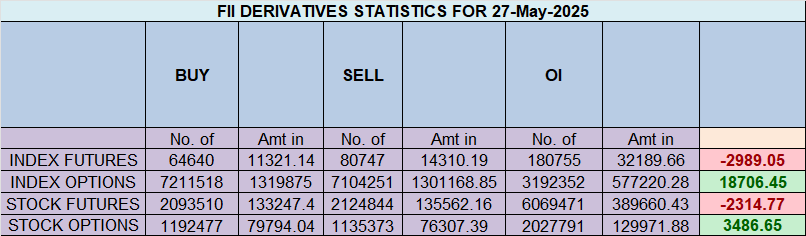

FII Activity – Aggressive Short Build-up in Index Futures (May 27, 2025)

Foreign Institutional Investors (FIIs) turned decisively bearish, shorting 14,295 contracts worth ₹2,685 crore, leading to a net open interest increase of 13,903 contracts — indicating fresh short positions were aggressively built.

Breakdown of FII Activity

-

✔ Longs Covered: 1,750 contracts

-

✔ Shorts Added: 14,357 contracts

-

FII Long-to-Short Ratio: 0.45 → Bearish Bias

-

Net Positioning: 31% Long : 69% Short

Client Activity Snapshot

-

✔ Longs Added: 3,576 contracts

-

✔ Shorts Covered: 3,918 contracts

-

Client Long-to-Short Ratio: 1.56 → Bullish Bias

-

Net Positioning: 61% Long : 39% Short

⚖️ Market Implications

-

FIIs are clearly betting on downside continuation or volatility increase, as seen from the scale of short additions.

-

Retail/Clients, meanwhile, are maintaining a contrarian bullish stance — potentially fueling short-covering if support levels hold.

-

Key Levels to Watch (for Nifty):

-

Support: 24389 / 24166

-

Resistance: 24729 / 24850

-

The Silent Killer: How Boredom Destroys Trader Profits & How to Combat It

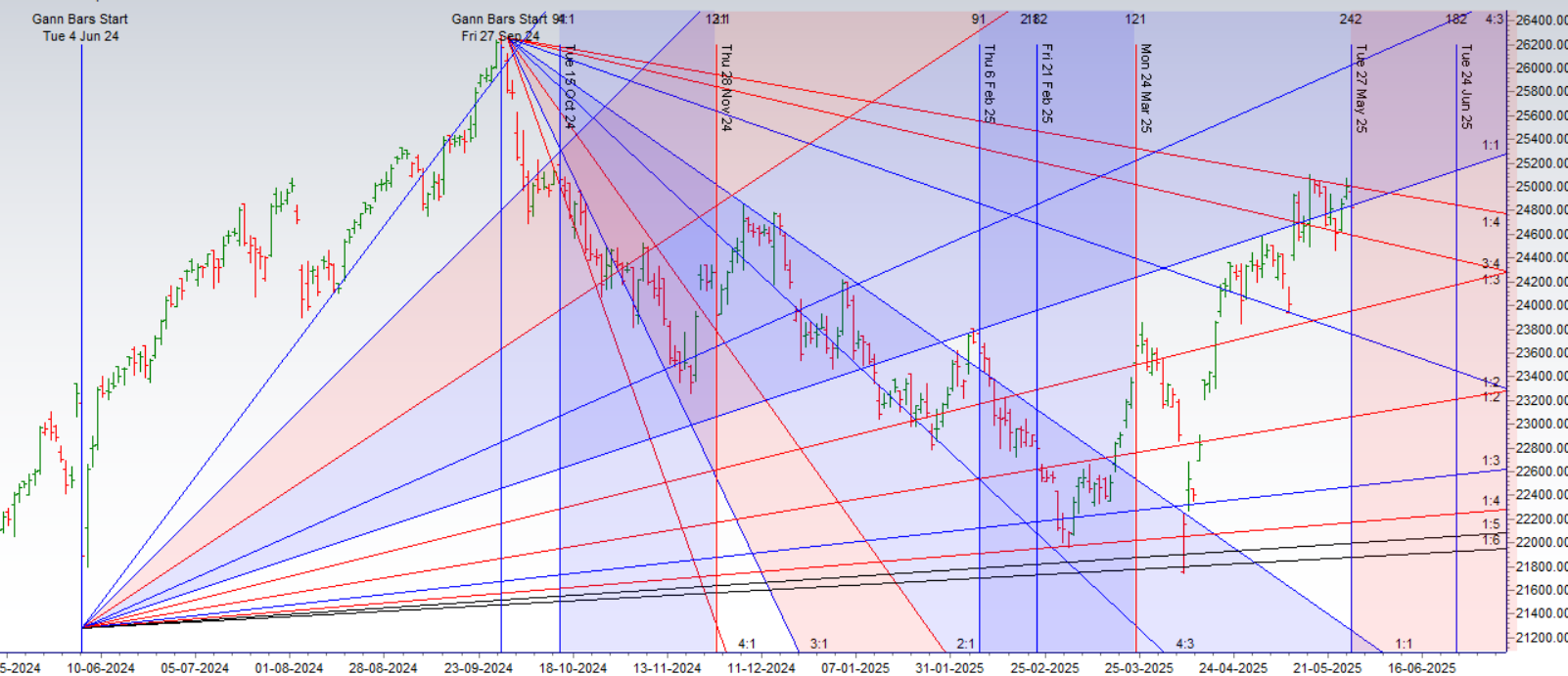

Nifty delivered a textbook upmove right on cue with the Bayer date highlighted in our previous analysis — validating the astro-technical confluence at work.

