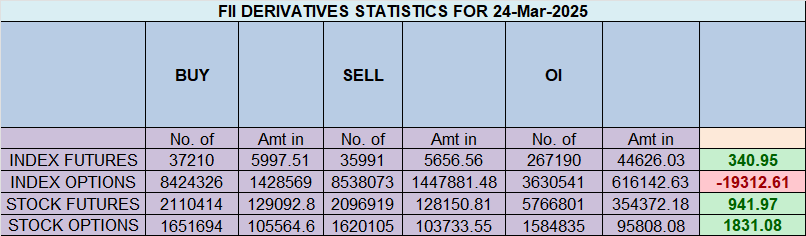

FII Activity: Bullish Shift in Nifty Index Futures with Fresh Long Additions

Foreign Institutional Investors (FIIs) maintained a bullish stance, actively buying 5,419 contracts worth ₹962 crore. This resulted in a net open interest increase of 4,001 contracts, signaling fresh long additions along with short covering.

Breaking Down FII Activity

✔ FIIs added 1,401 long contracts, increasing their bullish exposure.

✔ FIIs added 182 short contracts, indicating minimal bearish positioning.

✔ FII Long-to-Short Ratio: 0.47 → FIIs remain short-biased (32:68), but long additions and short covering suggest a shift in sentiment.

Client Behavior

✔ Clients covered 9,858 long contracts, likely booking profits after the recent rally.

✔ Clients covered 1,339 short contracts, showing some cautious hedging.

✔ Clients Long-to-Short Ratio: 1.31 → Clients remain bullish overall (57:43) but are taking a more defensive stance.

Current Positioning in Index Futures

FIIs: Still short-heavy (32:68), but reducing bearish exposure.

Clients: Maintaining a bullish bias (57:43), but reducing long exposure.

