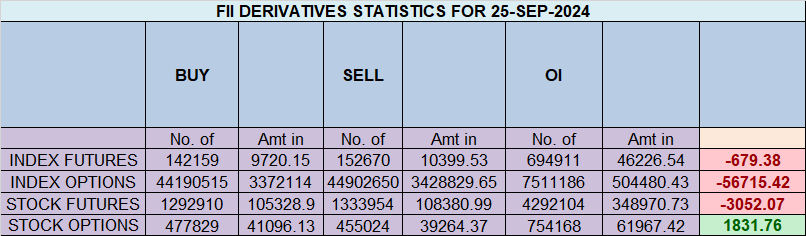

Foreign Institutional Investors (FIIs) displayed a Bearish approach in the Nifty Index Futures market by Shorting 9682 contracts worth ₹616 crores, resulting in a increase of 10690 contracts in the net open interest. FIIs covered 24932 long contracts and covered 38325 short contracts, indicating a preference for covering long positions and covering short positions. With a net FII long-short ratio of 2.1 , FIIs utilized the market rise to exit long positions and exit short positions in Nifty futures. Clients covered 12797 long contracts and covered 11224 short contracts. FII are holding 75 % Long and 25 % Shorts in Index Futures and Clients are holding 35 % Long and 65 % Shorts in Index Futures.

