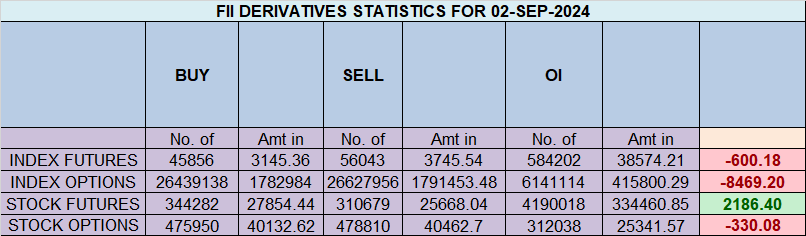

Foreign Institutional Investors (FIIs) displayed a Bearish approach in the Nifty Index Futures market by Shorting 13256 contracts worth ₹839 crores, resulting in a increase of 24176 contracts in the net open interest. FIIs added 9645 long contracts and added 19832 short contracts, indicating a preference for adding long positions and adding short positions. With a net FII long-short ratio of 1.36 , FIIs utilized the market rise to enter long positions and enter short positions in Nifty futures. Clients added 15022 long contracts and added 10630 short contracts.

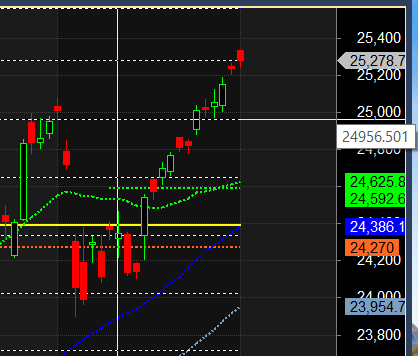

Price continue to move higher with Nifty rising for 12 days in a row. Record of its kind. Till Bulls are holding 25078 price can rally towards 25300.

Nifty made a fresh all time high today at 25300 as discussed in last analysis, Nifty has been up for 13 days in a row record in itself, We have two important astrological events: Venus Opposition Mercury HELIO and a New Moon. The aspect with the Mercury and Venus both short term plannets is likely to bring volatility to the market, so traders should use the high and low of the first 15 minutes to capture the trend for the day

Nifty Trade Plan for Positional Trade ,Bulls will get active above 25285 for a move towards 25359/25438/25517. Bears will get active below 25201 for a move towards 25122/250438/24964

Traders may watch out for potential intraday reversals at 09:17,11:49,02:07,02:50 How to Find and Trade Intraday Reversal Times

Nifty Sep Futures Open Interest Volume stood at 1.49 lakh cr , witnessing a addition of 10 Lakh contracts. Additionally, the increase in Cost of Carry implies that there was a addition of LONG positions today.

Nifty Advance Decline Ratio at 36:14 and Nifty Rollover Cost is @25178 closed above it.

