The U.S. has imposed a steep 104% tariff on Chinese imports after Beijing refused to soften its trade stance. This is a clear escalation of the trade war, and such protectionist moves tend to act as negative sentiment drivers for global markets, including India.

RBI MPC Meeting – Policy Expectations

-

A 25 bps rate cut is widely expected, and markets have likely already priced it in.

-

The focus will shift to the RBI’s commentary on liquidity, inflation, and growth outlook.

Key Technical Levels for Nifty

-

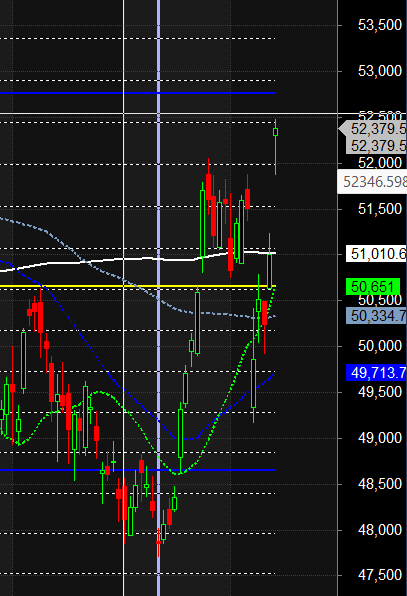

Bulls need a close above: 50809→ to regain control.

-

Bears will dominate below: 50359→ may trigger fresh downside.

-

Between 50359 –50809: Expect continued volatile, range-bound action.

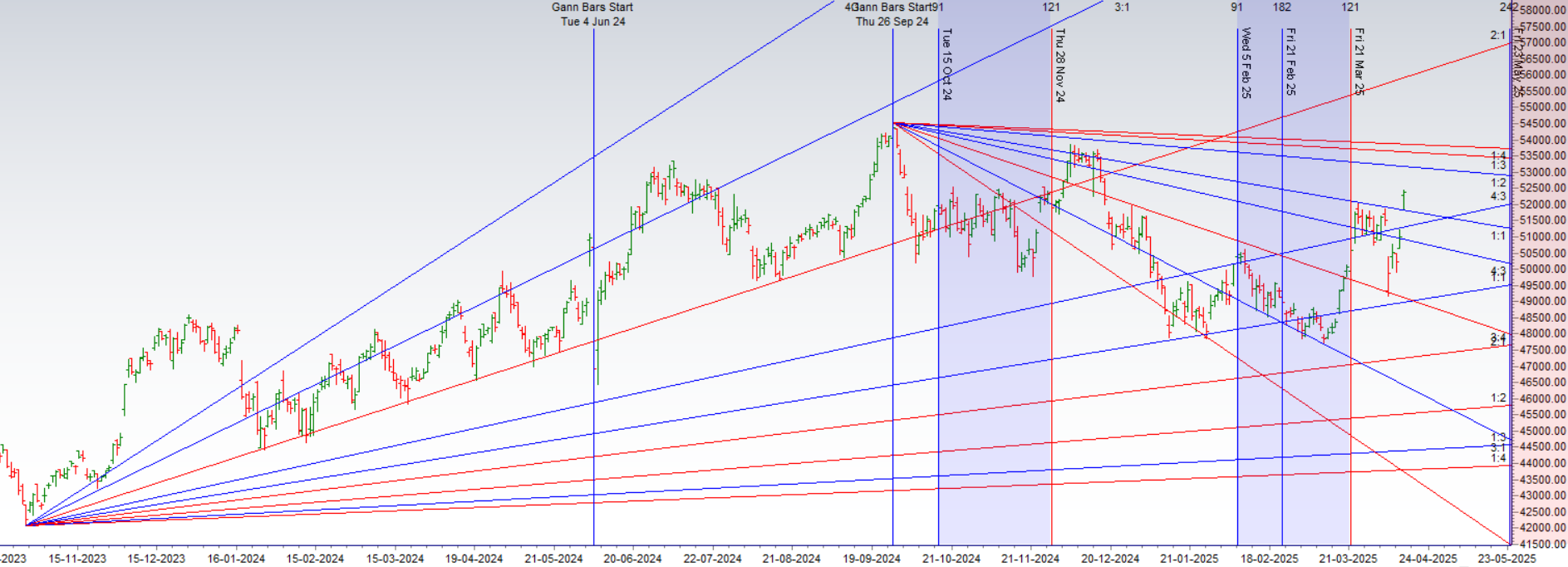

Astro Triggers + Gann Levels Align for Trend Move

Bank Nifty extended its rally on the back of positive global cues and key astrological shifts.