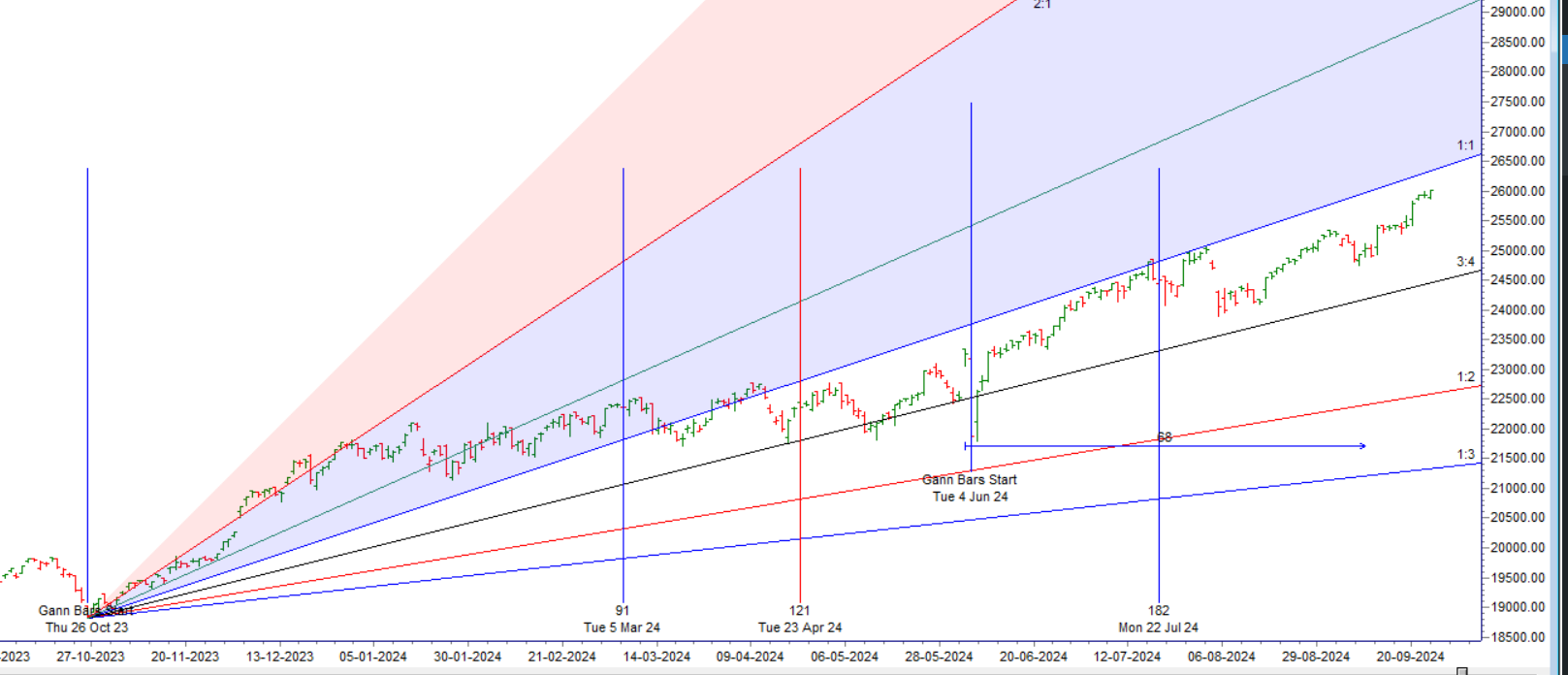

Nifty made a fresh all-time high today at 26,011 but failed to close above 26,000. Based on the Bayer’s Rule discussed in the video below, we can expect significant movement in the next two trading sessions. Trade cautiously with proper hedging. Strong Reversal only on close below 25847.

Thursday is the monthly expiry of the Nifty and the index has gained over 850 points so far this series. This will be the fourth consecutive F&O Series that the Nifty ends with gains, having gained over 300 points in August as well. Price made a new all time high today and tommrow Mercury is moving back in Libra so we can see volatlity and spikes in market. First 15 mins High and Low will guide for the day.

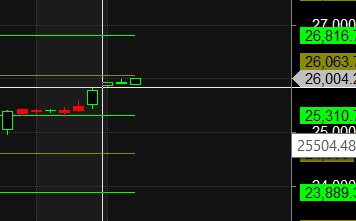

Nifty Trade Plan for Positional Trade ,Bulls will get active above 26064 for a move towards 26223/26383. Bears will get active below 25905 for a move towards 25745/25586

Traders may watch out for potential intraday reversals at 09:25,11:01,12:43,02:36 How to Find and Trade Intraday Reversal Times

Nifty Sep Futures Open Interest Volume stood at 0.67 lakh cr , witnessing a liquidation of 24 Lakh contracts. Additionally, the increase in Cost of Carry implies that there was a covering of SHORT positions today.

Nifty Advance Decline Ratio at 30:20 and Nifty Rollover Cost is @25178 closed above it.

Nifty Gann Monthly Trade level :25089 close above it.

Nifty closed above its 20SMA @25338 Trend is Buy on Dips till above 25300

Nifty options chain shows that the maximum pain point is at 25850 and the put-call ratio (PCR) is at 1.02 Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound.

Nifty 50 Options Chain Analysis

The Nifty 50 options chain indicates that the highest open interest (OI) on the call side is at the 26000 strike, followed by 26100 strikes. On the put side, the highest OI is at the 25900 strike, followed by 25800 strikes. This suggests that the market participants are expecting Nifty 50 to remain range between 25800-26200 levels.

In the cash segment, Foreign Institutional Investors (FII) sold 973 crores, while Domestic Institutional Investors (DII) bought 1778 crores.

Traders who follow the musical octave trading path may find valuable insights in predicting Nifty’s movements. According to this path, Nifty may follow a path of 25310-26063-26816 This means that traders can take a position and potentially ride the move as Nifty moves through these levels.Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable.

During this phase of the rule-finding and the clean implementation of your Trading system you are faced with mental conflicts. That’s the hardest part of the Trading education to resolve “Mental Conflicts”.

For Positional Traders, The Nifty Futures’ Trend Change Level is At 25997 . Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 26072, Which Acts As An Intraday Trend Change Level.

Nifty Expiry Range

Upper End of Expiry : 26177

Lower End of Expiry : 25830

Nifty Intraday Trading Levels

Buy Above 26033 Tgt 26067, 26100 and 26144 ( Nifty Spot Levels)

Sell Below 25950 Tgt 25906, 25864 and 25830 (Nifty Spot Levels)

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.