WTI crude has fallen below $69 per barrel, marking a decline of over 8%, the largest weekly drop since the last week of September. Weakness in oil intensified further today by slowing economic growth in China and a reduction in supply disruptions in the Middle East. China’s GDP grew by 4.6% in the September quarter compared to a year earlier, representing its slowest growth since the first quarter of 2023. The downward pressure on oil prices this week has also been fueled by lowered demand growth projections from OPEC and the IEA, a decrease in China’s refinery output, and the resumption of production and exports from Libya.

MCX Crude Oil Gann Angle Chart

Crude has formed an Outside Bar on Daily chart signalling short term reversal possible once price is above 5985

MCX Crude Oil Supply Demand Zone

MCX CRUDE OIL Supply Demand Chart : Demand in range of 5775-5800 Supply in range of 6084-6100

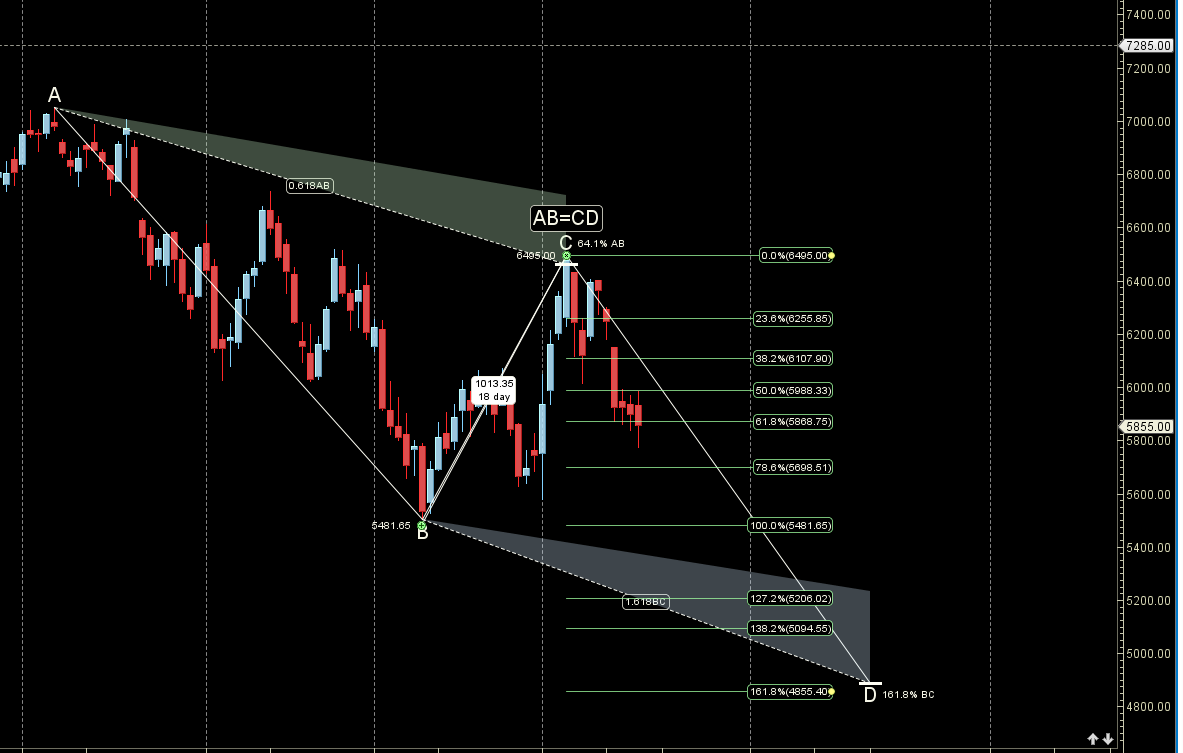

MCX Crude Oil Crude Harmonic

Price is heading towards 6300 once above 5985