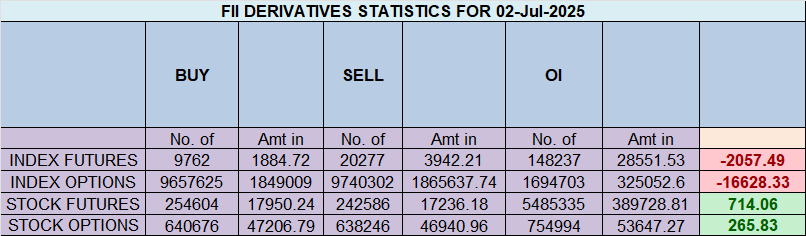

FIIs Intensify Bearish Bets in Nifty Futures, Clients Remain Bullish

A clear divergence emerged in the Nifty Index Futures market on the 2nd of July, painting a classic picture of institutional pessimism versus retail optimism. Foreign Institutional Investors (FIIs) took a strong bearish stance, while the client segment absorbed the selling pressure, setting the stage for a market tug-of-war.

Overall, FIIs were net sellers, shorting 5,839 contracts worth a significant ₹1120 crore. This activity led to a healthy net open interest increase of 5,135 contracts, indicating new positions are being built with conviction on both sides.

A Closer Look at FII Activity

The institutional “smart money” was decisively bearish. Their actions showed a two-pronged strategy to reduce bullish exposure and increase bearish bets:

-

Long Unwinding: FIIs covered (sold) 3,687 long contracts.

-

Fresh Shorting: They aggressively added 6,828 new short contracts.

How Did Clients Behave?

In stark contrast, the client segment displayed confidence in the market’s upside. They took the opposite side of the FII trade, accumulating long positions.

-

New Longs: Clients added 5,065 new long contracts.

-

Short Covering: They covered 7,048 short contracts, closing out their bearish positions.

The Current Standoff: Positioning Snapshot

This conflicting activity has led to a polarized positioning in the index futures market:

-

FII Positioning: Heavily skewed towards the short side, with a long-to-short ratio of just 0.50 (37% long vs. 63% short).

-

Client Positioning: Firmly in the bullish camp, with a long-to-short ratio of 1.14 (53% long vs. 47% short).

The battle lines are drawn. Will the FIIs’ bearish conviction pull the market down, or will the clients’ optimism prevail? The next few trading sessions will be crucial.

Big Movers in F&O: Who Won & Who Lost BIG Last Quarter?

Last Analysis can be read here

The market provided a textbook lesson today in the classic adage: “Buy the Rumour, Sell the News.” As we’ve been discussing, the hype surrounding the HDB Financial listing reached a fever pitch, but the reality triggered a wave of selling, particularly dragging down the financial sector.

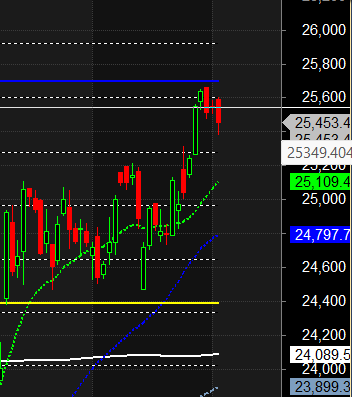

This selling pressure was strong enough to deliver a significant technical blow. The Nifty, which had been coiling in a tight range, finally made its move. It decisively broke the NR7 (Narrow Range 7) pattern on the downside, signaling an end to the recent consolidation and potentially unleashing a new wave of bearish momentum.

The quiet period is over. The breakout has chosen a direction, and for now, it’s down.

The Battleground for Tomorrow’s Expiry

With the bears now in the driver’s seat, the battle lines for tomorrow’s crucial expiry session are clearly drawn. The price action will revolve around two pivotal levels:

-

The Bullish Hurdle: 25,501

For any hope of a bullish expiry, the bulls have a steep hill to climb. They must reclaim and sustain a move above 25,501. A failure to do so will keep the pressure firmly on the downside. -

The Bearish Target: 25,368

The bears, on the other hand, will be looking to press their advantage. A break below the immediate support of 25,368 would likely trigger another leg down and cement a bearish expiry, putting them in firm control.