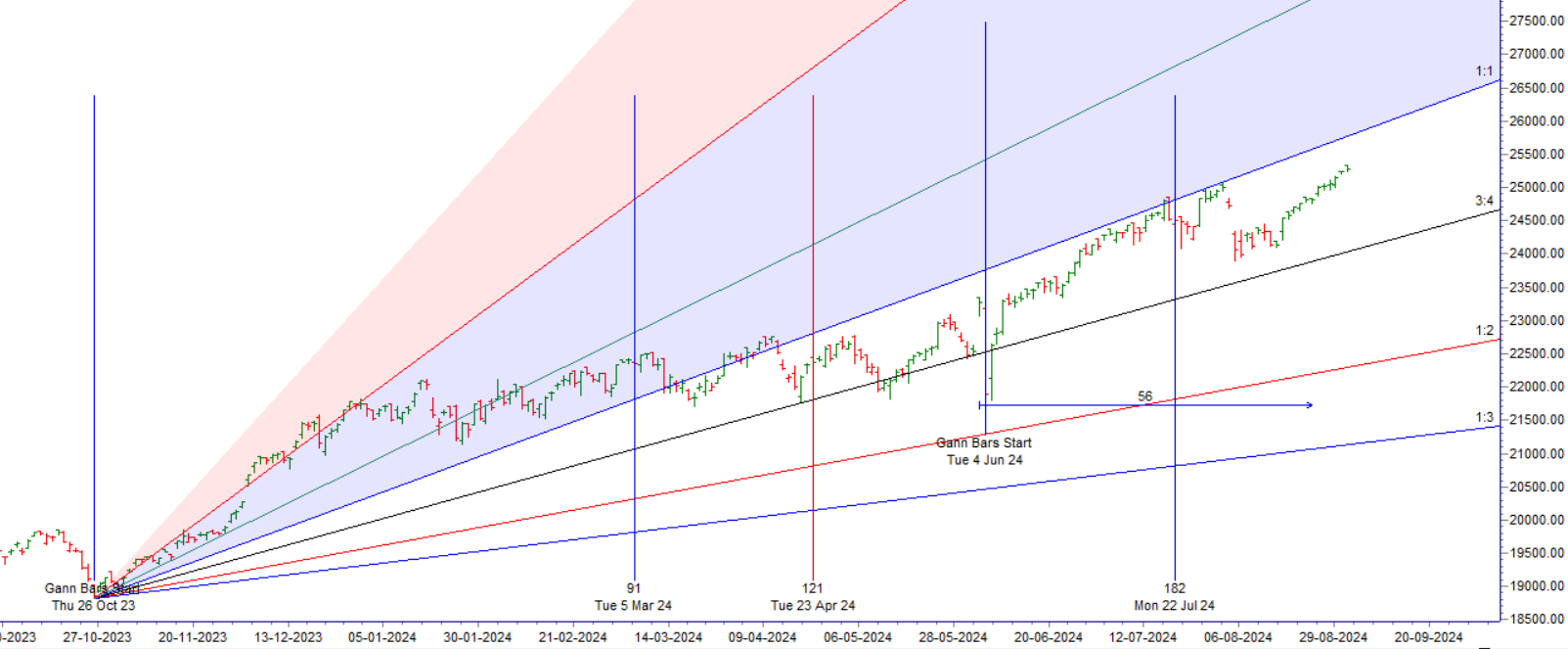

Nifty Gann Monthly Trade level :24592 close above it.

Nifty closed above its 20SMA @24625 Trend is Buy on Dips till above 24625

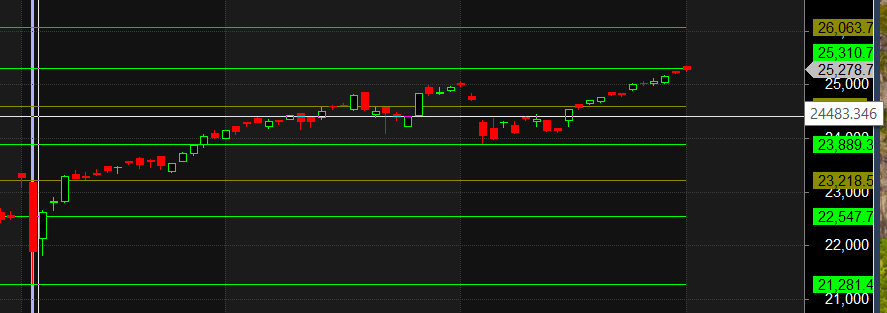

Nifty options chain shows that the maximum pain point is at 25300 and the put-call ratio (PCR) is at 1.5 Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound.

Nifty 50 Options Chain Analysis

The Nifty 50 options chain indicates that the highest open interest (OI) on the call side is at the 25300 strike, followed by 25400 strikes. On the put side, the highest OI is at the 25100 strike, followed by 25000 strikes. This suggests that the market participants are expecting Nifty 50 to remain range between 25000-25300 levels.

In the cash segment, Foreign Institutional Investors (FII) bought 1735 crores, while Domestic Institutional Investors (DII) bought 356 crores.

Traders who follow the musical octave trading path may find valuable insights in predicting Nifty’s movements. According to this path, Nifty may follow a path of 23889-24600-25310 This means that traders can take a position and potentially ride the move as Nifty moves through these levels.Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable.

One Reason for Overtrading is due to an excessive flood of knowledge. Through numerous books, seminars, workshops, webinars trader acquire an incredible amount of specialist knowledge over time. There is also a large number Trading approaches of other traders that are constantly floating around in your head like a swarm of bees gone wild. Knowledge can be here quickly too Cause confusion.

For Positional Traders, The Nifty Futures’ Trend Change Level is At 25310. Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 25361, Which Acts As An Intraday Trend Change Level.

Nifty Intraday Trading Levels

Buy Above 25285 Tgt 25329, 25380 and 25427 ( Nifty Spot Levels)

Sell Below 25231 Tgt 25184, 25133 and 25088 (Nifty Spot Levels)

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.