Foreign Institutional Investors (FIIs) displayed a Bearish approach in the Nifty Index Futures market by Shorting 8431 contracts worth ₹517 crores, resulting in a decrease of 11949 contracts in the net open interest. FIIs covered 8611 long contracts and covered 11002 short contracts, indicating a preference for covering long positions and covering short positions. With a net FII long-short ratio of 0.48 , FIIs utilized the market rise to exit long positions and exit short positions in Nifty futures. Clients covered 12254 long contracts and added 15239 short contracts. FII are holding 40% Long and 60 % Shorts in Index Futures and Clients are holding 64 % Long and 36 % Shorts in Index Futures.

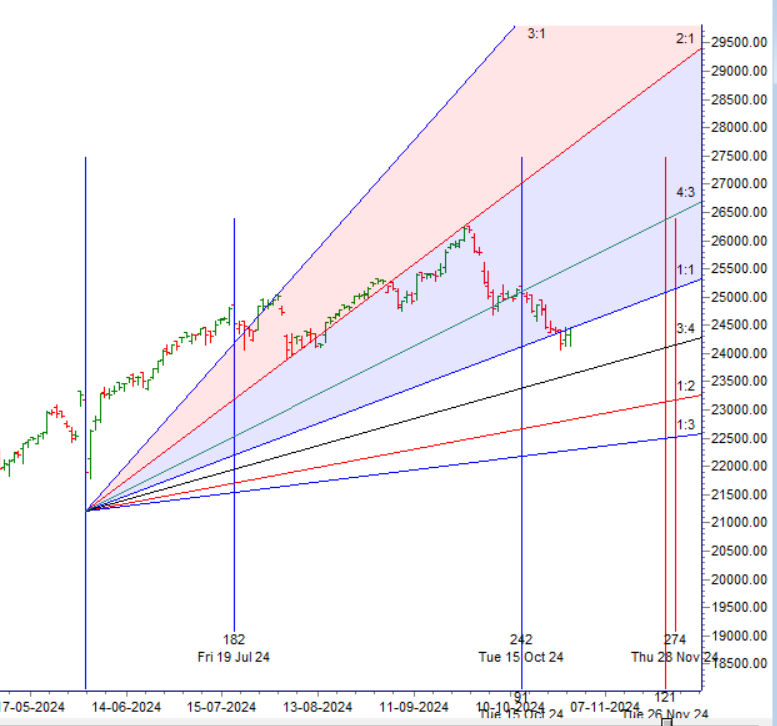

Nifty saw a reversal in line with Bayer Rule 9, which indicates that significant market changes occur when Mercury passes over 19 degrees 36 minutes of Scorpio and Sagittarius, as well as 24 degrees 14 minutes of Capricorn and Gann cycle date, as discussed in the video below.

Today, bulls need to close above the 24,474–24,500 range and maintain support at 24,270 during intraday volatility. For confirmation of a short-term bottom, the price needs to close above the 1×1 Gann line. With today’s Moon Declination, the first 15 minutes’ high and low should guide the day’s trend.

Following my theory, equity buying or selling typically aligns with the FnO cycle. FIIs often first take long positions in FnO, then start buying equities to drive a rally, eventually unwinding their FnO longs. FIIs have recently started buying in both stock and index futures, suggesting that cash market selling could ease soon.

Nifty saw a strong rise today after forming a double bottom, closing at the highest point of the day. Now, bulls need a close above 24,529 to trigger a rally toward last month’s low at 24,753 in the next two trading sessions. Tomorrow, we have Bayer Rule 7: Market changes are likely when Venus or Mars reaches its Aphelion or Perihelion (Geocentric). Watch the first 15 minutes’ high and low to capture the day’s trend.

Nifty Trade Plan for Positional Trade ,Bulls will get active above 24529 for a move towards 24607/24684/24762. Bears will get active below 24373 for a move towards 24296/24218/24140.

Traders may watch out for potential intraday reversals at 09:56,10:44,1:26,02:51 How to Find and Trade Intraday Reversal Times

Nifty Sep Futures Open Interest Volume stood at 0.83 lakh cr , witnessing a liquidation of 17.9 Lakh contracts. Additionally, the increase in Cost of Carry implies that there was closure of SHORT positions today.

Nifty Advance Decline Ratio at 30:19 and Nifty Rollover Cost is @25178 closed below it.

Nifty Gann Monthly Trade level :25343 close below it.

Nifty closed Below its 100 SMA@24488 Trend is Buy on Dips till above 24270

Nifty options chain shows that the maximum pain point is at 24500 and the put-call ratio (PCR) is at 0.95 Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound.

Nifty 50 Options Chain Analysis

The Nifty 50 options chain indicates that the highest open interest (OI) on the call side is at the 24500 strike, followed by 24600 strikes. On the put side, the highest OI is at the 24400 strike, followed by 24300 strikes. This suggests that the market participants are expecting Nifty 50 to remain range between 24300-24600 levels.

In the cash segment, Foreign Institutional Investors (FII) sold 548 crores, while Domestic Institutional Investors (DII) bought 730 crores.

Traders who follow the musical octave trading path may find valuable insights in predicting Nifty’s movements. According to this path, Nifty may follow a path of 23889-24600-25310-26063-26816 This means that traders can take a position and potentially ride the move as Nifty moves through these levels.Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable.

Trading needs Concentration and preparation. If you do it spontaneously, you will likely to be unsuccessful.

For Positional Traders, The Nifty Futures’ Trend Change Level is At 24378 . Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 24320 , Which Acts As An Intraday Trend Change Level.

Nifty Intraday Trading Levels

Buy Above 24500 Tgt 24529, 24575 and 24630 ( Nifty Spot Levels)

Sell Below 24415 Tgt 24364, 24312 and 24270 ( Nifty Spot Levels)

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.

Hi,

I came across your post… good information