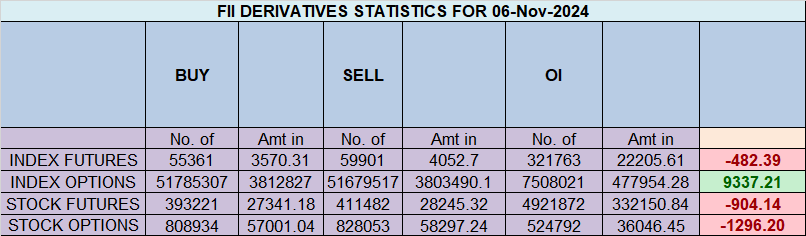

Foreign Institutional Investors (FIIs) displayed a Bullish approach in the Nifty Index Futures market by Buying 5548 contracts worth ₹341 crores, resulting in a increase of 4582 contracts in the net open interest. FIIs covered 2341 long contracts and added 2199 short contracts, indicating a preference for covering long positions and adding short positions. With a net FII long-short ratio of 0.28, FIIs utilized the market rise to exit long positions and enter short positions in Nifty futures. Clients added 6388 long contracts and added 4669 short contracts. FII are holding 26% Long and 74 % Shorts in Index Futures and Clients are holding 66 % Long and 34 % Shorts in Index Futures.

The Complete Election Day Guide: Trump vs. Kamala – An Indian Investor’s Perspective

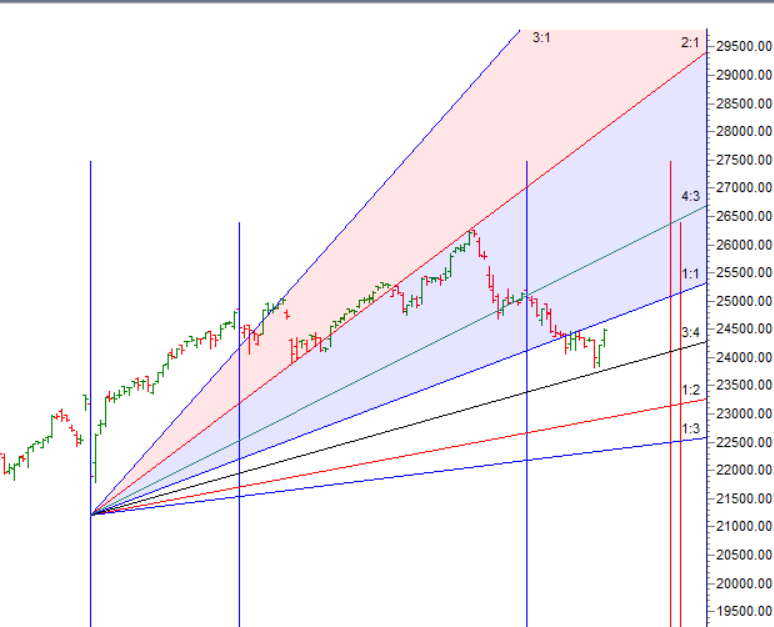

Nifty has formed a double bottom around 23,816 and 23,842, and the price is also near the 50% retracement of the entire move from June 4 to September 27. Additionally, we have discussed the significance of Mercury and Mars changing houses astrologically, as well as the Gann time cycle, with November 3, 2009 marking a major low, indicating a confluence of Gann and astro cycles.

If election results are favorable for the market, we could witness a big short-covering rally similar to what we saw in Bank Nifty today. Trade cautiously over the next two trading sessions.

Nifty continued its upmove, driven by the confluence of Gann and astro cycles, along with Trump becoming the president. Now, another important factor, Bayer Rule 2, states: “The trend goes down within 3 days when the speed difference between Mars and Mercury is 59 minutes, leading to a big move.” This will come into effect today, so bulls need to hold 24,270 in any dip that occurs.

The Federal Reserve’s November 2024 meeting results will be announced tomorrow night, which could lead to another significant gap opening on Friday. Bulls need a close above 24,500 to maintain momentum, while bears gain control below 24,270.

Nifty Trade Plan for Positional Trade ,Bulls will get active above 24515 for a move towards 24593/24670/24748. Bears will get active below 24359 for a move towards 24281/24204/24144.

Traders may watch out for potential intraday reversals at 09:37,10:44,12:18,1:40,02:47 How to Find and Trade Intraday Reversal Times

Nifty Sep Futures Open Interest Volume stood at 1.11 lakh cr , witnessing a liquidation of 0.67 Lakh contracts. Additionally, the increase in Cost of Carry implies that there was closure of SHORT positions today.

Nifty Advance Decline Ratio at 40:10 and Nifty Rollover Cost is @25178 closed below it.

Nifty Gann Monthly Trade level :25343 close below it.

Nifty closed Below its 100 SMA@24560 Trend is Buy on Dips till above 24270.

Nifty options chain shows that the maximum pain point is at 24500 and the put-call ratio (PCR) is at 0.92 Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound.

Nifty 50 Options Chain Analysis

The Nifty 50 options chain indicates that the highest open interest (OI) on the call side is at the 24300 strike, followed by 24500 strikes. On the put side, the highest OI is at the 24100 strike, followed by 24000 strikes. This suggests that the market participants are expecting Nifty 50 to remain range between 24100-24500 levels.

In the cash segment, Foreign Institutional Investors (FII) sold 4445 crores, while Domestic Institutional Investors (DII) bought 4889 crores.

Traders who follow the musical octave trading path may find valuable insights in predicting Nifty’s movements. According to this path, Nifty may follow a path of 23889-24600-25310-26063-26816 This means that traders can take a position and potentially ride the move as Nifty moves through these levels.Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable.

You can’t Trade successfully when your brain is not in the mental mechanisms trained for trading. Your brain needs appropriate thinking as well first learn new ways of trading.

For Positional Traders, The Nifty Futures’ Trend Change Level is At 24289. Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 24504, Which Acts As An Intraday Trend Change Level.

Nifty Expiry Range

Upper End of Expiry : 24674

Lower End of Expiry : 24293

Nifty Intraday Trading Levels

Buy Above 24450 Tgt 24484, 24525 and 24575 ( Nifty Spot Levels)

Sell Below 24404 Tgt 24370, 24325 and 24285 ( Nifty Spot Levels)

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.