The stage is set. Today’s “sell the news” event and the subsequent technical breakdown have handed the momentum to the bears. All eyes will now be on these key levels to see if the bulls can mount a defense or if the bears will continue their charge.

Nifty Trade Plan for Positional Trade ,Bulls will get active above 25509 for a move towards 25589/25669. Bears will get active below 25429 for a move towards 25348/25268

Traders may watch out for potential intraday reversals at 09:32,10:02,11:48,01:22, 02:45How to Find and Trade Intraday Reversal Times

Nifty July Futures Open Interest Volume stood at 14 lakh cr , witnessing liquidation of 4 Lakh contracts. Additionally, the increase in Cost of Carry implies that there was closure of LONG positions today.

Nifty Advance Decline Ratio at 23:27 and Nifty Rollover Cost is @24321 closed above it.

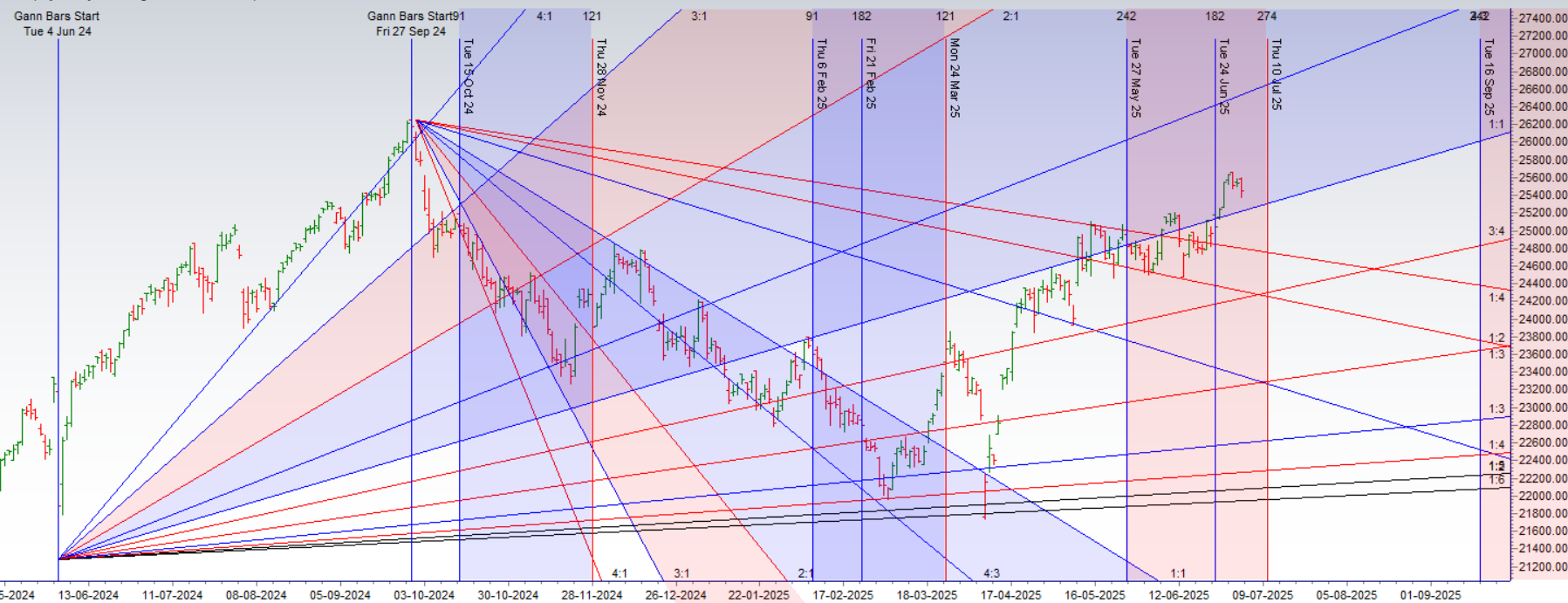

Nifty Gann Monthly Buy Level : 25709

Nifty Gann Monthly Buy Level : 25393

Nifty has closed above its 20 SMA @ 25288 Trend is Buy on Dips till above 25500.