Key Astro Events Coming Up:

The upcoming week features two major planetary ingresses:

-

Mercury Ingress

-

Saturn Ingress

➡️ This creates a Double Ingress setup, which historically triggers strong directional moves across major indices, especially when aligned with key price levels.

As discussed in the video below, this astro setup acts as a time trigger, often unleashing volatility and trend shifts within 1–2 sessions.

⚠️ Trader’s Outlook & Strategy:

-

✅ Trade with well-defined levels and risk management in place.

-

Avoid emotional trades — volatility can be deceptive.

-

Upside momentum could intensify if Nifty sustains above last week’s high.

-

Watch for reversals if price reacts sharply near known Gann or astro resistance zones.

The red dashed line marks the astro time trigger on May 27, 2024 — a zone historically tied to directional changes.

The shaded area represents the ±100 point volatility zone, highlighting the potential expansion range in response to planetary energy shifts.

Key Insight:

Expect explosive movement or trend acceleration in the next 1–2 sessions. Keep stops tight and trade only with confirmation above breakout zones.

Nifty witnessed a volatile session on May 27, aligning with a powerful confluence of time and astro cycles that suggest a decisive move is imminent.

⏳ Time & Astro Confluence at Play

-

242 days from the June 4, 2023 low

-

49 days from the April 7, 2024 bottom

-

New Moon + Double Ingress astro events → historically signal trend reversals or accelerations

(Explained in the video below)

Technical Recap

-

Closed below Monday’s low of 24,900

-

Got rejected again from the psychological resistance zone of 25,000

-

❌ 6th rejection from 25,000 in the past month — increasing the strength and significance of this resistance

Range in Focus:

24,700 – 25,000 → a tight range that’s becoming compressed and reactive

Key Insight:

“The more times a level is tested and rejected, the stronger the breakout will be once it occurs.”

Market Context:

-

Result season is ending, allowing insiders to resume buying/selling — expect volume and momentum to rise.

-

Institutional flows will now start reflecting forward-looking expectations.

Trading Strategy:

-

Breakout above 25,000 → could target 25,250–25,444

-

Breakdown below 24,700 → may trigger a move toward 24,444–24,300

-

Next 1–2 sessions are critical — expect a directional move

-

Intraday traders should monitor the first 15-minute high/low to catch early momentum.

Nifty Trade Plan for Positional Trade ,Bulls will get active above 24927 for a move towards 25006/25084/25163 Bears will get active below 24770 for a move towards 24692/24614.

Traders may watch out for potential intraday reversals at 09:32,11:12,12:19,01:59How to Find and Trade Intraday Reversal Times

Nifty May Futures Open Interest Volume stood at 1.03 lakh cr , witnessing liquidation of 2.5 Lakh contracts. Additionally, the increase in Cost of Carry implies that there was closeure of LONG positions today.

Nifty Advance Decline Ratio at 11:39 and Nifty Rollover Cost is @24321 closed above it.

Nifty Gann Monthly Trade level :24211 closed above it

Nifty has closed Above its 200 SMA @ 24626 Trend is Buy on Dips till above 24650

Nifty options chain shows that the maximum pain point is at 24800 and the put-call ratio (PCR) is at 0.75.Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound.

Nifty 50 Options Chain Analysis

The Nifty 50 options chain indicates that the highest open interest (OI) on the call side is at the 24800 strike, followed by 25000 strikes. On the put side, the highest OI is at the 24400 strike, followed by 24300 strikes. This suggests that the market participants are expecting Nifty 50 to remain range between 24500-24900 levels.

Retail & FII Options Market Activity – May 27, 2025

️ Retail Traders

Call Options:

-

Added: 529K contracts

-

Shorted: 580K contracts

Put Options:

-

Covered: 136K contracts

-

Shorted: 10.9K contracts

Retail Sentiment:

Net Call Shorts > Call Longs → Suggests limited confidence in upside.

Put Unwinding shows reduced fear and possibly expectation of sideways to mildly positive movement.

Foreign Institutional Investors (FIIs)

Call Options:

-

Added: 167K contracts

-

Shorted: 146K contracts

Put Options:

-

Added: 126K contracts

-

Shorted: 37K contracts

FII Sentiment:

Balanced approach on calls — adding and shorting in similar volumes.

Put addition > put shorting → Slight hedging or downside protection bias.

Quick Interpretation

-

Retail is cautiously neutral, avoiding aggressive bullish bets.

-

FIIs are lightly hedged, suggesting they’re preparing for volatility, possibly after recent heavy index futures shorts.

In the cash segment, Foreign Institutional Investors (FII) bought 348 Cr , while Domestic Institutional Investors (DII) bought 10104 cr.

Traders who follow the musical octave trading path may find valuable insights in predicting Nifty’s movements. According to this path, Nifty may follow a path of 23037-23722-24408-25134 This means that traders can take a position and potentially ride the move as Nifty moves through these levels.Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable.

Those who succeed big at anything all have the same attitude: You keep going until it happens or you die trying. Quitting is not an option.

For Positional Traders, The Nifty Futures’ Trend Change Level is At 24876 . Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 24637 , Which Acts As An Intraday Trend Change Level.

Nifty Intraday Trading Levels

Buy Above 24848 Tgt 24888, 24945 and 25008 ( Nifty Spot Levels)

Sell Below 24800 Tgt 24763, 24714 and 24666 (Nifty Spot Levels)

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.

► Join Youtube channel : Click here

► Check out Gann Course Details: W.D. Gann Trading Strategies

► Check out Financial Astrology Course Details: Trading Using Financial Astrology

► Check out Gann Astro Indicators Details: Gann Astro Indicators