Introduction

W.D. Gann remains one of the most enigmatic figures in the world of financial market analysis. Known for his unique methods, Gann’s approach to trading emphasized the interconnectedness of price ranges and time cycles. His theories are based on natural laws and geometric principles, which have fascinated traders for decades. This article delves into how Gann connected price ranges and time cycles to predict market behavior, providing a comprehensive understanding of his methods and their application in modern trading.

Who Was W.D. Gann?

William Delbert Gann (1878–1955) was a trader, author, and market theorist whose works have profoundly influenced technical analysis. Gann’s trading strategies were deeply rooted in mathematics, geometry, and ancient philosophies. His belief that markets move in predictable cycles driven by natural laws led him to develop tools and techniques still referenced today.

Gann’s significant contributions include the Square of Nine, Gann Angles, and his theories on time-price balance. His methods were used to predict market turning points with impressive accuracy, earning him both admiration and skepticism within the trading community.

The Philosophy Behind Gann’s Methods

At the core of Gann’s approach lies the belief that markets operate under universal natural laws. He drew parallels between market movements and the principles of geometry, astrology, and cycles found in nature. Gann theorized that time and price are interrelated and that understanding their relationship can reveal market trends and turning points.

This philosophy was influenced by ancient systems of knowledge, including Pythagorean mathematics and planetary cycles. Gann’s reliance on these principles allowed him to identify repeating patterns in markets and use them to anticipate future price movements.

Understanding Price Ranges in Gann’s Framework

Price ranges were fundamental to Gann’s market analysis. He believed that markets move in waves, with price ranges forming the building blocks of these movements. Key concepts include:

- Support and Resistance Levels:

- Gann used historical price ranges to identify critical support and resistance levels. These levels often indicated where markets would reverse or consolidate.

- Percentage Retracements:

- He emphasized specific percentages, such as 50%, 33.3%, and 66.6%, as important retracement levels within a price range. These ratios often aligned with natural proportions found in geometry.

- Price Projections:

- By analyzing past price ranges, Gann projected future price movements and identified potential targets for market trends.

Decoding Time Cycles in Gann’s Methodology

Time cycles were equally critical to Gann’s trading strategies. He believed that market events recur at regular intervals, influenced by cycles rooted in natural and astronomical phenomena. Key aspects of his time cycle theory include:

- Major Cycles:

- Gann identified significant cycles, such as the 30-year and 60-year cycles, which he linked to historical market behavior. These cycles often aligned with major economic events.

- Shorter Cycles:

- Gann also analyzed shorter cycles, including the 30.437-day lunar cycle, weekly cycles, and seasonal patterns. These cycles provided insights into shorter-term market movements.

- Repetition of Events:

- Gann’s studies revealed that market highs and lows often occurred at regular time intervals. He used these patterns to anticipate future turning points.

How Gann Combined Price Ranges and Time Cycles

Gann’s genius lay in his ability to integrate price ranges and time cycles into a cohesive analytical framework. This integration allowed him to predict market turning points with precision. Key concepts include:

Time-Price Balance: Gann believed that significant market movements occur when price and time reach a state of balance. For example, a price range might take an equal amount of time to retrace or consolidate.

Square of Price and Time: He used tools like the Square of Nine to visualize the relationship between price and time, identifying key levels where trends might revers

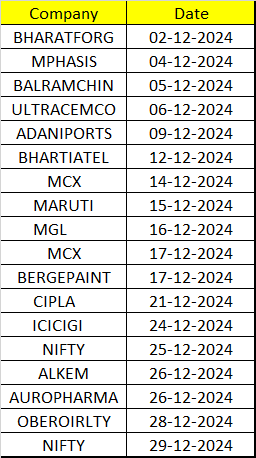

Stocks coming as per Time cycle

Tools and Techniques Gann Used to Analyze Price and Time

Gann’s analytical toolkit included several innovative methods and tools, many of which remain popular among technical analysts today:

- Square of Nine:

- A numerical grid used to calculate price and time relationships, helping traders identify key support and resistance levels.

- Gann Angles:

- Geometric angles plotted on price charts to measure the speed of price movements. Common angles include 1×1 (45 degrees), 2×1, and 1×2.

- Circle of 360:

- A tool that applies the principles of geometry to market analysis, dividing time and price into 360-degree intervals.

- Astrological Influences:

- Gann also incorporated planetary cycles, believing that astrological phenomena influenced market behavior.

Criticism and Limitations of Gann’s Theories

While Gann’s methods have inspired countless traders, they are not without criticism. Some of the key limitations include:

- Complexity:

- Gann’s techniques are often considered too intricate and time-consuming for practical use.

- Subjectivity:

- Interpreting Gann’s tools requires a high degree of personal judgment, leading to variability in results.

- Lack of Empirical Evidence:

- Critics argue that Gann’s success may have been due to luck or intuition rather than the systematic application of his methods.

Despite these criticisms, Gann’s work remains a cornerstone of technical analysis, offering valuable insights into market behavior.

Application of Gann’s Methods Today

Modern traders continue to apply Gann’s principles, adapting them to contemporary markets and technology. Examples include:

- Stock and Forex Markets:

- Traders use Gann’s tools to identify key price levels and time-based turning points in equities and currency pairs.

- Cryptocurrency Trading:

- Gann’s methods are increasingly applied to the volatile cryptocurrency market, providing insights into price patterns and timing.

- Technological Advancements:

- Software tools and algorithms have made it easier to implement Gann’s techniques, automating calculations and visualizations.

Conclusion

W.D. Gann’s revolutionary approach to market analysis continues to captivate traders and analysts. By connecting price ranges and time cycles, he provided a unique framework for predicting market behavior. While his methods require dedication and skill to master, their potential to uncover hidden patterns makes them invaluable tools in a trader’s arsenal.

The timeless relevance of Gann’s work lies in its ability to bridge the gap between technical analysis and natural law, reminding us that markets, like all systems, are governed by fundamental principles of balance and harmony. Traders who embrace Gann’s techniques stand to gain not only a deeper understanding of the markets but also a profound appreciation for the intricate interplay of time and price.