Decoding the Volatile Week Ahead for Global Markets (July 21-25, 2025)

Brace for impact. The celestial stage is set for one of the most dynamic, conflicted, and potentially transformative trading weeks of the year. We are heading into a cosmic crossfire, where powerful forces of support, aggression, and structural breakdown are all set to collide, culminating in a dramatic and volatile finale.

This is a week of extremes, with a rare bearish rule putting a timer on the market, a mid-week planetary battle, and a grand, climactic power struggle on the day of the New Moon. For the prepared trader, this volatility is an opportunity. For the unprepared, it is a significant threat.

Let’s break down the astrological script to navigate the chaos and see how it is likely to impact our key markets: Nifty, Bank Nifty, Sensex, Gold, and Crude Oil.

The Overarching Theme: A Ticking Clock on a Major Move

Before we dive into specific assets, one powerful rule looms over the entire week. On Tuesday, July 22nd, we trigger Bayer Rule 2. This is a highly specific rule in financial astrology which states that when the speed difference between Mars (aggression, action) and Mercury (trading, speed) hits 59 minutes, a significant down-move is expected within the next three trading days.

This puts a bearish timer on the market. From Tuesday’s open, the clock is ticking for a potentially sharp, high-momentum decline to materialize by Friday’s close. This is our guiding bearish thesis for risk-on assets this week.

Crude Oil: Caught in the Crossfire

Crude Oil is the wildcard of the week, as it is caught between two powerful and opposing narratives.

-

The Bearish Narrative (Demand Destruction): The primary signal from Bayer Rule 2 is a significant economic slowdown. A global recession means less manufacturing, less travel, and less shipping, which translates to a sharp drop in demand for energy. This places a heavy downward pressure on oil prices throughout the week.

-

The Bullish Narrative (Geopolitical Conflict): At the same time, the chart is packed with Mars-driven aspects (Mars vs. North Node, Mars vs. Venus) and a Pluto power struggle. Mars and Pluto govern conflict, war, and energy as a weapon. Any geopolitical headline related to a major oil-producing region could cause a sudden, violent supply-side price spike, completely ignoring the demand-side fears.

Bottom Line for Crude Oil: Expect extreme, whiplash-inducing volatility. The dominant pressure is likely to be to the downside due to recessionary fears. However, the risk of a sudden, headline-driven spike is exceptionally high. Trading Crude Oil this week requires extreme caution and a nimble approach, as it is caught in a tug-of-war between economic fear and geopolitical tension.

Dive Deeper Into Gann & Astro Trading:

W.D. Gann Trading Strategies

Trading Using Financial Astrology

MCX Crude Oil Gann Angle Chart

Crude has entered its gap zone above 5850 heading towards 6000-6066

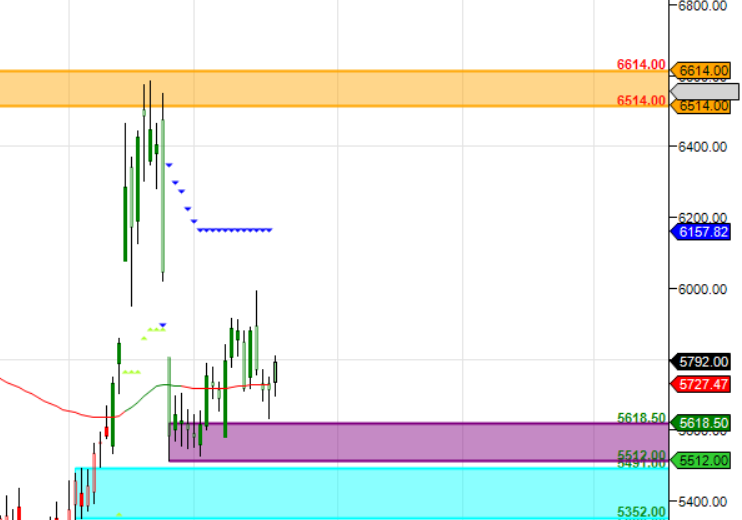

MCX Crude Oil Supply Demand Zone

MCX CRUDE OIL Supply Demand Chart : Demand in range of 5618-5555 Supply in range of 5850-5864

