FII Index Futures Positioning – 03 June 2025

Foreign Institutional Investors (FIIs) maintain a strong bearish stance

On 03 June 2025, FIIs continued to build on their bearish bias in the Nifty Index Futures segment, with significant short additions pointing to rising caution ahead of key macro events like the RBI Policy outcome on June 5.

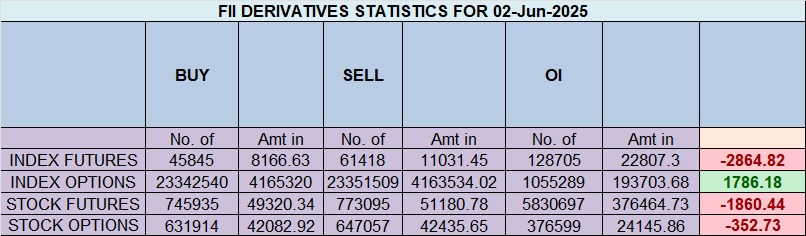

FIIs Activity Snapshot

-

Contracts Shorted: 10,194

-

Total Value: ₹1,897 crore

-

Net Open Interest Change: +10,120 contracts

→ This indicates fresh short positions, not just rollovers or unwinding.

Breaking Down FII Activity

| Activity | Contracts |

|---|---|

| Longs Covered | 877 |

| Shorts Added | 13,211 |

FIIs are rapidly increasing downside protection and directional bearish bets.

Client Activity

-

Longs Added: 8,976

-

Shorts Added: 1,563

Retail/DII clients are still net long, indicating confidence in short-term market stability or bounce-back.

Current Positioning in Index Futures

| Category | Long % | Short % | Long:Short Ratio |

|---|---|---|---|

| FIIs | 17% | 83% | 0.20 |

| Clients | 62% | 38% | 1.61 |

✅ FIIs: Deeply short-heavy — highest bearish exposure in recent weeks.

✅ Clients: Strong bullish tilt — possibly banking on support zones and macro triggers (like RBI rate policy) to reverse sentiment.

Interpretation & Market Outlook

-

This is the third consecutive session of heavy FII shorting — aligning with tight range behavior in Nifty near 25,000.

-

The 17:83 long-short ratio shows aggressive downside hedging or directional bearish play from FIIs.

-

With the RBI policy decision due on June 6, this aggressive stance could be anticipatory of policy disappointment, liquidity risk, or global volatility spillover.

Final Note

With FIIs heavily short and Clients overly long, the next 2–3 sessions will be crucial for determining trend continuation or reversal. The outcome of RBI’s stance and global cues (bond yields, dollar index) will likely drive the next major directional leg.

Traders are advised to stay hedged, avoid directional over-leverage, and watch for volatility spikes tied to macro triggers.

