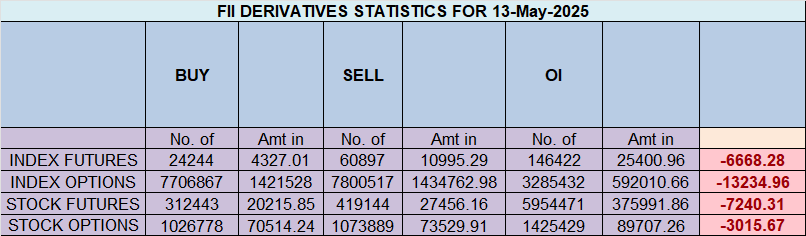

FIIs Turn Aggressively Bearish in Nifty Futures – May 13, 2024

On May 13, Foreign Institutional Investors (FIIs) adopted a strongly bearish stance in the Nifty Index Futures market by shorting 29,878 contracts worth a massive ₹5,542 crore. This activity was accompanied by a net open interest (OI) decrease of 10,906 contracts, indicating long unwinding combined with fresh short additions.

FII Activity Breakdown:

-

✔ Longs Covered: 25,350 contracts

-

✔ Shorts Added: 11,313 contracts

-

Net OI Change: –10,906 contracts

-

FII Long-to-Short Ratio: 0.60

-

Current Positioning: 38% Long : 62% Short

Interpretation:

FIIs are aggressively de-risking with major long liquidation and renewed short buildup, showing low confidence in the short-term index outlook — possibly due to overbought conditions, event risks, or macro triggers.

Client Activity Overview:

-

✔ Longs Added: 21,775 contracts

-

✔ Shorts Covered: 18,413 contracts

-

Client Long-to-Short Ratio: 1.17

-

Current Positioning: 54% Long : 46% Short

Interpretation:

Clients continue to lean bullish, absorbing some of the selling pressure from FIIs, and showing faith in further upside or at least support at lower levels.

Market Implications:

-

FII behavior signals potential caution or profit-booking ahead of key technical resistance (24,700+).

-

Clients’ counter-positioning hints at buy-the-dip mentality, but the sustainability will depend on global cues, VIX stability, and index holding 24,300–24,350 support.