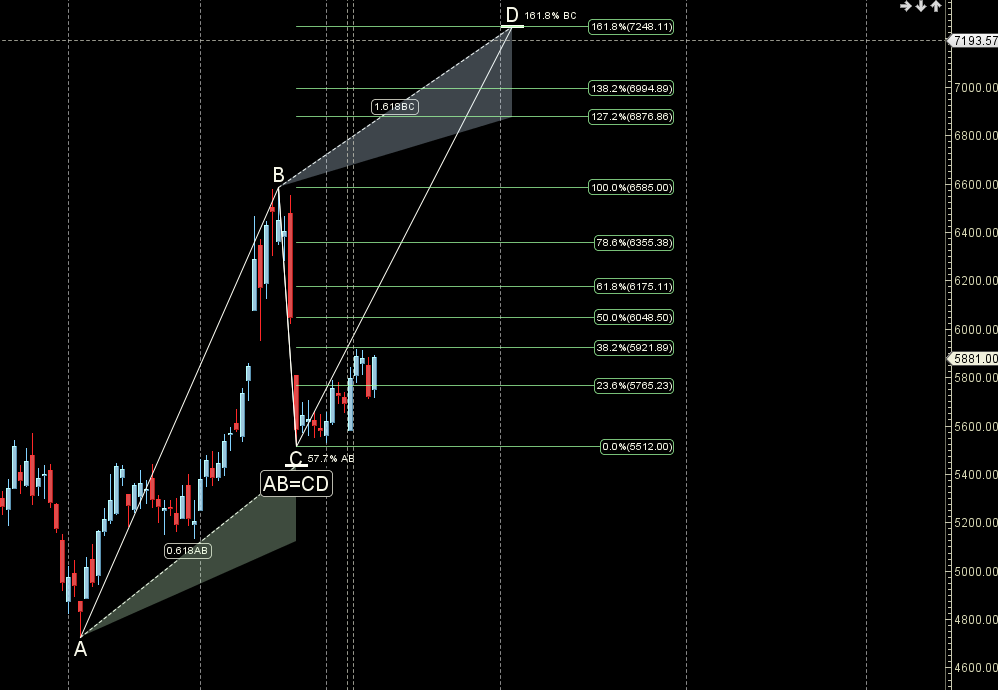

MCX Crude Oil Crude Harmonic

Price has bounced from Shark Pattern PRZ zone heading towards 6000 till holding 5700.

MCX Crude Oil Weekly

Price need to form weekly Bullish Engulfing with Higher High

MCX Crude Oil Monthly

6108 is Monthly Resistance and 5729 is Monthly Support

Crude Astro/Gann Trend Change Date

Key Pivot Dates: Watch July 22

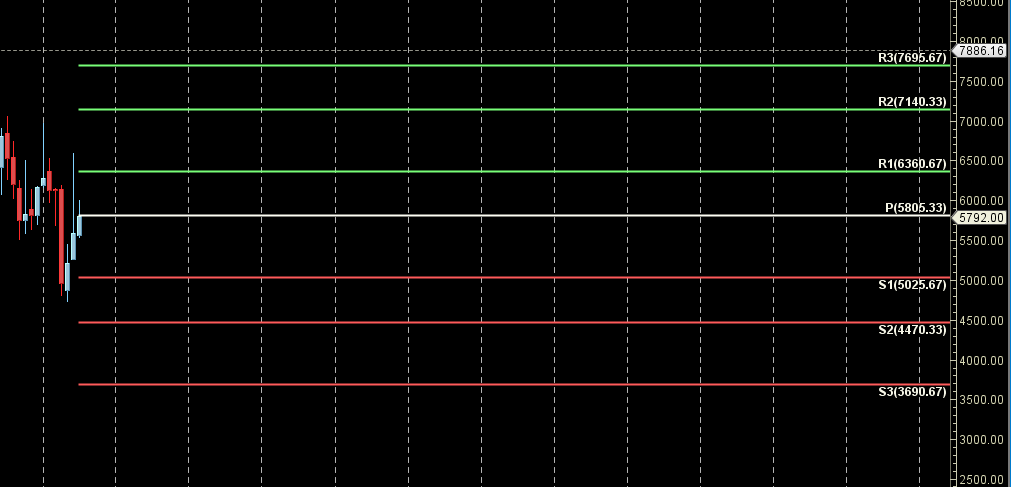

CRUDE Weekly Levels

Weekly Trend Change Level: 5808

Weekly Resistance : 5858,5900,5953,6028

Weekly Support: 5729,5654,5580

Levels Mentioned are for Current Month Future

Learn More:

W.D. Gann Trading Strategies – Learn how to decode markets using price, time, and geometry.

Trading Using Financial Astrology – Discover how planetary motion impacts market behavior and how to trade it effectively.

Ready to Trade Like a Time-Master?

Join our one-on-one mentorship to master astro-timing, Gann analysis, and institutional-grade setups.

Call: 09985711341

Email: bhandaribrahmesh@gmail.com

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.

Trade smartly and safely.