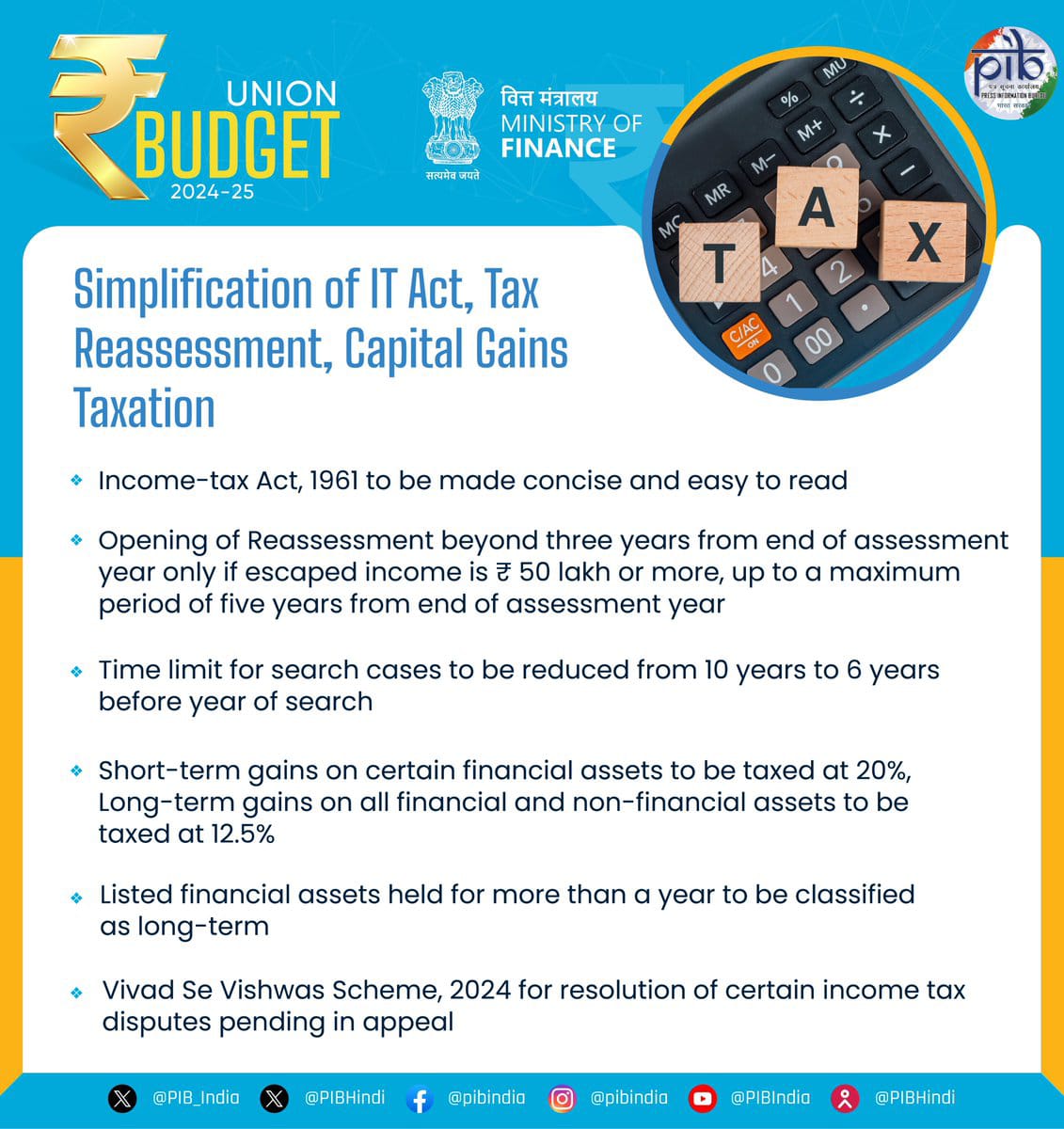

1. Budget 2024 proposes overhaul of Capital Gains Taxes – Short term gains 20% on all financial assets, On all other other assets it remains as it was, Long term – 12.5% on all assets, Exemption on profits 1.25 lakh a year