5 Bad Trading Habits That Destroy Profits – How to Fix Them Now

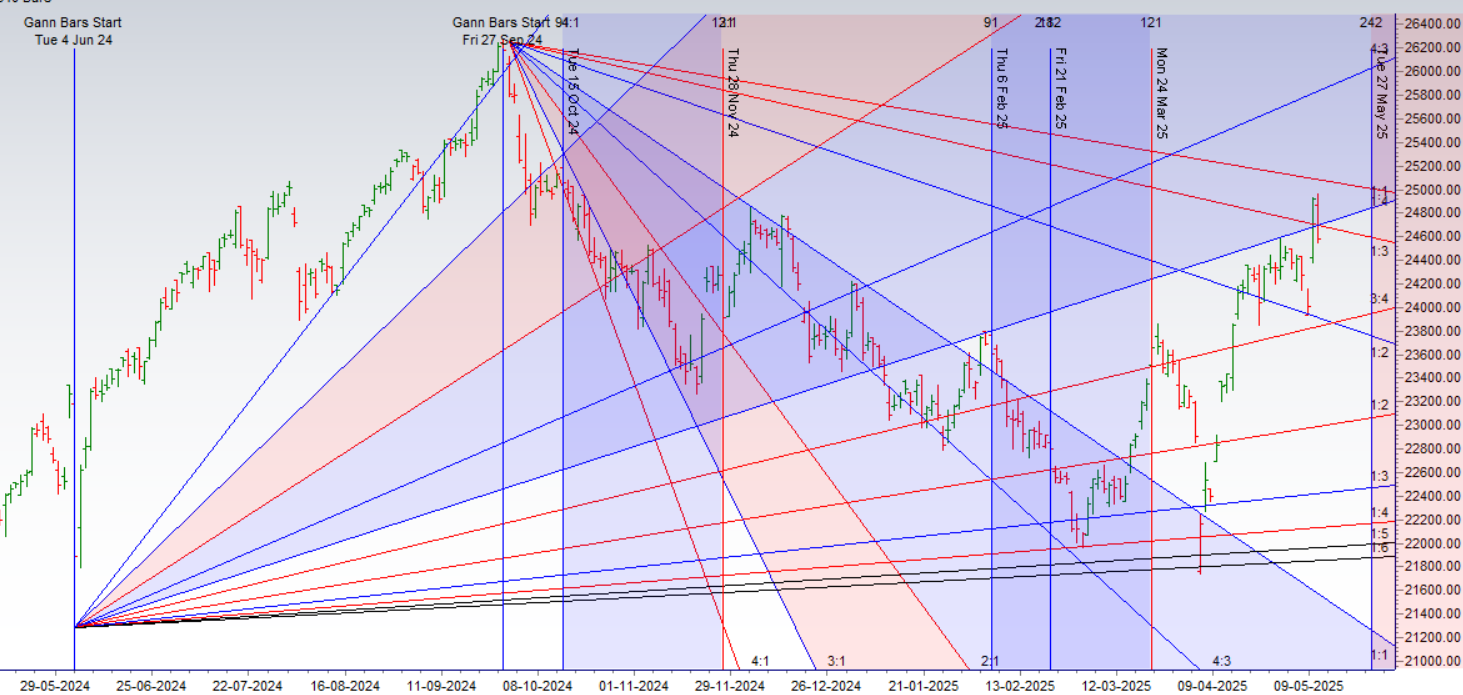

Nifty delivered a strong 3.3% rally, marking its biggest one-week gain in the past four years, driven by a powerful confluence of Gann and Astro time cycles, as discussed in our latest weekly video.

The index also respected key Gann angle support, triggering a sharp upward move and affirming the relevance of time–price alignment in directional shifts.

Key Level to Watch: 24,700–24,729

-

This zone marks the intersection of two major Gann angles, making it a high-value support area.

-

Any pullback toward 24,700–24,729 should be seen as a buying opportunity, with a tight stop-loss of 50 points.

-

A sustained hold above this zone could set the stage for a continuation toward 24,900–25,050.

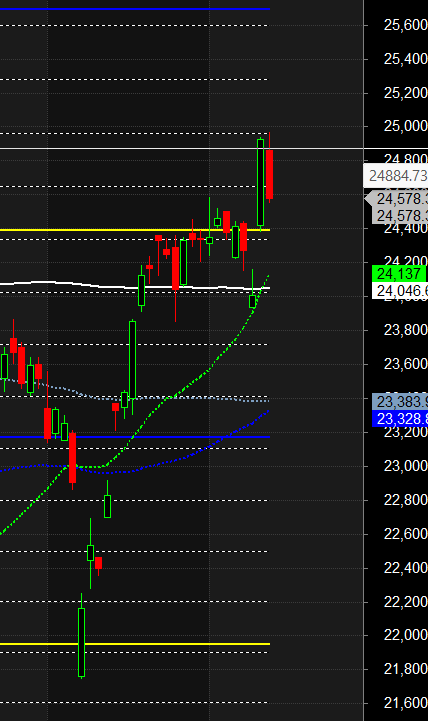

Nifty witnessed a mild decline today after Monday’s powerful rally. The index retraced approximately 25% of the previous session’s gains, indicating a running correction — a healthy pause within an ongoing uptrend.

Price action has settled right around the psychological level of 24500, while critically respecting the Gann support level of 24512.

Key Technical Insight:

-

Gann Support Level: 24512-24555

→ Holding above this zone keeps the bullish structure intact. -

Correction Type: Running correction

→ Typically followed by continuation in the prevailing trend (in this case, up).

Macro Boost – Inflation Data:

-

India’s Retail Inflation Drops to 3.16% (6-Year Low)

→ Eases pressure on the RBI, raising expectations of liquidity stability and maintaining a favorable backdrop for banks.