Retrain Your Brain for Success in Trading

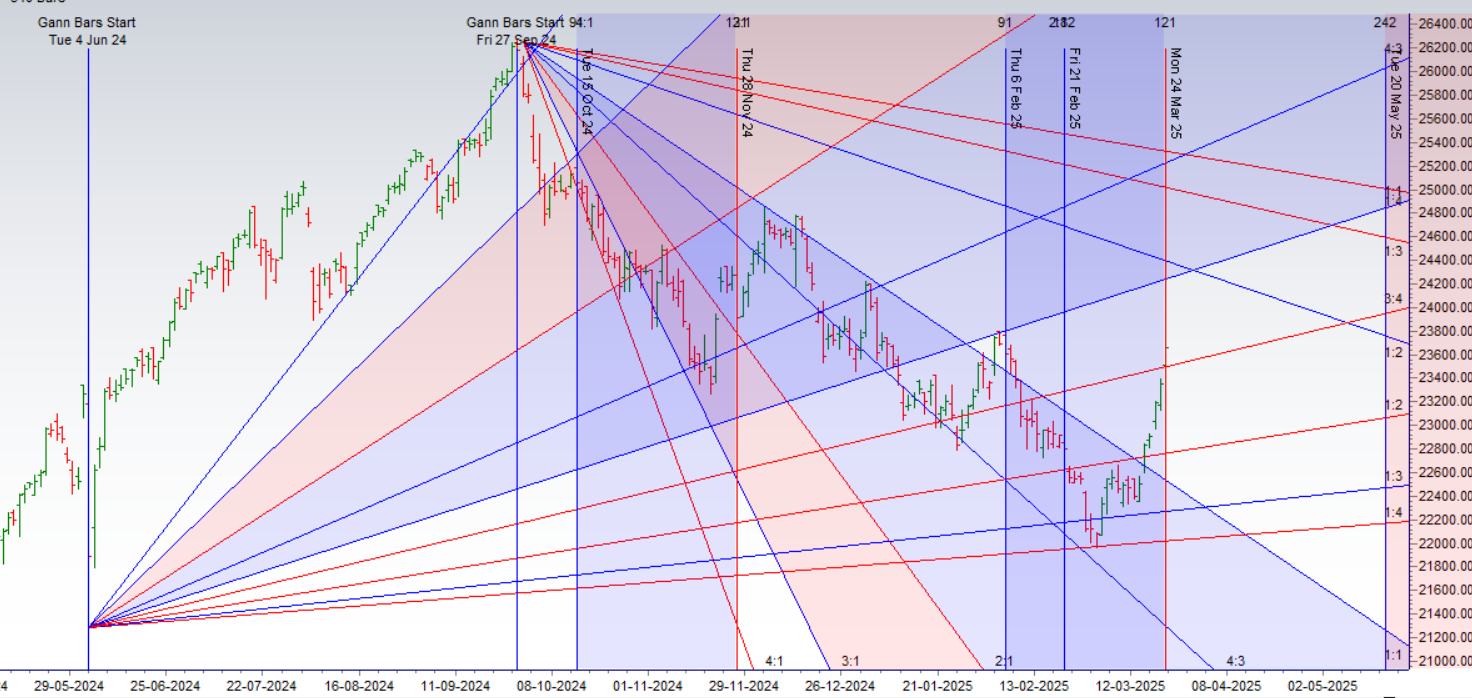

Nifty saw the impact of the Gann seasonal date, leading to a strong 300+ point rally and a breakout from the Gann angle, as discussed in the video below. Sun in Aries also played its role in driving the market higher, pushing Nifty up 3.5% for the week.

Key Technical & Astro Insights

✔ Gann Seasonal Date Impact → Triggered a strong breakout.

✔ Sun in Aries → Historically known to drive momentum in equities.

✔ Neptune Apogee Tomorrow → Pharma stocks should be on the radar, as Neptune influences this sector.

Key Levels to Watch

Support Zone: 23150–23189 → Bulls need to defend this range for further upside.

Upside Targets: 23471–23500 → The rally can extend towards these levels if support holds.

Nifty’s Explosive Rally Continues – 300-Point Surge

Nifty extended its powerful rally, gaining another 300 points, as the impact of Sun Conjunct Mercury fueled strong momentum. Once price crossed the SAP level of 23,521, the rally accelerated sharply.

Key Observations

✔ Retail traders often struggle by chasing trends in sideways markets and staying out in strong trends.

✔ This rally caused maximum pain to most participants, as many failed to position correctly.

✔ Understanding trend shifts and momentum is critical for successful trading.

Key Resistance Zone for Nifty

Nifty approaching 23,729–23,800, where multiple Gann angle resistance zones converge.

Expect some consolidation or profit booking in this range before the next major move.

Market Outlook & Trading Strategy

✔ If Nifty holds above 23,729, the next leg can target 23,800–23,900.

✔ A pullback from this zone could bring support retests at 23,521–23,444.

✔ Traders should watch for price action signals before taking aggressive trades.

Final Thoughts: With strong momentum in place, watch key resistance levels for either a breakout continuation or a consolidation phase before the next big move!

Nifty Trade Plan for Positional Trade ,Bulls will get active above 23739 for a move towards 23816/23892/23969 Bears will get active below 23586 for a move towards 23510/23433

Traders may watch out for potential intraday reversals at 09:56,11:18,12:29,01:33,02:45 How to Find and Trade Intraday Reversal Times

Nifty March Futures Open Interest Volume stood at 1.29 lakh cr , witnessing liquidation of 14.2 Lakh contracts. Additionally, the increase in Cost of Carry implies that there was closeure of LONG positions today.

Nifty Advance Decline Ratio at 42:08 and Nifty Rollover Cost is @22724 closed above it.

Nifty Gann Monthly Trade level :22336 closed above it

Nifty has closed above its 100 SMA @ 23513 Trend has changed to Buy on Dips till above 23500

Nifty options chain shows that the maximum pain point is at 23300 and the put-call ratio (PCR) is at 1.15 .Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound.

Nifty 50 Options Chain Analysis

The Nifty 50 options chain indicates that the highest open interest (OI) on the call side is at the 23700 strike, followed by 23800 strikes. On the put side, the highest OI is at the 23500 strike, followed by 23400 strikes. This suggests that the market participants are expecting Nifty 50 to remain range between 23500-23800 levels.

In the cash segment, Foreign Institutional Investors (FII) bought 3055 Cr , while Domestic Institutional Investors (DII) bought 98 cr.

Traders who follow the musical octave trading path may find valuable insights in predicting Nifty’s movements. According to this path, Nifty may follow a path of 22094-22751-23408-24105-24801 This means that traders can take a position and potentially ride the move as Nifty moves through these levels.Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable.

Don’t give up. Trading is a skill that takes time and practice to develop. Don’t give up if you don’t see results immediately. Keep learning and practicing, and you will eventually become a successful trader.

For Positional Traders, The Nifty Futures’ Trend Change Level is At 23364. Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 23619, Which Acts As An Intraday Trend Change Level.

Nifty Intraday Trading Levels

Buy Above 23710 Tgt 23763, 23816 and 23875 ( Nifty Spot Levels)

Sell Below 23629 Tgt 23600, 23555 and 23490 (Nifty Spot Levels)

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.

► Join Youtube channel : Click here

► Check out Gann Course Details: W.D. Gann Trading Strategies

► Check out Financial Astrology Course Details: Trading Using Financial Astrology

► Check out Gann Astro Indicators Details: Gann Astro Indicators