FII Activity: Mixed Sentiment in Bank Nifty Index Futures

Foreign Institutional Investors (FIIs) exhibited a bullish stance in the Bank Nifty Index Futures market by buying 2594 contracts worth ₹212 crores. This activity resulted in an decrease of 5280 contracts in the net open interest.

We witnessed a volatile move today due to Venus Opposition Mars, and Bank Nifty formed another Gravestone Doji, continuing to trade within the outside bar range established on 5th December. With Mercury turning direct this weekend, carrying overnight positions with a hedge is strongly advised.

Additionally, today is Friday the 13th, which is often considered inauspicious, so it’s crucial to trade cautiously.

Key Levels to Watch:

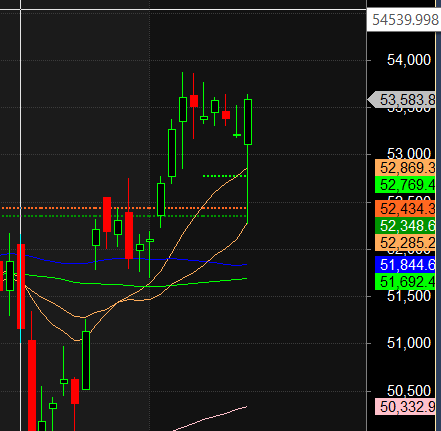

- For Bulls: A move above 53,500 is needed, with confirmation of a range breakout above 53,666.

- For Bears: A close below 53,300 will signal weakness, with further downside confirmation once the price closes below 53,160.

How to Recover from a Blown Trading Account: A Roadmap for Stock Traders

Bank Nifty experienced a wild ride today, falling nearly 900 points before recovering the entire move and closing 300 points in the green. A similar level of volatility was observed on 5th December Nifty expiry, and today’s swings coincided with Sensex Weekly expiry.

The price fluctuations, despite the absence of any major macroeconomic or corporate news, suggest the influence of hedge fund activity in options. This also highlights the lack of depth in our markets, as such wild moves are typically not seen frequently in US or European markets. Regulators need to take significant steps to improve the options market structure and reduce such volatility.