2. Standard Deduction Increased from 50,000 to 75,000.

3. Dedction of Family pension 15K to 25K

4. The New Slabs in the New Regime in #Budget2024, From 0-3 Lakh – Nil , 3-7 Lakh – 5% , 7-10 Lakh – 10% , 10-12 Lakh – 15% , 12-15 Lakh – 20% , If its more than 15 Lakh – 30%

5. Angel Tax Abolished for All Categories of Investors.

6. STT on F&O increased to 0.2 %

7. FM keeps capex at Rs 11.11 lakh crore or 3.4% of GDP

8. Capital Expenditure in the Budget, 2019 – ₹3.1 Lakh Crore, 2021 – ₹4.4 Lakh Crore, 2022 – ₹5.5 Lakh Crore, 2023 – ₹7.5 Lakh Crore, 2024 – ₹10 Lakh Crore, 2025 – ₹11.1 Lakh Crore

9. Fiscal deficit lowered to 4.9% of GDP, market borrowing unchanged at Rs 14.13 lakh crore

10. Fiscal deficit for FY25 further scaled down to 4.9 from 5.1% in interim Budget

11. Aim to reach a fiscal deficit of below 4.5% by FY26

12. BCD on mobile phones, chargers reduced to 15%.

13. Highest Capex Spending proposed to support the economy and job creation in

14. Govt allocates over Rs 3 lakh crore for schemes benefiting women, girls:

15. Limit of Mudra loans to extend to Rs 20 lakh from Rs 10 lakh for those who have availed and paid previous loans.New mechanism announced for facilitating continuation of bank credit to #MSMEs during their stress period

16. The Budget focus on employment, skilling, MSMEs and Middle class

17. The Detailed roadmap to pursue nine priorities for generating opportunities for India These are: Agri, Employment, Inclusive development, Mfg and Services, Urban Devp, Energy, Infra, Innovation, R&D, NexGen reforms

18. Turning attention to the full year and beyond, in this budget, we particularly focus on employment, skilling, MSMEs, and the middle class. I am happy to announce the Prime Minister’s package of 5 schemes and initiatives to facilitate employment, skilling and other opportunities for 4.1 crore youth over a 5-year period with a central outlay of ₹ 2 lakh crore

19. ₹2 Lakh crore will be spent on youth and skill development over next 5 years

20. Digital coverage of farm land and farmers to help farmers get their dues.

21. PM Garib Kalyan Ann Yojna was extended for 5 years benefiting 80 crore people

22. Govt to provide incentive to 30 lakh youth entering job market by providing 1 month PF contribution. Govt to launch three employment-linked schemes

23. Govt to set up working women hostels to promote women participation in workforce

24. The PM Vishwakarma Scheme was announced by the Hon’ble Finance Minister in the Annual Union Budget 2023-24 on 01.02.2023 and launched by the Prime Minister on 17.09.2023. The Scheme aims to provide end-to-end support to artisans and craftspeople who work with their hands and tools

25. FM allocated Rs. 1.48 lakh cr for education, employment and skilling. 5 schemes for 4.1 crore youth with an outlay of Rs. 2 lakh cr over a period of 5 years.

26. We will formulate plan Purvodaya for all round development of Bihar, Jharkhand, West Bengal, Odisha, and Andhra Pradesh

27. Govt to provide e-vouchers directly to 1 lakh students every year with interest subvention of 3 per cent of loan amount

28. 1,000 ITIs to be upgraded in hub and spoke model,

29. Model skilling loan scheme will be revised to facilitate loans up to Rs 7.5 lakh

30. New centrally-sponsored scheme for skilling in collaboration with states, industry; 20 lakh youth to be skilled over 5 years

31. Govt will release new 109 high yielding, climate resilient seeds for 32 field and horticulture crops. ₹ 1.52 lakh crore allotted for agriculture & allied sectors

32. Govt to set up working women hostels to promote women participation in workforce

33. Govt to provide funds to private sector, domain experts & others for developing climate-resilient seeds

34. Employment and skilling: 3 schemes for Employment linked incentives based on EPFO enrolment. Scheme A : First timers – 1 month wage to all entering the workforce in all formal sectors/eligibility of salary of 1 lakh a month . Scheme B : Job creation in Manf; Additional Employment in Manf to be incentivised EPFO contribution

35. 100 branches of India Post Payments Bank to be set up in North East:

36. 2.66L Cr Rs. Provision made for rural development

37. Union Budget 2024-25 proposes revision of Model Skill Loan Scheme to help 25,000 students every year.

38. E-vouchers for loans upto Rs. 10 lakh for higher education in domestic institutions to be given directly to 1 lakh students every year for annual interest subvention of 3% of loan amount.

