Foreign Institutional Investors (FIIs) displayed a Bullish approach in the Nifty Index Futures market by Buying 182 contracts worth ₹9.52 crores, resulting in a decrease of 11762 contracts in the net open interest. FIIs covered 5737 long contracts and added 2635 short contracts, indicating a preference for covering long positions and adding short positions. With a net FII long-short ratio of 0.50, FIIs utilized the market fall to exit long positions and enter short positions in Nifty futures. Clients added 4791 long contracts and added 15632 short contracts. FII are holding 33 % Long and 67 % Shorts in Index Futures and Clients are holding 68 % Long and 32 % Shorts in Index Futures.

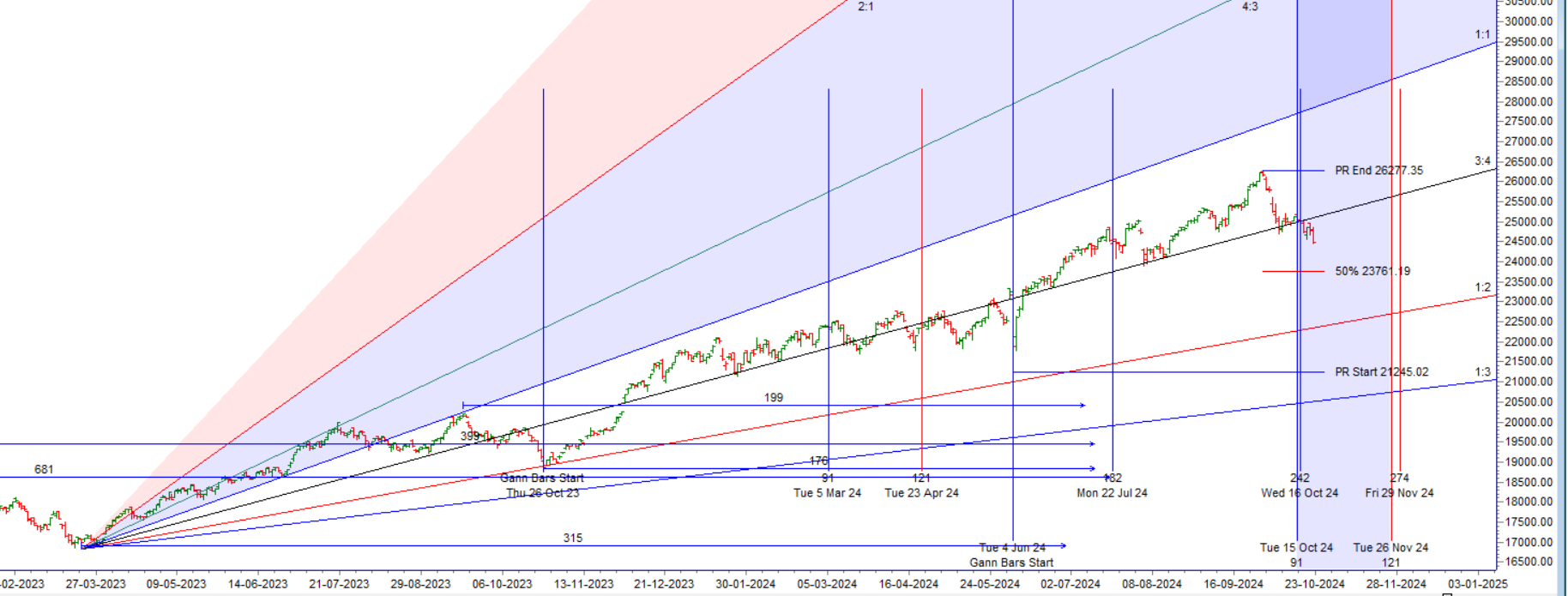

Nifty again failed to close above Venus Ingress high and again we are seeing selling at higher level, FII are selling for 16th day in a row.Yesterday, HDFC Bank and Reliance prevented Nifty from a deeper decline, despite Kotak and other banks weakening. Tomorrow, we have the Sun’s ingress into Scorpio, a water sign, which typically signals bearishness.