Nifty options chain shows that the maximum pain point is at 25450 and the put-call ratio (PCR) is at 0.61.Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound.

Nifty 50 Options Chain Analysis

The Nifty 50 options chain indicates that the highest open interest (OI) on the call side is at the 25600 strike, followed by 25700 strikes. On the put side, the highest OI is at the 25400 strike, followed by 25300 strikes. This suggests that the market participants are expecting Nifty 50 to remain range between 25300-25600 levels.

Options Market Heats Up: Retail Goes All-In on Bulls, FIIs Rush for the Exits

The options market data reveals a fascinating and stark divergence in strategy between retail traders and Foreign Institutional Investors (FIIs). While retail participants are aggressively placing bullish bets, FIIs appear to be de-risking, unwinding their bullish positions and adopting a more cautious stance.

Retail Activity: Bullish Conviction on Full Display

Retail traders showed strong optimism, making significant moves on both sides of the options chain, with a clear upward bias.

-

Call Options: Activity was massive here. Retail traders added a staggering 482,000 long call contracts while simultaneously shorting 290,000 call contracts. This results in a net addition of 192,000 long call positions, a significant bet on a market rally.

-

Put Options: The bullish sentiment continued. Retail players covered 45,000 put contracts (closing bearish bets) and shorted a minor 3,000 put contracts (a bullish strategy to collect premium).

In short: Retail is buying the market’s potential upside with both hands.

FII Activity: A Story of Caution and Unwinding

In complete contrast, the institutional “smart money” used the day to reduce their bullish exposure significantly.

-

Call Options: The most telling action was here. FIIs covered (closed) 99,000 long call contracts, while only adding a negligible 7,000 new ones. This large-scale exit from long calls signals a lack of confidence in further upside.

-

Put Options: The theme of de-risking continued as FIIs covered both 12,000 and 21,000 contracts respectively. This indicates a general unwinding of positions and a move to reduce overall market exposure rather than building new directional bets.

The takeaway: FIIs are cashing in their chips and taking a step back from the market.

This dramatic split in opinion sets a classic battleground: the optimism of the retail crowd versus the caution of institutional players. The market’s next move will likely declare a winner in this high-stakes standoff.

In the cash segment, Foreign Institutional Investors (FII) sold 1561 cr , while Domestic Institutional Investors (DII) bought 3036 cr.

Traders who follow the musical octave trading path may find valuable insights in predicting Nifty’s movements. According to this path, Nifty may follow a path of 23037-23722-24408-25134-25860 This means that traders can take a position and potentially ride the move as Nifty moves through these levels.Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable.

Don’t trade on emotion. Trading is a numbers game, and it’s important to make decisions based on logic and analysis, not emotion.

For Positional Traders, The Nifty Futures’ Trend Change Level is At 25621 . Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 25568 , Which Acts As An Intraday Trend Change Level.

Nifty Expiry Range

Upper End of Expiry : 25619

Lower End of Expiry : 25287

Nifty Intraday Trading Levels

Buy Above 25466 Tgt 25500, 25555 and 25619 ( Nifty Spot Levels)

Sell Below 25424 Tgt 25385, 25323 and 25287 (Nifty Spot Levels)

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.

► Join Youtube channel : Click here

► Check out Gann Course Details: W.D. Gann Trading Strategies

► Check out Financial Astrology Course Details: Trading Using Financial Astrology

► Check out Gann Astro Indicators Details: Gann Astro Indicators