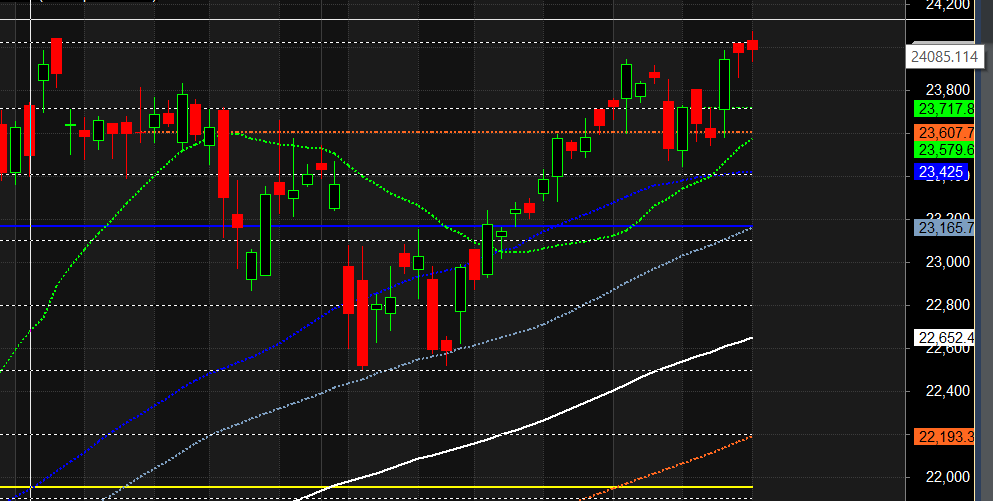

Finance Nifty continued its rally to the upside, making a fresh all-time high by breaking the high formed on July 4, 2024. It formed an NR7 pattern ahead of the US Fed rate cut decision and one of the most important astrological events of the year, the Lunar Eclipse.

Finance Nifty will confirm a double top if it closes below 23,900 in the next two trading sessions. Trade cautiously, as Lunar Eclipses have historically caused trend reversals.

Finance Nifty Trade Plan for Positional Trade ,Bulls will get active above 24039 for a move towards 24115/24192 . Bears will get active below 23885 for a move towards 23808/23732/23655

Traders may watch out for potential intraday reversals at 09:37,11:48,12:44,02:13 How to Find and Trade Intraday Reversal Times

Finance Nifty September Futures Open Interest Volume stood at 61175 with liquidation of 5725 contracts. Additionally, the increase in Cost of Carry implies that there was a liquidation of LONG positions today.

Finance Nifty Advance Decline Ratio at 08:11, Finance Nifty Rollover Cost is @23628 closed above it