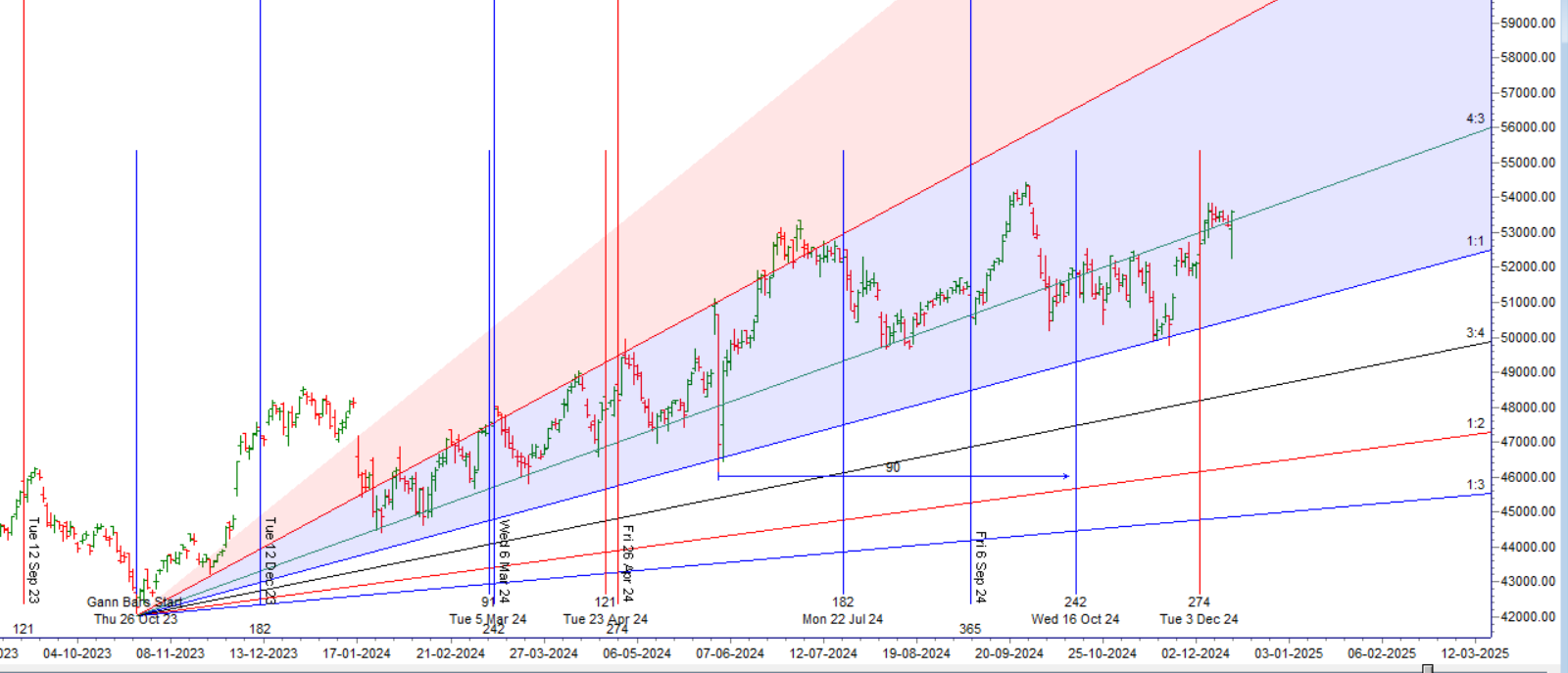

Without additional tools, navigating such sharp intraday moves can result in substantial losses. Today’s low was around the SAP and Gann Annual TC level confluence of 52,434-52,348, where previous resistance turned into support, sparking a strong rally.

Outlook:

There is a possibility of a gap-down opening on Monday, as we have two significant astrological events:

- New Moon

- Mercury Turning Direct

Traders should exercise caution and manage positions effectively in anticipation of further volatility.

Bank Nifty Trade Plan for Positional Trade ,Bulls will get active above 53636 for a move towards 53864/54093.Bears will get active below 53191 for a move towards 52959/52727.

Traders may watch out for potential intraday reversals at 09:15,10:12,11:15,12:56,02:33 How to Find and Trade Intraday Reversal Times

Bank Nifty December Futures Open Interest Volume stood at 21.8 lakh, with liquidation of 0.78 lakh contracts. Additionally, the increase in Cost of Carry implies that there was a covering of LONG positions today.

Bank Nifty Advance Decline Ratio at 06:06 and Bank Nifty Rollover Cost is @51689 closed above it.

Bank Nifty Gann Monthly Trade level :52769 closed above it.

Bank Nifty closed above 20/50/100/200 SMA @53000 Trend is Buy on Dips till above 53000.

Traders who follow the musical octave trading path may find valuable insights in predicting Bank Nifty’s movements. According to this path, Bank Nifty may follow a path of 51724-53263-54801. This means that traders can take a position and potentially ride the move as Bank Nifty moves through these levels. Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable.

According to the Bank Nifty options chain, the call side has the highest open interest (OI) at the 53500 strike, followed by the 53800 strike. On the put side, the 53000 strike has the highest OI, followed by the 52500 strike.This indicates that market participants anticipate Bank Nifty to stay within the 52500-53500 range.

The Bank Nifty options chain shows that the maximum pain point is at 53500 and the put-call ratio (PCR) is at 0.85 . Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound. PCR is on extreme end suggesting we can see sharp reversal .

You cannot achieve mastery with a mediocre effort. If you want big returns in the stock market, you must make your trading a priority.

For Positional Traders, The Bank Nifty Futures’ Trend Change Level is At 53051. Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 53070 , Which Acts As An Intraday Trend Change Level.

BANK Nifty Intraday Trading Levels

Buy Above 53610 Tgt 53777, 53888 and 54070 ( BANK Nifty Spot Levels)

Sell Below 53375 Tgt 53167, 52946 and 52718 (BANK Nifty Spot Levels)

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.