Weekly Astro-Trading Forecast: 13–19 July 2025

“Markets vibrate to the pulse of planetary alignments—those who listen trade ahead of the crowd.”

This week’s planetary setup indicates key turning points and volatility spikes across equities and commodities as Mercury, Venus, Saturn, and the Moon interact dynamically. With Mercury’s speed shifts, Saturn’s station, and Bayer rules aligning, traders should prepare for sharp intraday swings and potential trend reversals.

Key Planetary Events & Market Implications

13 July: Saturn Station Retrograde (01° Aries 56′)

-

Saturn’s retrograde in Aries may signal a pause or reassessment in long-term trends for indices. Watch for range-bound markets early in the week.

16 July: Moon Declination

-

Moon at declination often marks short-term volatility spikes, especially in Gold and Crude.

18 July: Mercury Leo S/R & Daily Speed Geocentric Shift

-

Mercury’s shift in speed (Bayer Rule 1) + sign reversal points to a major trend change in Nifty, Bank Nifty & Sensex.

-

Be cautious of false breakouts near this date.

18 July: Venus Sextile Mercury

-

Positive alignment favors support bounces and short-lived rallies in equities and energy markets.

Bayer Rule Highlights

-

15 July (Rule 6): Watch for bottom formations in stocks and commodities.

-

17 July (Rule 1): Mercury’s directional change reinforces a potential trend reversal window.

-

Rule 40 (Venus Helio Latitude): Critical zones for high-probability major moves in Gold & Crude.

Crude Oil Outlook

Crude could see whipsaw price action as Saturn’s station and Moon’s declination pull the market in both directions. Venus aspects favor short rallies post 17 July.

-

Critical Dates: 16, 18 July

-

Bias: Volatile but bullish bias into weekend

⚠️ Astro-Trading Note

This week’s combination of Mercury’s speed changes and Saturn’s retrograde station suggests markets may trap both bulls and bears. Focus on time cycles, key support/resistance, and avoid over-leveraging around 16–18 July.

Dive Deeper Into Gann & Astro Trading:

W.D. Gann Trading Strategies

Trading Using Financial Astrology

MCX Crude Oil Gann Angle Chart

Crude has entered its gap zone above 5850 heading towards 6000-6066

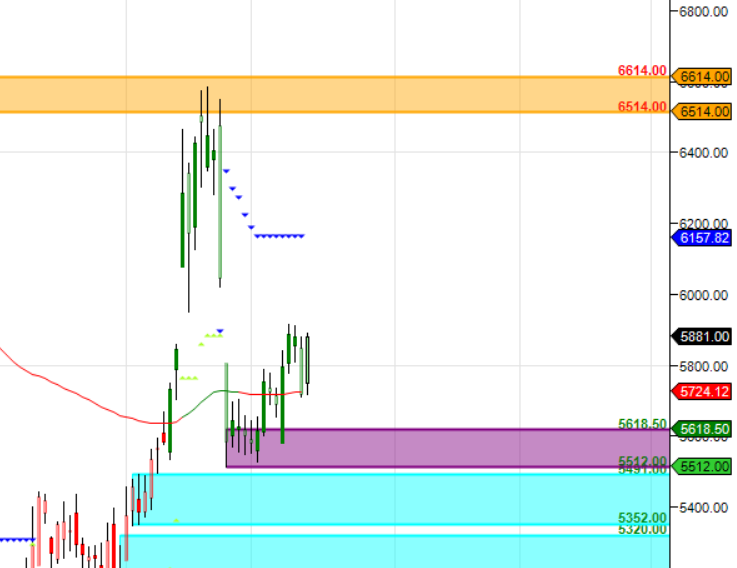

MCX Crude Oil Supply Demand Zone

MCX CRUDE OIL Supply Demand Chart : Demand in range of 5618-5555 Supply in range of 5850-5864

MCX Crude Oil Crude Harmonic

Price has bounced from Shark Pattern PRZ zone heading towards 6000 till holding 5700.

MCX Crude Oil Weekly

Price need to form weekly Bullish Engulfing with Higher High

MCX Crude Oil Monthly

6108 is Monthly Resistance and 5729 is Monthly Support

Crude Astro/Gann Trend Change Date

Key Pivot Dates: Watch July 16th

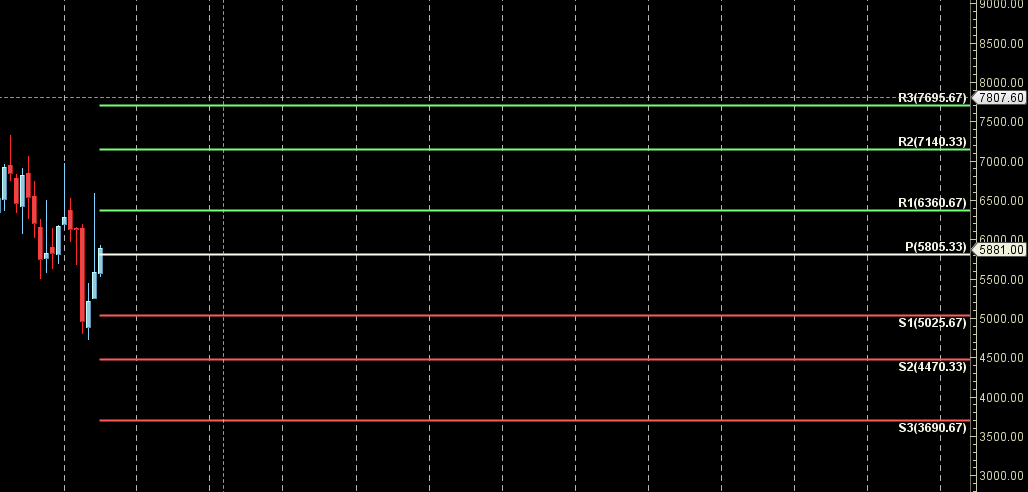

CRUDE Weekly Levels

Weekly Trend Change Level: 5878

Weekly Resistance : 5953,6028,6102,6177

Weekly Support: 5804,5729,5654,5580

Levels Mentioned are for Current Month Future

Learn More:

W.D. Gann Trading Strategies – Learn how to decode markets using price, time, and geometry.

Trading Using Financial Astrology – Discover how planetary motion impacts market behavior and how to trade it effectively.

Ready to Trade Like a Time-Master?

Join our one-on-one mentorship to master astro-timing, Gann analysis, and institutional-grade setups.

Call: 09985711341

Email: bhandaribrahmesh@gmail.com

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.

Trade smartly and safely.