Below are the Nifty Weekly Expiry Options Trading Levels for July 03, 2025 Trading .

Please see the Below Video How to Trade Levels.

Nifty Expiry Range

Upper End of Expiry : 25619

Lower End of Expiry : 25287

Nifty Intraday Trading Levels

Buy Above 25466 Tgt 25500, 25555 and 25619 ( Nifty Spot Levels)

Sell Below 25424 Tgt 25385, 25323 and 25287 (Nifty Spot Levels)

Traders may watch out for potential intraday reversals at 09:32,10:02,11:48,01:22, 02:45

Key Trading Levels (Based on Open Interest – OI Data):

- Maximum Call Open Interest: The highest Call OI is seen at 25,600. This suggests that 25,600 will act as a strong resistance level for today’s expiry.

- Maximum Put Open Interest: The highest Put OI is observed around 25,300 and 25,200. This indicates strong support at these levels

Put-Call Ratio (PCR):

- The Nifty PCR for today’s expiry ( July 03, 2025) is 0.61 indicating a bearish to sell bias. Recent PCR values have been below 1 (e.g., around 0.288 to 0.495 in the afternoon session yesterday), suggesting that Call writing is more aggressive than Put writing, which implies resistance at higher levels. A low PCR indicates a bearish sentiment.

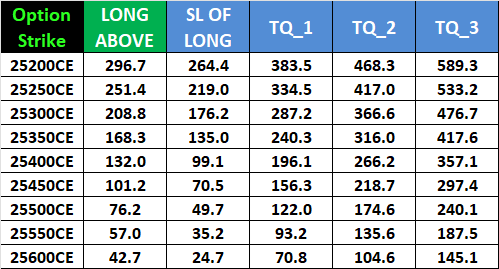

Nifty Call Options for LONG Trade

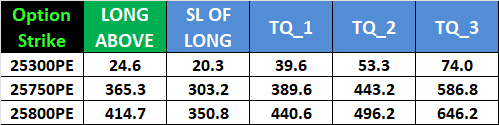

Nifty PUT Options for LONG Trade

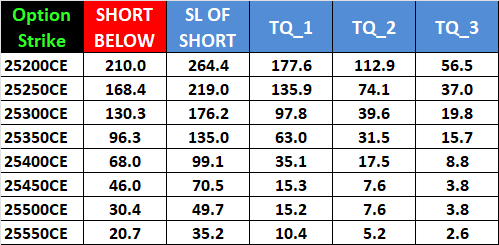

Nifty Call Options for SHORT Trade

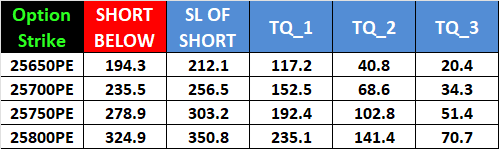

Nifty PUT Options for SHORT Trade

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.

► Join Youtube channel : Click here

► Check out Gann Course Details: W.D. Gann Trading Strategies

► Check out Financial Astrology Course Details: Trading Using Financial Astrology

► Check out Gann Astro Indicators Details: Gann Astro Indicators