FII & Client Activity – Index Futures Update for 16 June 2025

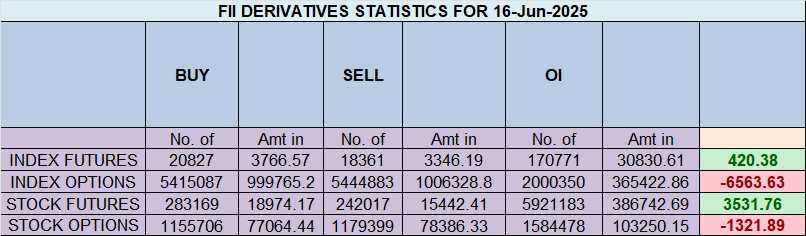

On 16 June 2025, Foreign Institutional Investors (FIIs) maintained a Bullish stance in the Nifty Index Futures market. Despite broader market indecision, the data indicates strategic long buildup from FIIs, even as clients displayed signs of caution.

Key Highlights

Contracts Bought by FIIs: 418

Total Value: ₹74 crore

Net Open Interest (OI): Increased by 4,404 contracts → Indicates fresh positions being built, particularly long-side.

Breaking Down FII Activity

-

✔ FIIs added: 2,399 long contracts

-

✔ FIIs covered: 67 short contracts

-

Interpretation: Subtle, yet notable bullish intent from FIIs — building fresh longs while trimming shorts.

Client Behavior

-

✔ Clients covered: 7,725 long contracts

-

✔ Clients added: 3,303 short contracts

-

Interpretation: Clients may be profit-booking on longs or turning defensive, possibly expecting near-term resistance or volatility.

Current Positioning Snapshot

| Participant | Long % | Short % | Long:Short Ratio |

|---|---|---|---|

| FIIs | 20% | 80% | 0.25 |

| Clients | 60% | 40% | 1.51 |

➡️ FIIs remain heavily short-biased, though today’s shift shows early signs of repositioning.

➡️ Clients are still optimistic, but rising shorts suggest hedging or a wait-and-watch approach.

Master Losses: Your Trading War Journal for Unbreakable Discipline

Today marks the Sensex monthly expiry, a key event that often brings increased volatility and unwinding of positions. Adding to this, we also have an important astrological trigger:

Mars is changing signs, a movement historically associated with sudden directional shifts and impulsive moves in financial markets — particularly in Banking and Midcap stocks.

Why This Matters:

-

Expiry day + planetary motion = double volatility trigger

-

Traders can expect sharp intraday swings as positions are rolled forward or squared off.

-

With Mars ruling momentum, sectors like Banking, PSU, and Auto could witness sharp moves.

Intraday Strategy

First 15-minute high and low will act as the key breakout/breakdown levels. Use them to frame:

-

Directional trades once price moves decisively above/below these levels.

-

Scalp setups with tight stop losses on either side for expiry-day volatility.

Trading Caution

-

Don’t chase gap-ups or gap-downs — wait for confirmation.

-

Maintain strict risk management, especially on options trades where premiums may decay rapidly post-11:30 AM.

Nifty Trade Plan for Positional Trade ,Bulls will get active above 24964 for a move towards 25075/25155. Bears will get active below 24900 for a move towards 24807/24729

Traders may watch out for potential intraday reversals at 09:20,10:20,12:22,01:40,02:47 How to Find and Trade Intraday Reversal Times

Nifty May Futures Open Interest Volume stood at 1.17 lakh cr , witnessing liquidation of 0.75 Lakh contracts. Additionally, the increase in Cost of Carry implies that there was covering of SHORT positions today.

Nifty Advance Decline Ratio at 46:04 and Nifty Rollover Cost is @24321 closed above it.