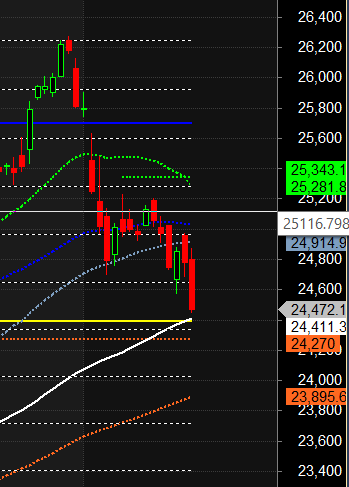

PSU Banks and PSU stocks should be closely watched. Below 24,555, bears will gain the upper hand, while bulls will take control above 24,886, the Venus Ingress High. For today, keep an eye on the first 15 minutes’ high and low to capture the trend for the day.

Nifty once again failed to close above the Venus Ingress High of 24,886, with the high reaching only 24,882. Just as the Hyundai IPO was listed at 10 AM, the price made a top and saw a sharp decline, breaking Friday’s low of 24,567 and closing well below its 100 DMA at 24,544. We also witnessed the impact of the Sun’s ingress into Scorpio, a water sign, which often signals bearishness.

For today, as long as the price remains below the 24,550–24,567 range, the bears will have the upper hand, and we could see a decline towards the 24,389/24,270 range. Additionally, Mercury is at aphelion today, a position that has historically marked key turning points, as shown in the video below. The first 15 minutes’ high and low will provide guidance for the day’s trend.

Nifty Trade Plan for Positional Trade ,Bulls will get active above 24567 for a move towards 24645/24724. Bears will get active below 24408 for a move towards 24329/24251

Traders may watch out for potential intraday reversals at 09:15,10:38,12:25,01:12,02:43 How to Find and Trade Intraday Reversal Times

Nifty Sep Futures Open Interest Volume stood at 1.31 lakh cr , witnessing a addition of 2.1 Lakh contracts. Additionally, the increase in Cost of Carry implies that there was addition of SHORT positions today.

Nifty Advance Decline Ratio at 01:49 and Nifty Rollover Cost is @25178 closed below it.

Nifty Gann Monthly Trade level :25343 close below it.

Nifty closed Below its 100 SMA@24544 Trend is Sell on Rise till below 24567

Nifty options chain shows that the maximum pain point is at 24600 and the put-call ratio (PCR) is at 0.82 Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound.

Nifty 50 Options Chain Analysis

The Nifty 50 options chain indicates that the highest open interest (OI) on the call side is at the 24600 strike, followed by 24700 strikes. On the put side, the highest OI is at the 24400 strike, followed by 24300 strikes. This suggests that the market participants are expecting Nifty 50 to remain range between 24300-24700 levels.

In the cash segment, Foreign Institutional Investors (FII) sold 3979 crores, while Domestic Institutional Investors (DII) bought 5869 crores.

Traders who follow the musical octave trading path may find valuable insights in predicting Nifty’s movements. According to this path, Nifty may follow a path of 23889-24600-25310-26063-26816 This means that traders can take a position and potentially ride the move as Nifty moves through these levels.Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable.

As a trading psychologist, I therefore see my job not in telling you why it is, but in how you can help yourself to find your own solutions to your problems.

For Positional Traders, The Nifty Futures’ Trend Change Level is At 24869. Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 24713, Which Acts As An Intraday Trend Change Level.

Nifty Intraday Trading Levels

Buy Above 24536 Tgt 24600, 24666 and 24729 ( Nifty Spot Levels)

Sell Below 24444 Tgt 24400, 24360 and 24317 (Nifty Spot Levels)

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.

Wonderful analysis. Thanks a lot for your prediction and Trend deciding levels update. Keep up the good work and I will be waiting for your regular updates.