological resistance at the 25000 mark. The intense battle between buyers and sellers throughout the day resulted in the formation of another Doji candlestick. This pattern, characterized by a near-identical open and close price, is a classic sign of market indecision and equilibrium. It indicates that despite the bullish gap-up, the bears mounted a powerful defense, and the bulls lacked the conviction to push prices decisively higher.

From a technical standpoint, the situation is finely balanced, creating a tense setup for the days ahead.

On the bullish side, the price is now firmly trading above the 24885 level, which corresponds to the high of the recent lunar eclipse. As long as Nifty holds above this critical support, the immediate technical advantage remains with the bulls. This level has effectively become the new “line in the sand” for the current uptrend.

However, the repeated failure to secure a close above 25000 and the formation of Doji candles are significant warning signs. It suggests that supply is overwhelming demand at these higher levels, and the bullish momentum is waning.

Volatility on the Horizon: A Key Sun-Rahu Aspect Looms

Adding another layer of complexity and anticipation, tomorrow is marked by an important astrological aspect between the Sun and Rahu (North Node). As discussed previously, such aspects often correlate with periods of increased volatility, confusion, or significant trend shifts in the market. This alignment suggests that the current state of indecision is about to be resolved, likely in a dramatic fashion.

Given this backdrop, tomorrow’s trading strategy will be crucial. The high and low of the first 15 minutes of the session will serve as critical pivot points.

-

A breakout above the opening 15-minute high could signal that the bulls have finally absorbed the selling pressure and are ready to challenge the 25000 level again with renewed force.

-

A breakdown below the opening 15-minute low would indicate that the bears have won the stalemate, potentially leading to a swift reversal to test the key support at 24885.

Traders should prepare for a significant expansion in volatility. The market’s next directional move is imminent, and the opening range on Thursday will likely provide the first and most important clue.

Nifty Trade Plan for Positional Trade ,Bulls will get active above 25013 for a move towards 25092/25170. Bears will get active below 24935 for a move towards 24857/24778

Traders may watch out for potential intraday reversals at 09:39,10:27,01:24,02:30 How to Find and Trade Intraday Reversal Times

Nifty Sep Futures Open Interest Volume stood at 1.73 lakh cr , witnessing addition of 2.9 Lakh contracts. Additionally, the increase in Cost of Carry implies that there was covering of SHORT positions today.

Nifty Advance Decline Ratio at 33:17 and Nifty Rollover Cost is @24980 closed below it.

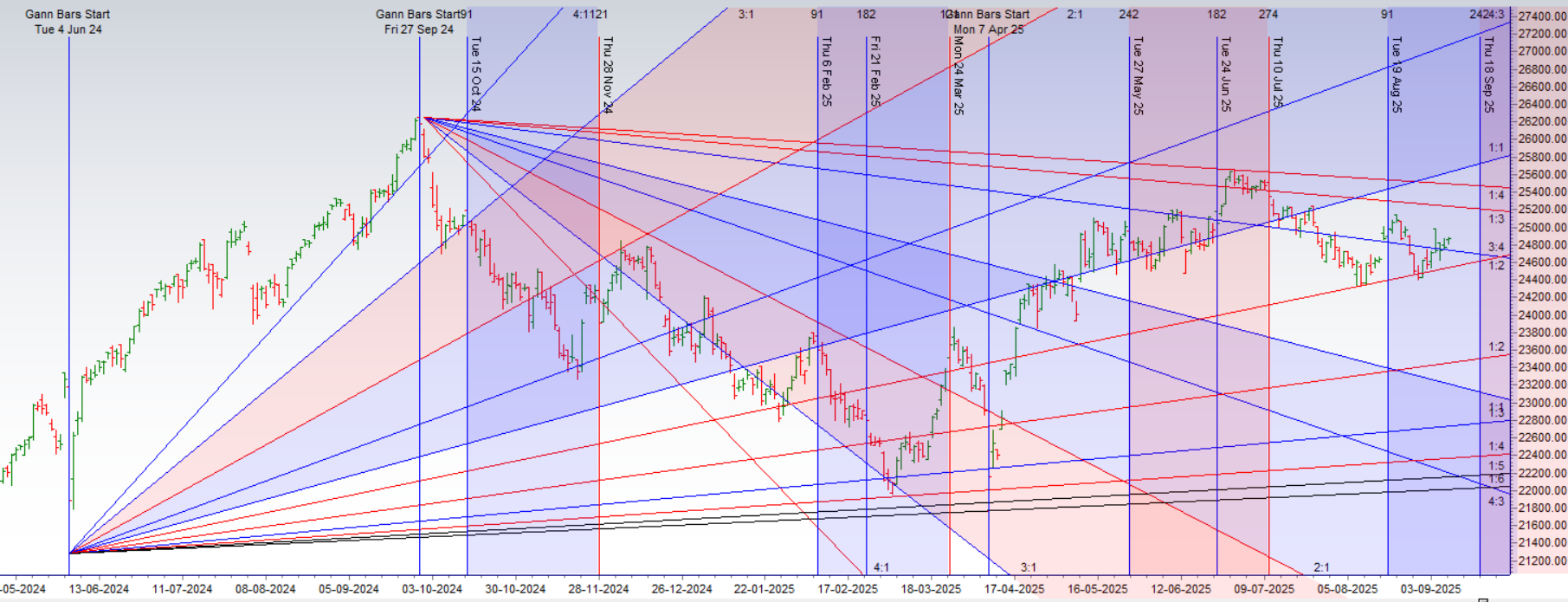

Nifty Gann Monthly Trend Change level 24678 closed above it.