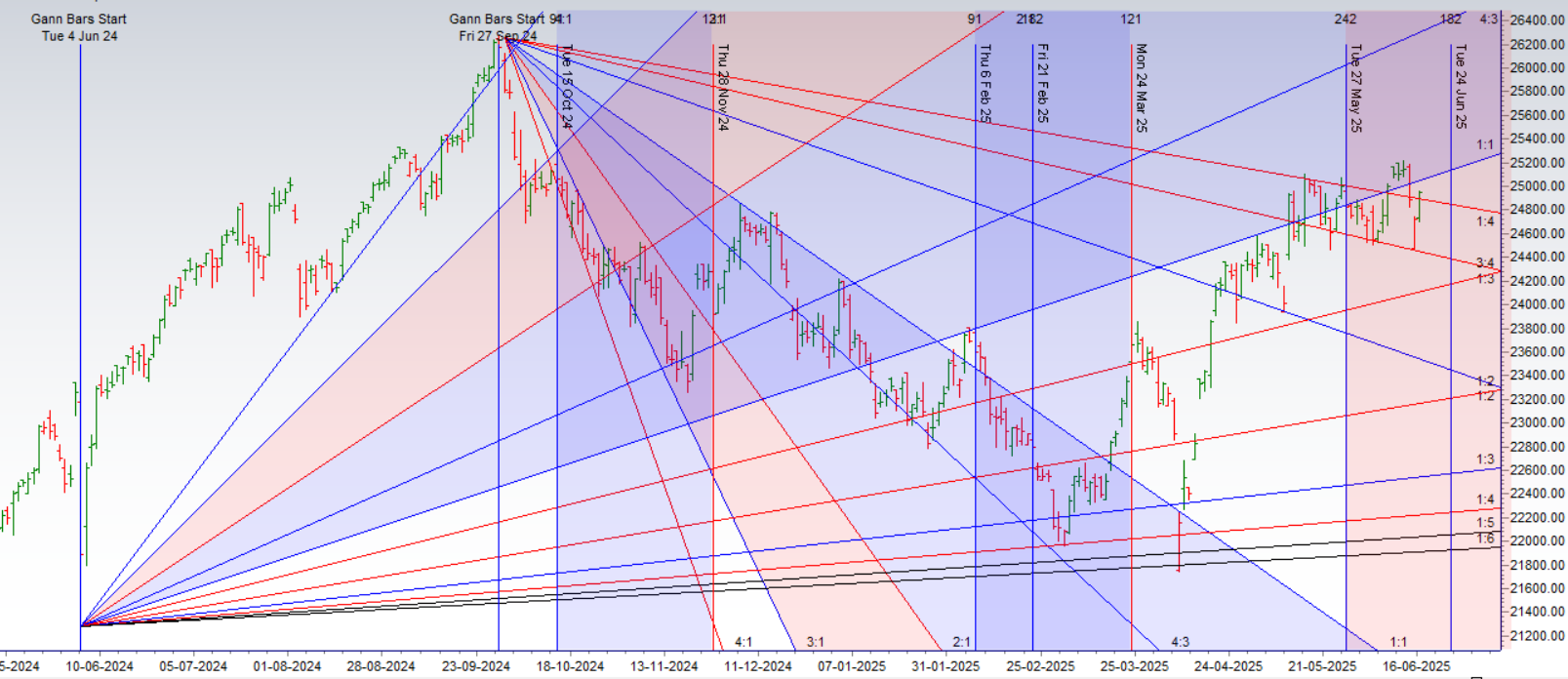

Nifty Gann Monthly Buy Level : 24822 — Closed above it

Nifty Gann Monthly Buy Level : 24669

Nifty has closed above its 20 SMA @ 24833 Trend is Buy on Dips till above 24800.

Nifty options chain shows that the maximum pain point is at 24800 and the put-call ratio (PCR) is at 1.11.Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound.

Nifty 50 Options Chain Analysis

The Nifty 50 options chain indicates that the highest open interest (OI) on the call side is at the 25000 strike, followed by 25100 strikes. On the put side, the highest OI is at the 24800 strike, followed by 24700 strikes. This suggests that the market participants are expecting Nifty 50 to remain range between 24700-25000 levels.

Options Market Activity – 11 June 2025

Retail Activity in Options Market

Call Options:

-

✅ Added: 55,000 contracts

-

❌ Shorted: 273,000 contracts

Put Options:

-

✅ Added: 81,000 contracts

-

❌ Shorted: 269,000 contracts

➡️ Interpretation:

Retail participants are displaying a cautious or slightly bearish outlook, especially visible through the aggressive shorting of both calls and puts, which typically signals a view of rangebound movement or a volatility crush play ahead of key data.

FII Activity in Options Market

Call Options:

-

✅ Added: 125,000 contracts

-

✅ Covered: 33,800 contracts

Put Options:

-

✅ Covered: 106,000 contracts

-

✅ Covered: 36,900 contracts

➡️ Interpretation:

FIIs are reducing downside hedges and unwinding both call and put shorts — signaling a neutral to mildly bullish positioning, possibly ahead of key triggers like US CPI data and India’s inflation print.

Summary View:

-

Retail: High volume in short positions across both legs → Suggests expectation of low volatility or consolidation.

-

FII: Net reduction in options exposure, especially on the put side → Indicates improving risk appetite or confidence in market stability short-term.

In the cash segment, Foreign Institutional Investors (FII) sold 446 cr , while Domestic Institutional Investors (DII) bought 1584 cr.

Traders who follow the musical octave trading path may find valuable insights in predicting Nifty’s movements. According to this path, Nifty may follow a path of 23037-23722-24408-25134-25860 This means that traders can take a position and potentially ride the move as Nifty moves through these levels.Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable.

Be patient. The market is constantly changing, and it’s important to be patient when trading. Don’t expect to make a lot of money overnight. Be patient and let the market work in your favor.

For Positional Traders, The Nifty Futures’ Trend Change Level is At 24932. Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 24918 , Which Acts As An Intraday Trend Change Level.

Nifty Intraday Trading Levels

Buy Above 24950 Tgt 24985, 25025 and 25075 ( Nifty Spot Levels)

Sell Below 24900 Tgt 24872, 24835 and 24777 (Nifty Spot Levels)

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.

► Join Youtube channel : Click here

► Check out Gann Course Details: W.D. Gann Trading Strategies

► Check out Financial Astrology Course Details: Trading Using Financial Astrology

► Check out Gann Astro Indicators Details: Gann Astro Indicators