39. Industrial node at Gaya on Amritsar Kolkata Industrial Corridor to be developed

40. On the Amritsar-Kolkata Industrial Corridor, we will support development of an industrial node at Gaya. This corridor will catalyze industrial development of the eastern region

41. More than 100 branches of India Post Payment Bank to be set up in the North East region

42. Budget provides Rs 2.66 lakh crore for rural development

43. Voluntary Closure of LLPs – Much needed Lakhs will save late fees and fine

44. We will formulate a plan ‘Poorvodaya’ for all-round development of the Eastern region of the country, covering Bihar, Jharkhand, West Bengal, Odisha and Andhra Pradesh.

45. MSME Buyers T/o Threshold reduced for mandatory onboarding to treds reduced from Rs. 500 Cr to Rs. 250Cr.

46. The IBC has dissolved more than 1000 companies, resulting in direct recovery of Rs 3.3 lakh cr

47. Appropriate changes to IBC will be initiated, additional tribunals will be established

48. Rental housing with dorm like accomodation for industrial workers will be facilitated in PPP mode

49. For facilitating term loans to MSMEs, a credit guarantee scheme will be introduced. The scheme will operate on the cooling of credit risks of such MSMEs. A self-financing guarantee fund will provide to each applicant cover of up to Rs 100 crore while loan amount may be larger,

50. Andhra Pradesh Reorganisation Act- Our govt has made efforts to fulfil the commitments in Andhra Pradesh Reorganisation Act. Recognising the state’s need for capital, we will facilitate special financial support through multilateral agencies. In the current FY, Rs 15,000 crore will be arranged with additional amounts in future years

51. Sidbi to open 24 new branches to serve MSMEs clusters, says FM

52. Pradhan Mantri Janjatiya Unnat Gram Abhiyan will be launched for improving the socio-economic condition of tribal communities. The scheme will adopt saturation coverage for tribal families in tribal-majority villages and aspirational districts. This will cover 63,000 villages benefitting 5 crore tribal people.

53. Female Labour Force Participation Rate (LFPR) rose to 37% in 2022-2023 from 23.3% in 2017-2018

54. Women hold 55.6 per cent of PM Jan Dhan Yojana accounts

55. With creation of 8.3 million SHGs, 89 million women covered under Deendayal Antyodaya Yojana-NRLM

56. Under PM Mudra Yojana, 68% loans sanctioned to women and 77.7% women beneficiaries under Stand Up India

57. Nuclear energy to be an important part of energy requirements

58. 1 crore farmers across the country will be initiated into natural farming supported by certification and, branding.

59. 10,000 need-based bio-input resource centers will be established

60. Integrated technology platform to be set up for improving the outcomes under Insolvency & Bankruptcy Code

61. To achieve Aatmanirbharta in pulses & oil seeds, their production, storage, and, marketing

62. Debt recovery tribunals to be strengthened & additional tribunals to be established to speed up recovery

63. 14 large cities with a population above 30 lakh will have Transit Oriented Development plans

64. 1 cr urban poor and middle-class families to be covered under PM Awas Yojana Urban 2.0

65. 100 weekly ‘haats’ or street food hubs in select cities

66. Investment-ready “plug and play” industrial parks to be developed in or near 100 cities

67. 12 industrial parks sanctioned under National Industrial Corridor Development Programme

68. More than 1.28 crore registrations and 14 lakh applications received under PM Surya Ghar Muft Bijli Yojana

69. Pumped Storage Policy to be brought out for electricity storage and smooth integration of renewable energy in the overall energy mix

70. Joint venture between ntpclimited & BHEL_India to set up a full scale 800 MW commercial thermal plant using AUSC technology

71. Policy to support pump storage projects will be brought to provide round the clock energy, says finance minister.

72. Finance minister Sitharaman announced scheme for rooftop solar panels that would enable 1 crore households to have electricity free of cost upto 300 units per month.