The Silent Killer: How Boredom Destroys Trader Profits & How to Combat It

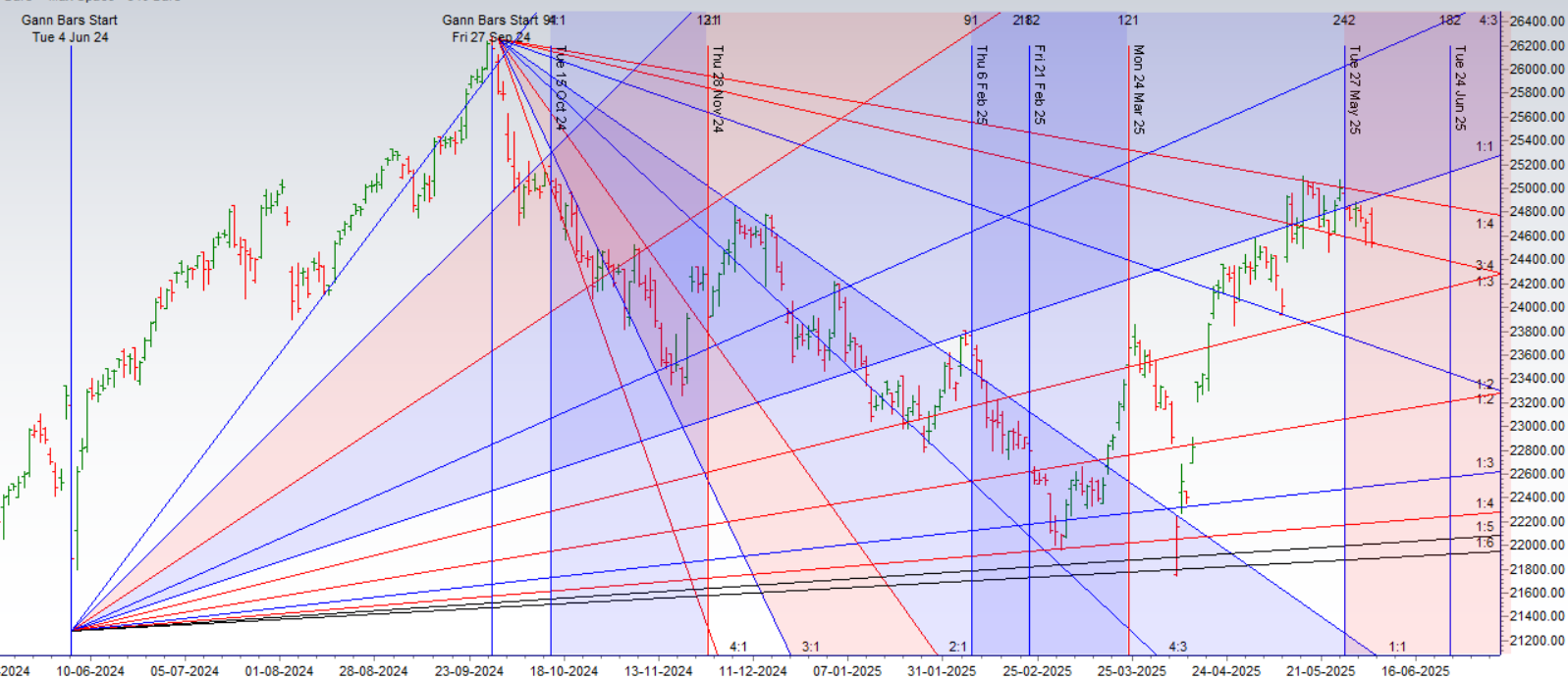

Nifty formed a bearish outside bar today — a strong signal indicating the potential beginning of a new trend, especially as we approach a critical macro event: the RBI Monetary Policy on 5 June 2025.

Key Technical Setup

-

Outside Bar Candle: Typically signals exhaustion of the prior trend and sets the stage for trend reversal or continuation with strength.

-

3×4 Gann Angle Support: Price is hovering near this crucial level. Historically, these angles often serve as major inflection points.

-

⚠️ Below Double Ingress Low: Despite the bounce attempts, price remains below the Venus-Mercury Double Ingress low, reinforcing the importance of this resistance.

Astro-Tech Confluence

-

New Trend Cycle: With the market rejecting higher levels post-ingress and Mercury now fully conjunct the Sun, we are entering a zone where price + time + event align — a classic Gann trigger.

- 04 June was the date last year when Nifty was down 8% due to Lok Sabha Results. Gann 1 Year Cycle also in Play.

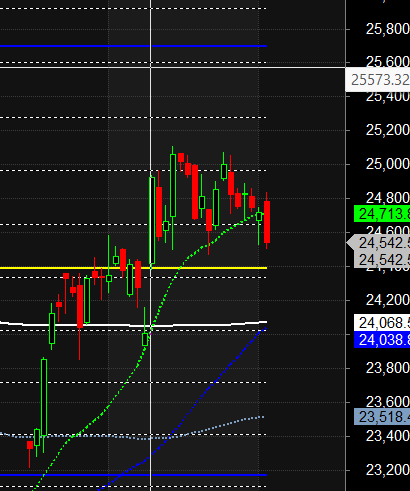

Level to Watch: 24,500

-

A sustained close below 24,500 will likely confirm bearish momentum and open the downside toward:

-

24,389 – previous support

-

24,211–24,144 – gap-fill zone if selling accelerates

-

-

On the upside, bulls will regain strength only above 24,640, which would negate today’s outside bar setup.

What’s Ahead

-

RBI Policy (June 5):

With FIIs maintaining high short positions and Nifty forming an outside bar near major Gann levels, expect increased volatility leading into the policy. -

Volatility Spike?

The Sun-Mercury aspect and pre-policy uncertainty make this a prime time for a breakout or breakdown over the next two sessions.

