Foreign Institutional Investors (FIIs) exhibited a Bullish Stance in the Bank Nifty Index Futures market by Buying 4513 contracts with a total value of 353 crores. This activity led to a decrease of 3029 contracts in the Net Open Interest.

Bank Nifty experienced the impact of Bayer Rule 2: “Trend goes down within 3 days when the speed difference between Mars and Mercury is 59 minutes, leading to a big move,” with the price closing below yestarday Low, Bank Nifty has been very volatile in recent sessions, with an up day often followed by a 2-3 days of fall For traders, this market can be challenging as it requires a high degree of flexibility, which many struggle to maintain.

Tomorrow, we have the weekly close, and both bulls and bears will be fighting hard for the 52000 level to form a weekly doji, potentially leading to a trending move next week as Venus and Saturn form significant astrological aspects. Today’s FOMC announcement could result in a gap opening tomorrow. A clear trend is likely to emerge with a close above 52500 favoring the bulls or below 51820 favoring the bears. SBI results tommorow so traders will observe intraday voaltlity.

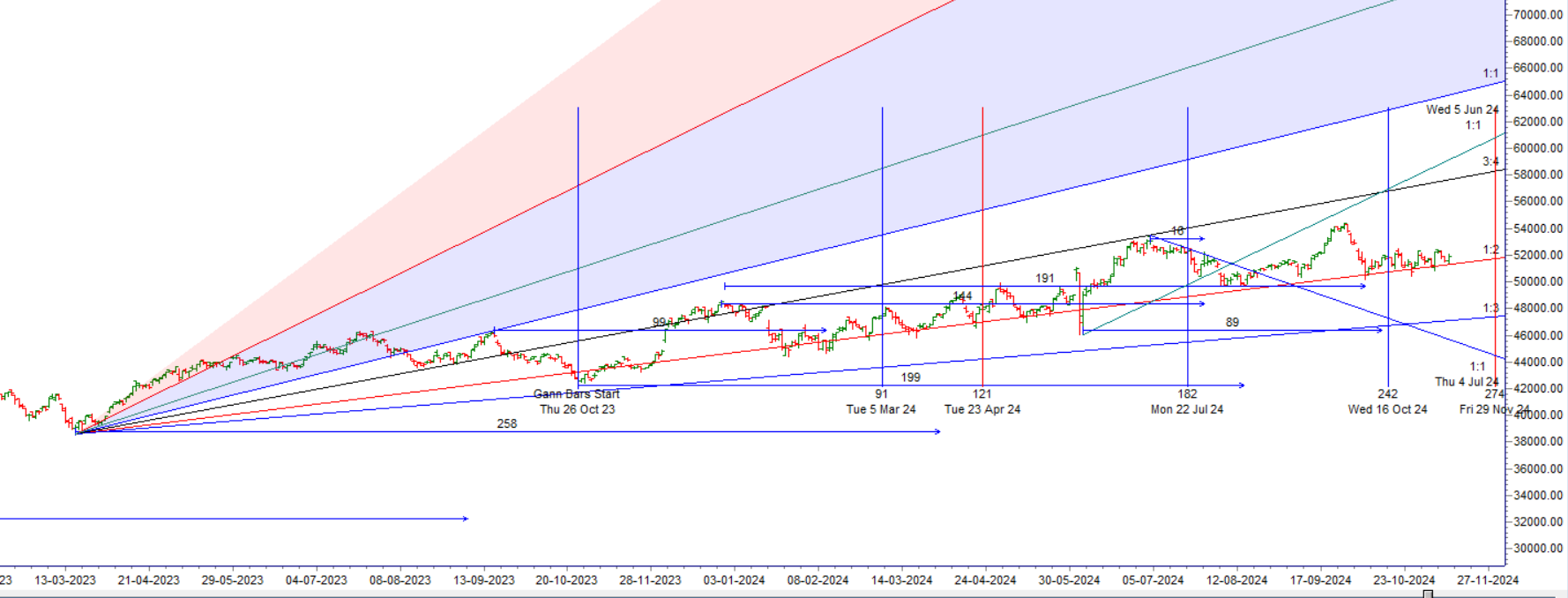

Bank Nifty formed an Outside Bar candle today, with the price still trading within the range of the large candle from November 5. Strong consolidation is ongoing in Bank Nifty, as the price has once again bounced from the 1×2 Gann angle. Today, we have inflation data expected to be on the higher side, around 5.80. Additionally, there are three important astro events today that could lead to intraday volatility. As long as bulls hold the 51617 level, the price could rally towards 52434.

Important Astro Events:

- Moon Conjunct North Node — The North Node, also known as Rahu, often brings volatility.

- Bayer Rule 14: “Venus movements in geocentric longitude using a unit of 1°9’13”.”

- Rule No. 38: Mercury Latitude Heliocentric — “Significant tops and bottoms are often produced when Mercury, in this motion, passes certain degrees.”

Intraday traders can watch the first 15 minutes’ high and low to capture the trend for the day.

Bank Nifty Trade Plan for Positional Trade ,Bulls will get active above 51973 for a move towards 52200/52426.Bears will get active below 51747 for a move towards 51520/51294.

Traders may watch out for potential intraday reversals at 09:29,10:57,12:44,02:25 How to Find and Trade Intraday Reversal Times

Bank Nifty November Futures Open Interest Volume stood at 25.9 lakh, with liquidation of 0.63 lakh contracts. Additionally, the increase in Cost of Carry implies that there was a closure of SHORT positions today.

Bank Nifty Advance Decline Ratio at 10:02 and Bank Nifty Rollover Cost is @52026 closed below it.

Bank Nifty Gann Monthly Trade level :51617 closed above it.

Bank Nifty closed above its 100 SMA @51745 Trend is Buy on Dips till above 51614

Traders who follow the musical octave trading path may find valuable insights in predicting Bank Nifty’s movements. According to this path, Bank Nifty may follow a path of 48819-50271-51724-53263-54801. This means that traders can take a position and potentially ride the move as Bank Nifty moves through these levels. Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable.

According to the Bank Nifty options chain, the call side has the highest open interest (OI) at the 52000 strike, followed by the 52500 strike. On the put side, the 51500 strike has the highest OI, followed by the 51000 strike.This indicates that market participants anticipate Bank Nifty to stay within the 51500-52500 range.

The Bank Nifty options chain shows that the maximum pain point is at 52000 and the put-call ratio (PCR) is at 0.90 . Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound. PCR is on extreme end suggesting we can see sharp reversal .

To create money management, position size calculation or the elaboration of a profitable set of rules. All of these very useful tools are of little help if you are not able to use them in a disciplined manner

For Positional Traders, The Bank Nifty Futures’ Trend Change Level is At 52059 . Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 52030 , Which Acts As An Intraday Trend Change Level.

BANK Nifty Intraday Trading Levels

Buy Above 51900 Tgt 52015, 52225 and 52444 ( BANK Nifty Spot Levels)

Sell Below 51820 Tgt 51650, 51450 and 51225 (BANK Nifty Spot Levels)

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.