Nifty has closed above its 50 SMA @ 24921 Trend is Sell on Rise till below 25000

Nifty options chain shows that the maximum pain point is at 25000 and the put-call ratio (PCR) is at 1.08.Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound.

A Tale of Two Markets: Retail Hedges in Panic While FIIs Sell Insurance with Conviction

The options market data from today’s session paints a vivid and compelling picture of a market at a crossroads, revealing a sharp divergence between the fearful, scattered approach of retail traders and the surgically precise, confident strategy of the Foreign Institutional Investors (FIIs). While both players seem to anticipate a cap on the immediate upside, their views on downside risk could not be more different.

The Retail Dilemma: Hedging Every Possibility

The activity in the retail segment is a classic sign of indecision and anxiety. Traders were active on both sides of the market, effectively placing bets on every possible outcome. In Call options, they added 379,000 long contracts, hoping for a continued rally, but simultaneously wrote 422,000 Call contracts, betting that the upside is limited. This creates a net short position in Calls, indicating that, as a whole, the retail crowd believes the market will struggle to rally further.

However, their activity in Put options reveals their primary emotion: fear. Retail traders bought a staggering 793,000 Put contracts, the largest single activity block from either participant. This is a clear and direct bet on a market decline, or a desperate attempt to hedge their existing long portfolios against a potential fall. At the same time, they wrote 697,000 Put contracts, likely to collect premium and bet that a catastrophic fall is not imminent. This frantic, high-volume activity in all four directions points to a lack of a unified, high-conviction view. The retail segment is effectively “playing the range,” but with a clear and expensive bias towards hedging for a downturn.

The FII Masterstroke: A Clear Bet Against a Market Fall

In stark contrast, the FIIs, or “smart money,” ignored the noise and executed a clear, powerful, and unified strategy. Their activity in the Call options was muted, with a negligible net short position, suggesting they agree with retail that a runaway rally is unlikely.

The entire story, however, is in their Put option activity. FIIs engaged in a massive and calculated move of writing 143,000 Put contracts. This is an unambiguous, high-conviction bet that the market’s downside is limited. By selling Puts, FIIs are collecting the premium that fearful retail traders are willing to pay for protection. They are effectively acting as the “insurance house,” confidently stating that they do not expect a significant decline and are willing to be buyers at lower levels if the market does dip.

Further cementing this view, FIIs also covered 85,000 of their existing long Put contracts. This means they are closing out the insurance policies they previously held for themselves. An institution only reduces its own protection when its confidence grows that the risk of a fall is diminishing.

Conclusion: The Divergence is the Signal

When we synthesize this data, a powerful narrative emerges. The retail crowd is fearful, hedging against a fall by buying expensive Puts. The FIIs are the primary sellers of these Puts, gladly taking the other side of the trade and profiting from the high premiums that retail fear has created.

This is a classic smart money vs. retail dynamic. The FIIs are not necessarily forecasting a massive bull run, but they are positioning with strong conviction that a market crash or a sharp correction is not on the immediate horizon. They are effectively setting a floor under the market, and their actions suggest that any minor dips are likely to be bought. For a trader, the signal is clear: following the FIIs’ conviction and being wary of downside panic appears to be the most prudent path forward.

In the cash segment, Foreign Institutional Investors (FII) sold 115 cr , while Domestic Institutional Investors (DII) bought 5004 cr.

Traders who follow the musical octave trading path may find valuable insights in predicting Nifty’s movements. According to this path, Nifty may follow a path of 23037-23722-24408-25134-25860 This means that traders can take a position and potentially ride the move as Nifty moves through these levels.Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable.

the most profitable traders will tell you that the true mastery lies not in understanding the market, but in understanding yourself.

For Positional Traders, The Nifty Futures’ Trend Change Level is At 24826 . Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 25071 , Which Acts As An Intraday Trend Change Level.

Nifty Intraday Trading Levels

Buy Above 25000 Tgt 25034, 25095 and 25154 ( Nifty Spot Levels)

Sell Below 24950 Tgt 24912, 24872 and 24824 (Nifty Spot Levels)

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.

► Join Youtube channel : Click here

► Check out Gann Course Details: W.D. Gann Trading Strategies

► Check out Financial Astrology Course Details: Trading Using Financial Astrology

► Check out Gann Astro Indicators Details: Gann Astro Indicators

Jai jinendra sir.

Today’s article is very insightful and full of information for a market participant whether he is an intraday trader or an investor. Thank you sir. We also wish you good health and happiness as always. Jai jinendra.

Thank you so much for your incredibly kind and thoughtful words!

It is the biggest reward for me to know that the article was insightful and valuable for you, whether as a trader or an investor. Readers like you, who engage so deeply, are what make this effort truly worthwhile.

Thank you also for your warm wishes for health and happiness. That means a great deal.

Jai Jinendra! Wishing you continued success and prosperity in all your endeavors.