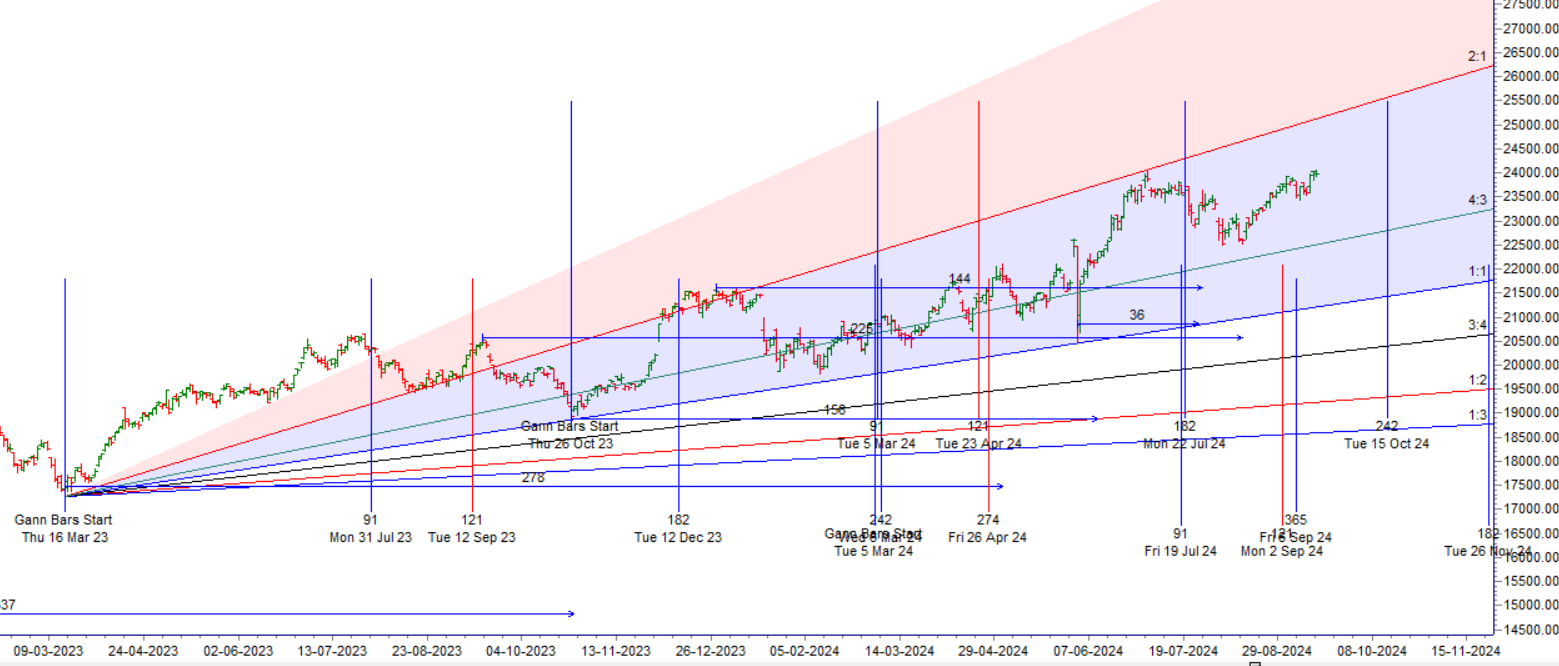

Finance Nifty Gann Monthly Trade level :23717 close above it.

Finance Nifty closed below 20 SMA, Trend is Buy on Dips till above 23717.

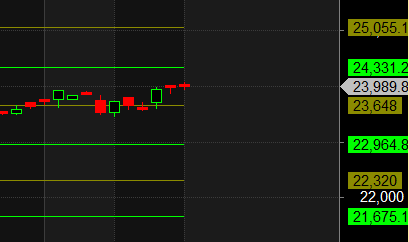

Traders who follow the musical octave trading path may find valuable insights in predicting Bank Nifty’s movements. According to this path, Finance Nifty may follow a path of 22964-23648-24331. This means that traders can take a position and potentially ride the move as Bank Nifty moves through these levels. Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable.

According to the Finance Nifty options chain, the call side has the highest open interest (OI) at the 24000 strike, followed by the 24100 strike. On the put side, the 23900 strike has the highest OI, followed by the 23800 strike. This indicates that market participants anticipate Finance Nifty to stay within the 23600-23800 range.

The Finance Nifty options chain shows that the maximum pain point is at 24000 and the put-call ratio (PCR) is at 0.85 . Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound.

The brain stem is the oldest brain because it is with its functions was already in reptiles. It saves experiences from Millions of years. It is the seat of the feelings of life and instincts like eg fear and panic. It is also called the “reptilian brain”.

For Positional Traders, The Finance Nifty Futures’ Trend Change Level is At 23805. Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 24040 , Which Acts As An Intraday Trend Change Level.

FIN Nifty Expiry Range

Upper End of Expiry : 24156

Lower End of Expiry : 23843

FIN Nifty Intraday Trading Levels

Buy Above 24006 Tgt 24044, 24088 and 24144 ( FIN Nifty Spot Levels)

Sell Below 23960 Tgt 23921, 23888 and 23843 (FIN Nifty Spot Levels)

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.