73. substantial sum of Rs. 2.66 lakh crore has been earmarked for the development of rural areas, which includes the enhancement of rural infrastructure.

74. PM Awas Yojana-Urban 2.0 that would fulfill housing requirements of 1 crore poor and middle-class families.

75. Power projects, including setting up a new 2400 MW power plant at Pirpainti in Bihar, will be taken up at a cost of Rs 21,400 crore:

76. Govt will launch Phase IV of PM Gram Sadak Yojana in 25 rural habitations, which have become eligible due to population increase

77. Govt to maintain strong fiscal support for infra projects for next 5 year

78. Govt to facilitate investment grade energy audit of micro and small industries in 60 clusters

79. PM Surya Ghar Muft Bijli Yojana generated remarkable response with 1.8 crore people registering under it:

80. FM proposes central assistance of Rs 2.2 lakh crore for urban housing over next five years.

81. Proposes Rs 1.5 lakh cr long-term interest-free loans to support states towards infra development.

82. Vishnupad Temple Corridor & Mahabodhi Temple Corridor to be transformed into world class pilgrim & tourist destinations

83. Nalanda to be developed as a tourist Centre; Nalanda University to be revived to its glorious stature

84. Next gen reform proposal: NPS Vatsalya in which parents can contribute for child. Coverts to regular NPS account when child becomes major.

85. Government to aid flood-affected states like Bihar, Assam, Himachal Pradesh, Uttarakhand, and Sikkim with Flood Management and Development Support, including Financial Backing for Flood Control Projects

86. Reforms in land administration, urban planning, usage and building bylaws in both rural and urban areas

87. All lands in rural areas to be assigned Unique Land Parcel Identification Number

88. Land registry to be established in rural areas

89. The govt. is committed to the all-around, all-pervasive, and all-inclusive development of people, particularly farmers, women, youth, and the poor.

90. For achieving social justice comprehensively, the saturation approach of covering all eligible people through various programs including those for education and health will empower them by improving their capabilities.

91. Anusandhan National Research Fund to be set up for basic research and prototype development

92. Financing pool of ₹ 1 lakh crore to spur private sector-driven research and innovation at commercial scale

93. The government has proposed to set up a venture capital fund of ₹1000 crore for the space economy

94. Financial Assistance for Veteran Artists’ to provide financial assistance to veteran artists aged 60 years and above having annual income not exceeding Rs. 72,000/-

95. Internships for students of various technical disciplines within MSMEs

96. Government will strive to further simplify, rationalise GST tax structure

97. Technology Centres impart short term industrial training/internship as part of AICTE course curriculum to the youth. The National Institute for Micro, Small and Medium Enterprises (Ni-MSME) under the Ministry is providing internships for students of several educational institutions like IIIT Design Management, Andhra Pradesh, Institute of Public Enterprises, Hyderabad, Hissar Agricultural University Haryana, Rajeev Gandhi National Institute for Youth Development, Tamil Nadu etc

98. Rules for FDI and overseas investment will be simplified, including nudging privatisation, using Indian rupee for overseas investment:

99. Government will develop taxonomy for climate finance

100. Govt will revamp Shram Suvidha Portal to enhance compliance for industry and trade

101. customs duties on 25 critical minerals, and lowers BCD for two of them. Many changes in Basic Custom Duty

102. Technology to speed up digitalization of economy, Jan Vishwas Bill 2.0 to improve Ease of Doing Business, States to be incentivized to implement Business Reforms Action Plans and digitalization

103. NPS for Minors NPS-Vatsalya, a plan for contribution by parents and guardians for minors, to be launched Plan can be seamlessly converted into a normal NPS account on minor becoming an adult

104. Net tax receipts estimated at Rs 25.83 lakh crore in FY25

105. propose to reduce customs duties on gold and silver to 6% and 6.5% on platinum