Nifty Trade Plan for Positional Trade ,Bulls will get active above 24640 for a move towards 24799/24957 Bears will get active below 24482 for a move towards 24323/24165

Traders may watch out for potential intraday reversals at 09:31,10:27,11:50,01:38,02:38 How to Find and Trade Intraday Reversal Times

Nifty May Futures Open Interest Volume stood at 1.27 lakh cr , witnessing addition of 0.57 Lakh contracts. Additionally, the increase in Cost of Carry implies that there was addition of SHORT positions today.

Nifty Advance Decline Ratio at 07:43 and Nifty Rollover Cost is @24321 closed above it.

Nifty Gann Monthly Trade level :24211 closed above it

Nifty has closed Below its 20 SMA @ 24713 Trend is Sell on Rise till below 24713

Nifty options chain shows that the maximum pain point is at 24650 and the put-call ratio (PCR) is at 0.49.Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound.

Nifty 50 Options Chain Analysis

The Nifty 50 options chain indicates that the highest open interest (OI) on the call side is at the 24600 strike, followed by 24700 strikes. On the put side, the highest OI is at the 24500 strike, followed by 24400 strikes. This suggests that the market participants are expecting Nifty 50 to remain range between 24400-24800 levels.

Options Market Activity – 03 June 2025

Retail Remains Aggressively Active While FIIs Maintain a Hedged Outlook

Today’s options data reflects continued hedging and mixed sentiment, especially ahead of the crucial RBI policy meeting on June 6. Let’s break down how both Retail traders and FIIs positioned themselves.

Retail Activity in Options Market

Call Options:

-

Added: 875K contracts

-

Shorted: 682K contracts

Put Options:

-

Added: 122K contracts

-

Shorted: 34K contracts

Interpretation:

Retail participants were net long on calls, suggesting continued bullish sentiment or speculation around a bounce. However, the heavy call writing also indicates that many are betting against a major breakout above 25,000. Put buying was relatively light, indicating moderate downside hedging.

➡️ Net Retail Bias: Mildly bullish with a hedge-light setup, vulnerable if market breaks below key support.

FII Activity in Options Market

Call Options:

-

Added: 34K contracts

-

Shorted: 109K contracts

Put Options:

-

Added: 54K contracts

-

Shorted: 115K contracts

Interpretation:

FIIs are continuing with their net short options strategy, particularly:

-

Call writing dominates call buying → bearish to neutral view, likely expecting consolidation below resistance.

-

Put shorting is slightly higher than put buying → hinting at a view that major downside is not imminent or that they are funding call shorts via puts.

➡️ Net FII Bias: Neutral to mildly bearish, playing range and volatility more than strong directional conviction.

Market Sentiment Summary

| Segment | Net Call View | Net Put View | Overall Bias |

|---|---|---|---|

| Retail | Long-biased | Light Hedge | Moderately Bullish |

| FIIs | Heavy Writing | Net Neutral to Long | Neutral to Bearish |

Strategic Takeaways

-

Retail longs may be underestimating downside risks with limited put protection.

-

FIIs are playing range compression, consistent with broader VIX cooling and post-event uncertainty.

-

With price rejection at 25,000, the options positioning reinforces a tight range unless key levels are decisively breached.

What to Watch

-

-

Expiry-wise OI near the 24,500 and 25,000 strikes to assess max pain zones.

-

RBI outcome reaction → a surprise (on rates or liquidity tools) could cause violent unwinding of these neutral structures.

-

Global cues (USDINR, crude, bond yields) that may disrupt this fragile balance.

-

In the cash segment, Foreign Institutional Investors (FII) sold 2853 Cr , while Domestic Institutional Investors (DII) bought 5907 cr.

Traders who follow the musical octave trading path may find valuable insights in predicting Nifty’s movements. According to this path, Nifty may follow a path of 23037-23722-24408-25134 This means that traders can take a position and potentially ride the move as Nifty moves through these levels.Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable.

Those who succeed big at anything all have the same attitude: You keep going until it happens or you die trying. Quitting is not an option.

For Positional Traders, The Nifty Futures’ Trend Change Level is At 24822 . Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 24741 , Which Acts As An Intraday Trend Change Level.

Nifty Intraday Trading Levels

Buy Above 24586 Tgt 24618, 24666 and 24729 ( Nifty Spot Levels)

Sell Below 24529 Tgt 24500, 24460 and 24412 (Nifty Spot Levels)

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.

► Join Youtube channel : Click here

► Check out Gann Course Details: W.D. Gann Trading Strategies

► Check out Financial Astrology Course Details: Trading Using Financial Astrology

► Check out Gann Astro Indicators Details: Gann Astro Indicators