FII Activity: Bearish Sentiment in Bank Nifty Index Futures

Foreign Institutional Investors (FIIs) demonstrated a bearish stance in the Bank Nifty Index Futures market by shorting 4,985 contracts worth ₹367 crores. This activity resulted in an increase of 4,695 contracts in the net open interest.

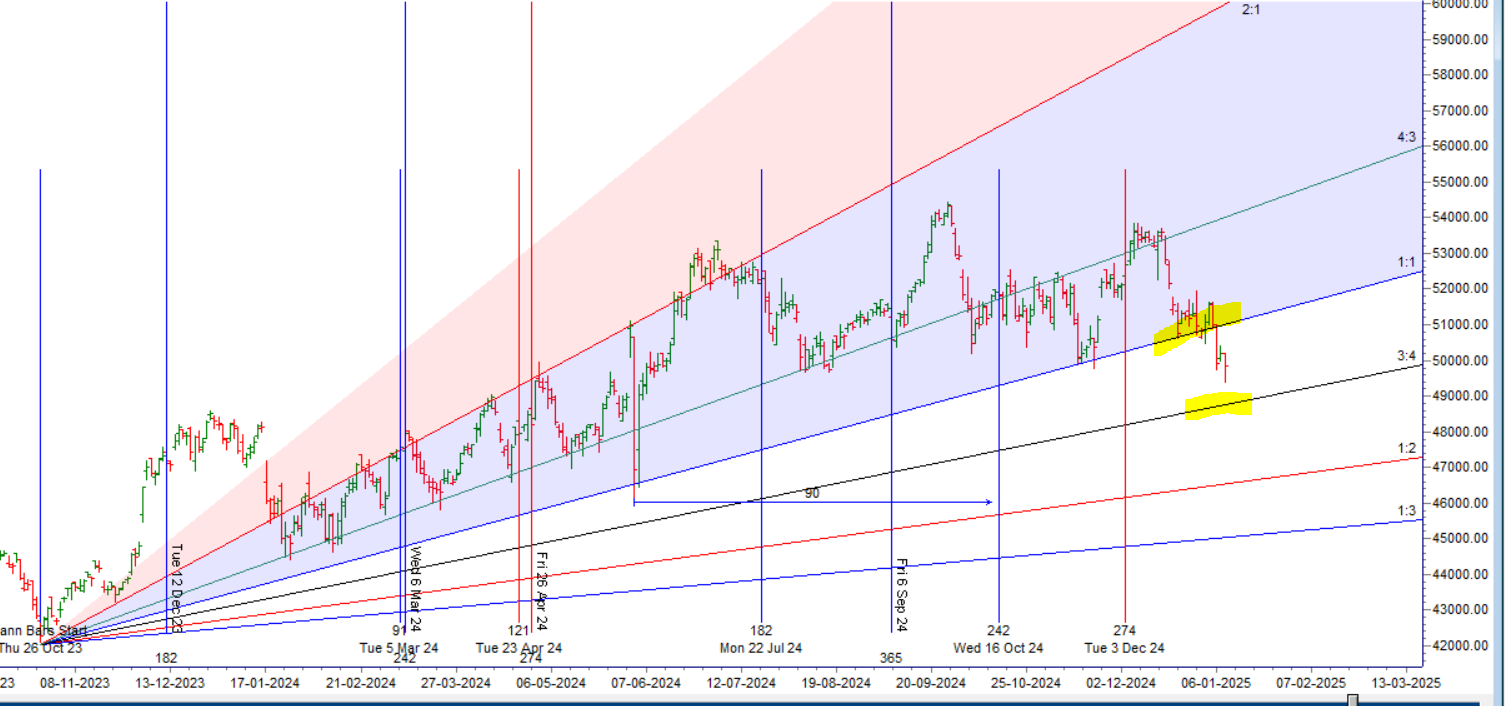

Bank Nifty continues to exhibit cautious movement, forming a small candle while trading below the crucial level of 50,706, which aligns with the 200 SMA. A close above this level is essential for bulls to neutralize the current short-term bearish sentiment.

Additionally, with Mercury entering Capricorn, an earth sign, the market might witness the onset of a new trend. This cosmic shift could bring structural changes, as suggested in the accompanying video analysis.

For intraday traders, the first 15 minutes’ high and low will serve as critical levels to watch, providing direction for the trading day.

The Mental Side: The Key to Success in Stock Market Trading

Bank Nifty continued its decline after breaking the Mars Ingress low at 49,751, resulting in a 400+ point drop. Yesterday’s Mercury in Capricorn alignment indicated the emergence of a fresh trend, making yesterday’s low of 49,389 the new critical level for bears to break. On the other hand, bulls need to push the price above 50,246 for any upside momentum to materialize.

Key Astro Event Today:

We have Rule No. 38 – Mercury Latitude Heliocentric, which states:

“Some mighty fine tops and bottoms are produced when Mercury, in this motion, passes the mentioned degrees.”

The first 15 minutes’ high and low will be critical in determining today’s trend.

Additional Market Insight:

- TCS will kick off the result season today, which is expected to introduce volatility.

- TCS results will be announced after market hours, so traders should prepare for potential overnight impacts.

Bank Nifty Trade Plan for Positional Trade ,Bulls will get active above 50000 for a move towards 50223/50447.Bears will get active below 49773 for a move towards 49549/49324/49100

Traders may watch out for potential intraday reversals at 10:03,11:22,01:59 How to Find and Trade Intraday Reversal Times

Bank Nifty December Futures Open Interest Volume stood at 23.5 lakh, with addition of 55.2 lakh contracts. Additionally, the increase in Cost of Carry implies that there was a addition of SHORT positions today.

Bank Nifty Advance Decline Ratio at 03:09 and Bank Nifty Rollover Cost is @51689 closed above it.

Bank Nifty Gann Monthly Trade level :50841 closed above it.

Bank Nifty closed below 233 SMA @50129,Trend is Sell on Rise till close below 50500.

Traders who follow the musical octave trading path may find valuable insights in predicting Bank Nifty’s movements. According to this path, Bank Nifty may follow a path of 51408-49965-48521. This means that traders can take a position and potentially ride the move as Bank Nifty moves through these levels. Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable.– Price has closed below 49965

According to the Bank Nifty options chain, the call side has the highest open interest (OI) at the 51300 strike, followed by the 51800 strike. On the put side, the 49500 strike has the highest OI, followed by the 49000 strike.This indicates that market participants anticipate Bank Nifty to stay within the 49000-50000 range.

The Bank Nifty options chain shows that the maximum pain point is at 50000 and the put-call ratio (PCR) is at 0.75. Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound. PCR is on extreme end suggesting we can see sharp reversal .

The central theme in stock market trading are feelings, especially fears.

For Positional Traders, The Bank Nifty Futures’ Trend Change Level is At 51191. Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 50020, Which Acts As An Intraday Trend Change Level.

BANK Nifty Intraday Trading Levels

Buy Above 49850 Tgt 50000, 50125 and 50256 ( BANK Nifty Spot Levels)

Sell Below 49729 Tgt 49610, 49444 and 49323 (BANK Nifty Spot Levels)

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.

► Join Youtube channel : Click here

► Check out Gann Course Details: W.D. Gann Trading Strategies

► Check out Financial Astrology Course Details: Trading Using Financial Astrology

► Check out Gann Astro Indicators Details: Gann Astro Indicators