Foreign Institutional Investors (FIIs) exhibited a Bullish Stance in the Bank Nifty Index Futures market by Buying 4498 contracts with a total value of 350 crores. This activity led to a increase of 4480 contracts in the Net Open Interest.

Bank Nifty continued its rally on the upside, but its underperformance compared to Nifty persisted, as Nifty has hit a fresh all-time high while Bank Nifty is still trading below its all-time high of 53357 , formed on July 4, 2024. We have two important astrological events: Venus Opposition North Node and a New Moon. The aspect with the North Node is likely to bring volatility to the market, so traders should use the high and low of the first 15 minutes to capture the trend for the day

“Bank Nifty formed an Outside Bar, and the aspect with the North Node had the expected impact as discussed yesterday. Today, as discussed in the video below, we will see the effects of the New Moon and Bayer Rule 27, which states that big tops and major bottoms occur when Mercury’s speed in geocentric longitude is 59 minutes or 1 degree 58 minutes. Tomorrow, we also have important Mars and Mercury astrological events, which could lead to market volatility, so trade carefully and consider hedging any overnight positions. A break below 51,200 is the first sign of trouble for the bulls, and bears will gain the upper hand only below 51,000.”

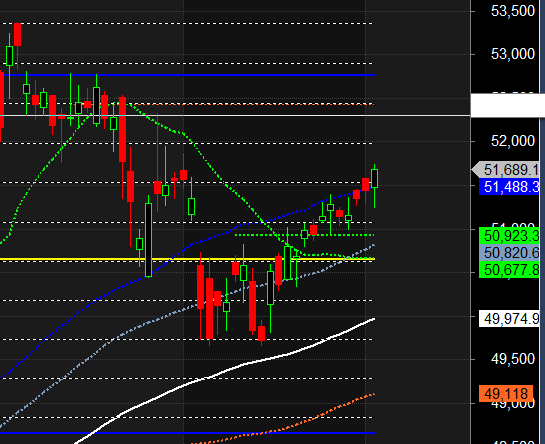

Bank Nifty Trade Plan for Positional Trade ,Bulls will get active above 51466 for a move towards 51679/51903/52128 Bears will get active below 51230 for a move towards 51006/50782/50557

Traders may watch out for potential intraday reversals at 09:15,12:39,01:47,02:49 How to Find and Trade Intraday Reversal Times

Bank Nifty September Futures Open Interest Volume stood at 23.2 lakh, with addition of 0.015 lakh contracts. Additionally, the increase in Cost of Carry implies that there was a additon of LONG positions today.

Bank Nifty Advance Decline Ratio at 05:07 and Bank Nifty Rollover Cost is @51260 closed above it.

Bank Nifty Gann Monthly Trade level :50923 closed above it.

Bank Nifty closed below 20 SMA @51454 Trend is Sell on Rise

Traders who follow the musical octave trading path may find valuable insights in predicting Bank Nifty’s movements. According to this path, Bank Nifty may follow a path of 48819-50271-51724-53263. This means that traders can take a position and potentially ride the move as Bank Nifty moves through these levels. Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable.

According to the Bank Nifty options chain, the call side has the highest open interest (OI) at the 51500 strike, followed by the 51800 strike. On the put side, the 51000 strike has the highest OI, followed by the 50800 strike.This indicates that market participants anticipate Bank Nifty to stay within the 51300-51800 range.

The Bank Nifty options chain shows that the maximum pain point is at 51600 and the put-call ratio (PCR) is at 1.01. Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound. PCR is on extreme end suggesting we can see sharp reversal .

One Reason for Overtrading is due to an excessive flood of knowledge. Through numerous books, seminars, workshops, webinars trader acquire an incredible amount of specialist knowledge over time. There is also a large number Trading approaches of other traders that are constantly floating around in your head like a swarm of bees gone wild. Knowledge can be here quickly too Cause confusion.

For Positional Traders, The Bank Nifty Futures’ Trend Change Level is At 51582 . Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 51735, Which Acts As An Intraday Trend Change Level.

BANK Nifty Expiry Range

Upper End of Expiry : 51741

Lower End of Expiry : 50986

BANK Nifty Intraday Trading Levels

Buy Above 51466 Tgt 51580, 51722 and 51864 ( BANK Nifty Spot Levels)

Sell Below 51400 Tgt 51297, 51154 and 51013 (BANK Nifty Spot Levels)

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.