-

Venus turned direct yesterday, easing market sentiment.

-

Today, Mercury enters Aries, a fire sign, often associated with strong directional trends and increased market momentum.

Technical Highlights

-

✅ Closed above March swing high of 52,063, indicating strength.

-

✅ Today’s low was precisely at the 1×1 Gann angle, a major support level—showing price-time confluence.

-

Gann Yearly Trend Change Level: 52,348 → Bulls need to sustain above this to unlock higher targets.

Key Levels to Watch

Bullish Scenario:

-

Above 52,348 (Gann YTC Level)

→ Opens the path toward 53,729 – 54,000 in the near term.

Bearish Trigger:

-

Below 51,900

→ Bears may regain control, with downside targets of 51,000 – 50,785 (Gann support zone).

Intraday Strategy

-

Watch the first 15-minute high and low → Crucial to gauge trend strength and breakout zones.

-

Expect volatility as astro and Gann influences align.

Bank Nifty Trade Plan for Positional Trade ,Bulls will get active above 52171 for a move towards 52628/53088 Bears will get active below 51715 for a move towards 51261/50809.

Traders may watch out for potential intraday reversals at 09:15,10:43,12:27,01:39,02:34 How to Find and Trade Intraday Reversal Times

Bank Nifty April Futures Open Interest Volume stood at 22.5 lakh, with addition of 0.80 lakh contracts. Additionally, the Increase in Cost of Carry implies that there was a addition of LONG positions today.

Bank Nifty Advance Decline Ratio at 11:01 and Bank Nifty Rollover Cost is @52173 closed above it.

Bank Nifty Gann Monthly Trade level :52348 closed above it.

Bank Nifty closed above 200 SMA @51000,Trend is Buy on Dips till above 51500

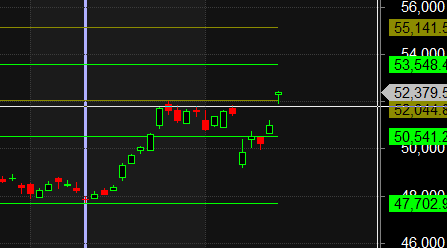

Traders who follow the musical octave trading path may find valuable insights in predicting Bank Nifty’s movements. According to this path, Bank Nifty may follow a path of 50541-52044-53548. This means that traders can take a position and potentially ride the move as Bank Nifty moves through these levels. Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable.

According to the Bank Nifty options chain, the call side has the highest open interest (OI) at the 52500 strike, followed by the 53000 strike. On the put side, the 52000 strike has the highest OI, followed by the 51500 strike.This indicates that market participants anticipate Bank Nifty to stay within the 52000-53000 range.

The Bank Nifty options chain shows that the maximum pain point is at 51700 and the put-call ratio (PCR) is at 1. Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound. PCR is on extreme end suggesting we can see sharp reversal .

It’s not just putting in the hours that will make you successful; it’s the persistent intention to improve by examining your results, tweaking your approach, and making incremental progress.

For Positional Traders, The Bank Nifty Futures’ Trend Change Level is At 51096 . Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 52240 , Which Acts As An Intraday Trend Change Level.

Intraday Levels for Bank Nifty:

Buy Above 52450 Tgt 52610, 52850 and 53000 ( Bank Nifty Spot Levels)

Sell Below 52300 Tgt 52174, 52000 and 51729 (Bank Nifty Spot Levels)

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.

► Join Youtube channel : Click here

► Check out Gann Course Details: W.D. Gann Trading Strategies

► Check out Financial Astrology Course Details: Trading Using Financial Astrology

► Check out Gann Astro Indicators Details: Gann Astro Indicators