“When planetary tension builds, markets respond—often before the news catches up.”

Crude Oil Weekly Forecast: Bracing for a Plunge as Risk-Off Sentiment Dominates

This week is poised to be overwhelmingly bearish for Crude Oil. As a powerful series of astrological events are set to trigger a significant “risk-off” wave and panic in global markets, Crude Oil, as a primary risk asset, is expected to face intense selling pressure. The forecast indicates that after a potentially stable start, prices will enter a steep decline, culminating in a capitulation low on Friday before a sharp, unexpected reversal.

Day-by-Day Forecast for Crude Oil

-

Monday, August 4: The week for Crude Oil is likely to begin with a deceptive sense of calm. Rule No. 38 suggests a “mighty fine top” could be established. This may manifest as Crude prices testing the upper end of their recent range or forming a final peak. This high point will likely serve as the launching pad for the week’s subsequent decline.

-

Tuesday, August 5: The bullish momentum, if any, will likely exhaust itself today. Venus reaching its Extreme Declination signals a turning point for asset values, while the Moon’s influence adds volatility. Crude prices may become choppy and struggle to hold onto gains. This is a day to watch for signs of weakness and confirmation that a top has been formed.

-

Wednesday, August 6: The bearish trend begins to take hold. The Jupiter Opposition Moon aspect creates a negative bias across markets, souring risk appetite. As investors begin to sell equities, fears of an economic slowdown will mount, directly impacting the demand outlook for Crude Oil. Expect prices to trend decisively lower.

-

Thursday, August 7: This is the day the sell-off is expected to accelerate dramatically. Bayer Rule 2 triggers a “Big Move” down, and the Mars Ingress unleashes a new, aggressive wave of energy. For Crude Oil, this translates into a high probability of a waterfall decline. Fear of a global slowdown will grip the market, leading to aggressive selling and a sharp drop in prices.

-

Friday, August 8: The week concludes with a climactic session of fear and reversal.

-

Morning/Early Afternoon: The intense fear from the Moon-Pluto and Mars-Saturn aspects will likely drive a final, panic-driven plunge in Crude prices. This “capitulation” phase should mark the low point of the week.

-

Late Afternoon: Just as the panic peaks, the Mars Trine Uranus (Key Turning Point) and Mars Zero Declination (major pivot) are activated. This points to a sudden, sharp, and unexpected reversal. Crude Oil is likely to bounce violently from its session lows as the market pivots. The day will likely end with prices significantly recovered from their bottom, but still down for the week.

-

Dive Deeper Into Gann & Astro Trading:

W.D. Gann Trading Strategies

Trading Using Financial Astrology

MCX Crude Oil Gann Angle Chart

Crude failed to close above its 1×2 Gann Angel.

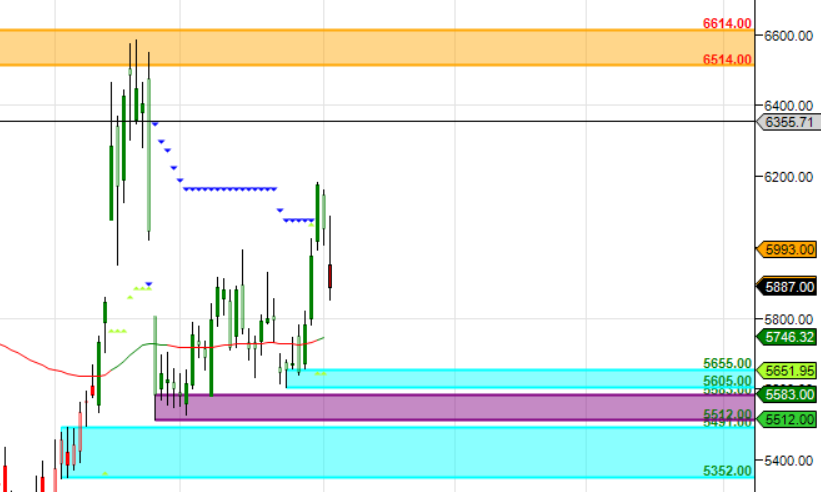

MCX Crude Oil Supply Demand Zone

MCX CRUDE OIL Supply Demand Chart : Demand in range of 5618-5555 Supply in range of 5850-5864

MCX Crude Oil Crude Harmonic

Price is forming Alternate ABCD pattern Bulls should hold 5765-5729 range for a move back to 6000-6108 range.

MCX Crude Oil Weekly

Price bounced from weekly pyrapoint support zone.

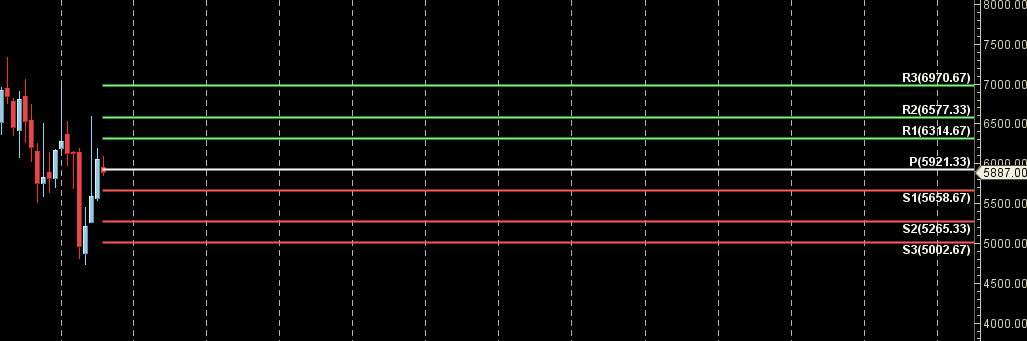

MCX Crude Oil Monthly

5921 is Monthly Resistance and 5658 is Monthly Support

Crude Astro/Gann Trend Change Date

Key Pivot Dates: Watch August 05/07

CRUDE Weekly Levels

Weekly Trend Change Level: 5888

Weekly Resistance : 5926,6002,6079,6155

Weekly Support: 5840,5790,5712,5666

Levels Mentioned are for Current Month Future

Learn More:

W.D. Gann Trading Strategies – Learn how to decode markets using price, time, and geometry.

Trading Using Financial Astrology – Discover how planetary motion impacts market behavior and how to trade it effectively.

Ready to Trade Like a Time-Master?

Join our one-on-one mentorship to master astro-timing, Gann analysis, and institutional-grade setups.

Call: 09985711341

Email: bhandaribrahmesh@gmail.com

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.

Trade smartly and safely.