Foreign Institutional Investors (FIIs) exhibited a Bearish Stance in the Bank Nifty Index Futures market by Shorting 364 contracts with a total value of 27 crores. This activity led to a increase of 5702 contracts in the Net Open Interest.

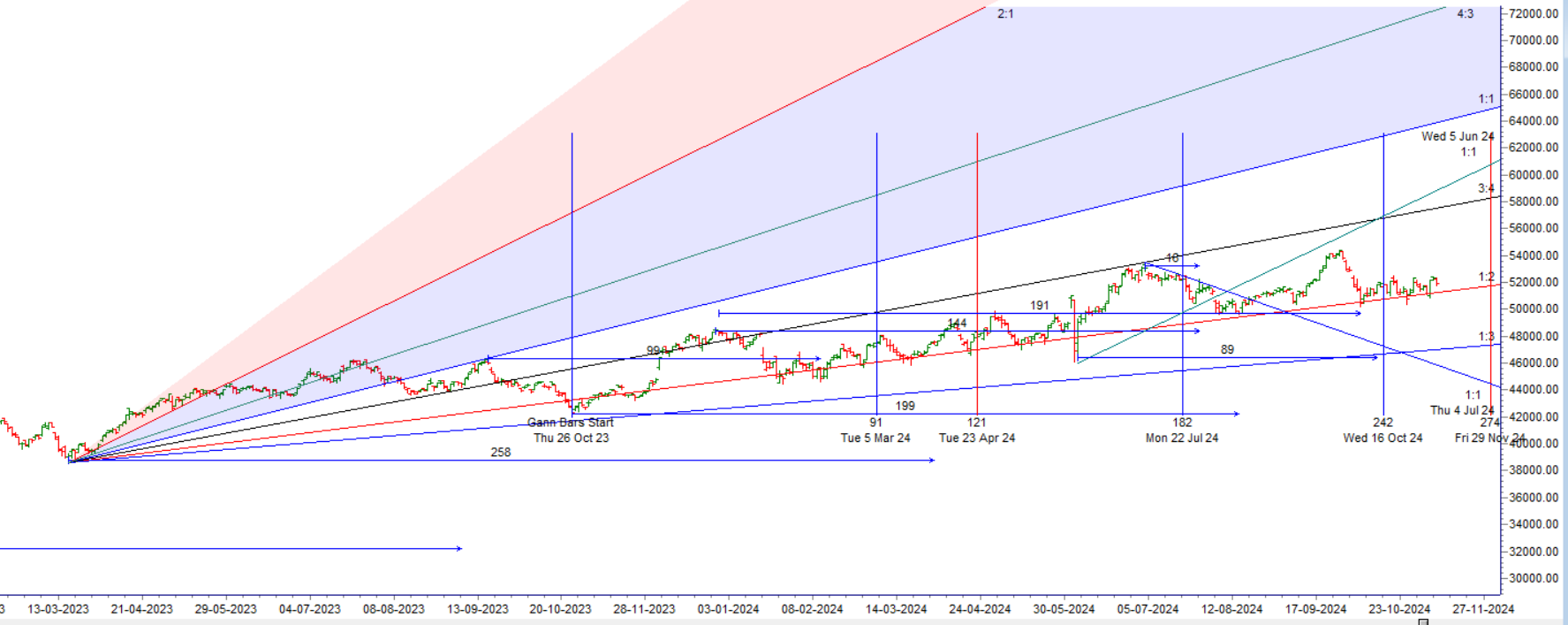

The price continues to face resistance at the SAP Gann TC level and the 50% retracement point in rnage of 52434-52500, forming a small candle as IT stocks took the lead today. The Federal Reserve’s November 2024 meeting results will be announced tomorrow night, which could result in a significant gap opening on Friday. Bulls need a close above 52,500 to maintain momentum, while bears will gain control below 52,166.

Bank Nifty experienced the impact of Bayer Rule 2: “Trend goes down within 3 days when the speed difference between Mars and Mercury is 59 minutes, leading to a big move,” with the price closing below yestarday Low, Bank Nifty has been very volatile in recent sessions, with an up day often followed by a 2-3 days of fall For traders, this market can be challenging as it requires a high degree of flexibility, which many struggle to maintain.

Tomorrow, we have the weekly close, and both bulls and bears will be fighting hard for the 52000 level to form a weekly doji, potentially leading to a trending move next week as Venus and Saturn form significant astrological aspects. Today’s FOMC announcement could result in a gap opening tomorrow. A clear trend is likely to emerge with a close above 52500 favoring the bulls or below 51820 favoring the bears. SBI results tommorow so traders will observe intraday voaltlity.

Bank Nifty Trade Plan for Positional Trade ,Bulls will get active above 52035 for a move towards 52264/52493.Bears will get active below 51806 for a move towards 51577/51348.

Traders may watch out for potential intraday reversals at 09:37,10:44,12:18,1:40,02:47 How to Find and Trade Intraday Reversal Times

Bank Nifty November Futures Open Interest Volume stood at 25.8 lakh, with addition of 0.46 lakh contracts. Additionally, the increase in Cost of Carry implies that there was a closure of SHORT positions today.

Bank Nifty Advance Decline Ratio at 04:08 and Bank Nifty Rollover Cost is @52026 closed below it.

Bank Nifty Gann Monthly Trade level :51820 closed above it.

Bank Nifty closed above its 100 SMA @51496 Trend is Buy on Dips till above 51820

Traders who follow the musical octave trading path may find valuable insights in predicting Bank Nifty’s movements. According to this path, Bank Nifty may follow a path of 48819-50271-51724-53263-54801. This means that traders can take a position and potentially ride the move as Bank Nifty moves through these levels. Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable.

According to the Bank Nifty options chain, the call side has the highest open interest (OI) at the 52000 strike, followed by the 52500 strike. On the put side, the 51500 strike has the highest OI, followed by the 5100 strike.This indicates that market participants anticipate Bank Nifty to stay within the 51500-52500 range.

The Bank Nifty options chain shows that the maximum pain point is at 52000 and the put-call ratio (PCR) is at 0.90 . Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound. PCR is on extreme end suggesting we can see sharp reversal .

You can’t Trade successfully when your brain is not in the mental mechanisms trained for trading. Your brain needs appropriate thinking as well first learn new ways of trading.

For Positional Traders, The Bank Nifty Futures’ Trend Change Level is At 52082. Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 52261 , Which Acts As An Intraday Trend Change Level.

BANK Nifty Intraday Trading Levels

Buy Above 52015 Tgt 52225, 52444 and 52666 ( BANK Nifty Spot Levels)

Sell Below 51820 Tgt 51650, 51450 and 51225 (BANK Nifty Spot Levels)

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.