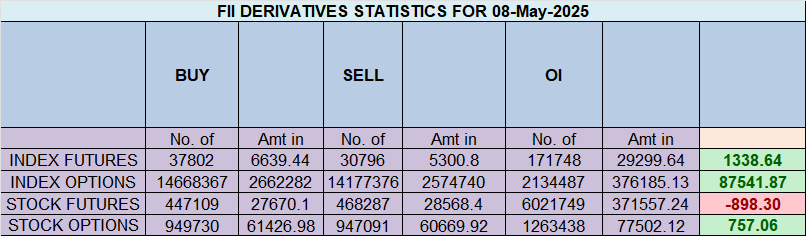

FIIs Strengthen Bullish Bias in Nifty Futures – May 08, 2024

Foreign Institutional Investors (FIIs) continued to build on their bullish positioning in the Nifty Index Futures segment on May08, buying 9,825 contracts worth ₹1,784 crore. This activity was supported by a net open interest (OI) increase of 4,411 contracts, indicating fresh long additions along with short covering.

FII Activity Breakdown:

-

✔ Longs Added: 6,133 contracts

-

✔ Shorts Covered: 873 contracts

-

Net OI Change: +4,411 contracts

-

FII Long-to-Short Ratio: 1.09

-

Positioning: 52% Long : 48% Short

Interpretation:

FIIs are firmly shifting toward a bullish bias, marking a significant turn in sentiment as long exposure crosses the 50% mark. The increase in OI confirms these are fresh directional bets, not just rollovers or adjustments.

Client Activity Overview:

-

✔ Longs Covered: 7,710 contracts

-

✔ Shorts Added: 5,071 contracts

-

Client Long-to-Short Ratio: 0.75

-

Positioning: 43% Long : 57% Short

Interpretation:

Clients are taking a more defensive stance, unwinding long positions while increasing shorts, possibly anticipating near-term resistance or protecting gains after the recent rally.

Trading Consistency & Discipline: Key to Long-Term Success

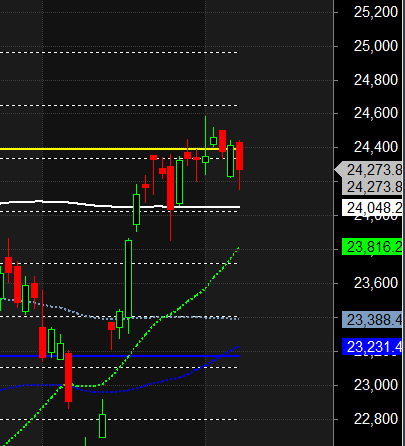

Nifty Opens Gap Down Amid Geopolitical Tension – Gann Support Holds at 23,900

Nifty opened with a gap down on heightened India-Pakistan tensions, following a close below the critical 24,389 Gann level. However, the index found strong support at the Gann angle zone of 23,900–23,935, which has temporarily halted the decline.

Key Technical Levels:

-

Support:

-

Gann angle zone: 23,900–23,935

-

A break below this may invite further selling pressure toward 23,800/23,666

-

-

Resistance (Weekly Close Watch):

-

24,000–24,054

-

Bulls need a close above this zone for a positive weekly close and potential recovery early next week

-

Astro Outlook: Mercury Sign Change This Weekend

-

Mercury’s ingress over the weekend is known to trigger trend reversals or gap openings, especially when aligned with geopolitical stress.

-

This could lead to sharp directional moves in early trade next week — traders should be prepared.

Trading Strategy:

-

Watch for a sustained move above 24,054 for short covering and bullish momentum into the weekend.

-

If 23,900 breaks decisively, it could trigger a deeper pullback.

-

Carry positions with hedge given the geopolitical and astro cycle risk.

Nifty Trade Plan for Positional Trade ,Bulls will get active above 24167 for a move towards 24478/24792 Bears will get active below 23857 for a move towards 23549/23243 — Waiting for 24478/24792

Traders may watch out for potential intraday reversals at 09:32,10:24,11:12,12:33,01:22,02:56 How to Find and Trade Intraday Reversal Times

Nifty May Futures Open Interest Volume stood at 1.33 lakh cr , witnessing addition of 2.7 Lakh contracts. Additionally, the increase in Cost of Carry implies that there was addition of LONG positions today.

Nifty Advance Decline Ratio at 17:33 and Nifty Rollover Cost is @24321 closed below it.

Nifty Gann Monthly Trade level :23521 closed above it

Nifty has closed Above its 200 SMA @ 24048 Trend is Buy on Dips till above 24200

Nifty options chain shows that the maximum pain point is at 24350 and the put-call ratio (PCR) is at 1.04.Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound.

Nifty 50 Options Chain Analysis

The Nifty 50 options chain indicates that the highest open interest (OI) on the call side is at the 24400 strike, followed by 24500 strikes. On the put side, the highest OI is at the 24200 strike, followed by 24100 strikes. This suggests that the market participants are expecting Nifty 50 to remain range between 24200-24500 levels.

In the cash segment, Foreign Institutional Investors (FII) bought 50 Cr , while Domestic Institutional Investors (DII) bought 1792 cr.

Traders who follow the musical octave trading path may find valuable insights in predicting Nifty’s movements. According to this path, Nifty may follow a path of 23037-23722-24408-25134 This means that traders can take a position and potentially ride the move as Nifty moves through these levels.Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable.

Trading is not about being right—it’s about managing risk. Doubling down is the arrogance of certainty meeting the brutality of randomness. The market doesn’t care about your conviction; it only respects survival.

For Positional Traders, The Nifty Futures’ Trend Change Level is At 24416. Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 24424 , Which Acts As An Intraday Trend Change Level.

Nifty Intraday Trading Levels

Buy Above 24343 Tgt 24385, 24424 and 24484 ( Nifty Spot Levels)

Sell Below 24295 Tgt 24256, 24212 and 24166 (Nifty Spot Levels)

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.

► Join Youtube channel : Click here

► Check out Gann Course Details: W.D. Gann Trading Strategies

► Check out Financial Astrology Course Details: Trading Using Financial Astrology

► Check out Gann Astro Indicators Details: Gann Astro Indicators