→ Sentimentally positive for Nifty and interest-rate sensitive sectors.

Outlook & Strategy:

-

✅ Bullish Bias Maintains:

As long as price sustains above 24555, the uptrend remains active with potential to retest or break the 25000 -

Immediate Target: All-time high zone above 24729

-

⚠️ Invalidation Level: Breakdown below 24389 could trigger a deeper retracement toward 24222-24108

Nifty Trade Plan for Positional Trade ,Bulls will get active above 24620 for a move towards 24774/24928 Bears will get active below 24478 for a move towards 24311/24156

Traders may watch out for potential intraday reversals at 09:17,11:35,12:35,01:20,02:41 How to Find and Trade Intraday Reversal Times

Nifty May Futures Open Interest Volume stood at 1.26 lakh cr , witnessing addition of 0.24 Lakh contracts. Additionally, the increase in Cost of Carry implies that there was addition of LONG positions today.

Nifty Advance Decline Ratio at 13:37 and Nifty Rollover Cost is @24321 closed above it.

Nifty Gann Monthly Trade level :24211 closed above it

Nifty has closed Above its 200 SMA @ 24137 Trend is Buy on Dips till above 24389

Nifty options chain shows that the maximum pain point is at 24550 and the put-call ratio (PCR) is at 0.69.Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound.

Nifty 50 Options Chain Analysis

The Nifty 50 options chain indicates that the highest open interest (OI) on the call side is at the 24800 strike, followed by 25000 strikes. On the put side, the highest OI is at the 24400 strike, followed by 24300 strikes. This suggests that the market participants are expecting Nifty 50 to remain range between 24300-24800 levels.

Retail & FII Options Activity – May 13, 2024

Understanding how Retail and FIIs are positioning in the options market provides a valuable edge, especially during high-volatility or event-driven weeks.

Retail Activity Overview:

Call Options:

-

Added: 100K contracts

-

Shorted: 823K contracts

Put Options:

-

Covered: 81.8K contracts

-

Covered: 45K contracts

Interpretation:

Retail traders are aggressively shorting Call options, reflecting hedging or expectations of a pullback. The simultaneous covering of puts signals neutral-to-bearish bias — suggesting they believe upside is limited or already priced in.

FII Activity Overview:

Call Options:

-

Added: 59K contracts

-

Shorted: 141K contracts

Put Options:

-

Added: 87.8K contracts

-

Shorted: 99.6K contracts

Interpretation:

FIIs are reducing directional conviction — adding both Calls and Puts while shorting them in larger quantities. This pattern indicates a range-bound expectation or volatility harvesting strategy such as short strangles or iron condors.

Key Takeaways:

-

Retail is positioning for limited upside (heavy Call shorts).

-

FIIs are deploying volatility-neutral strategies, possibly ahead of expiry

-

This data aligns with the recent Nifty resistance at 24,700–24,729 and suggests consolidation or pullback unless momentum breaks higher.

In the cash segment, Foreign Institutional Investors (FII) sold 476 Cr , while Domestic Institutional Investors (DII) bought 4273 cr.

Traders who follow the musical octave trading path may find valuable insights in predicting Nifty’s movements. According to this path, Nifty may follow a path of 23037-23722-24408-25134 This means that traders can take a position and potentially ride the move as Nifty moves through these levels.Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable.

Those who succeed big at anything all have the same attitude: You keep going until it happens or you die trying. Quitting is not an option.

For Positional Traders, The Nifty Futures’ Trend Change Level is At 24448. Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 24777, Which Acts As An Intraday Trend Change Level.

Nifty Intraday Trading Levels

Buy Above 24639 Tgt 24699, 24743 and 24785 ( Nifty Spot Levels)

Sell Below 24600 Tgt 24575, 24512 and 24444 (Nifty Spot Levels)

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.

► Join Youtube channel : Click here

► Check out Gann Course Details: W.D. Gann Trading Strategies

► Check out Financial Astrology Course Details: Trading Using Financial Astrology

► Check out Gann Astro Indicators Details: Gann Astro Indicators