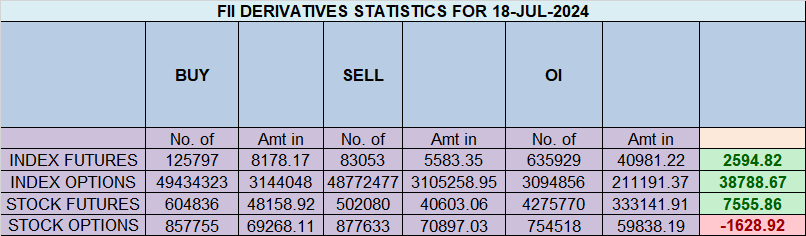

Foreign Institutional Investors (FIIs) displayed a Bullish approach in the Nifty Index Futures market by Buying 46719 contracts worth ₹2594 crores, resulting in a increase of 70183 contracts in the net open interest. FIIs added 57851 long contracts and added 15107 short contracts, indicating a preference for adding long positions and adding of short positions. With a net FII long-short ratio of 3.5 , FIIs utilized the market rise to enter long positions and enter short positions in Nifty futures. Clients covered 9630 long contracts and added 27850 short contracts.

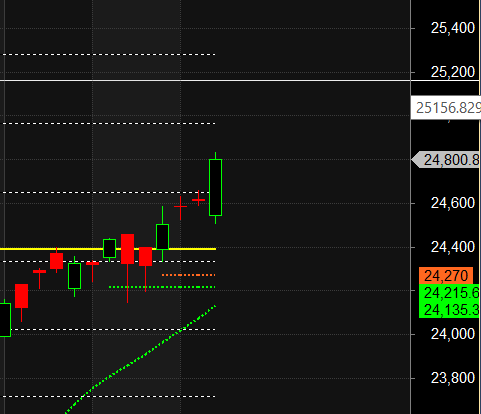

Nifty has foremd 2 DOJI in last 2 trading session and price is holding 24520-24530 range which is Solar Degree level, Till Bulls are holding 24512 Trend stays up. Jupiter 72 Neptune Aspect today so Banking and Pharma shares should be kept on radar today.

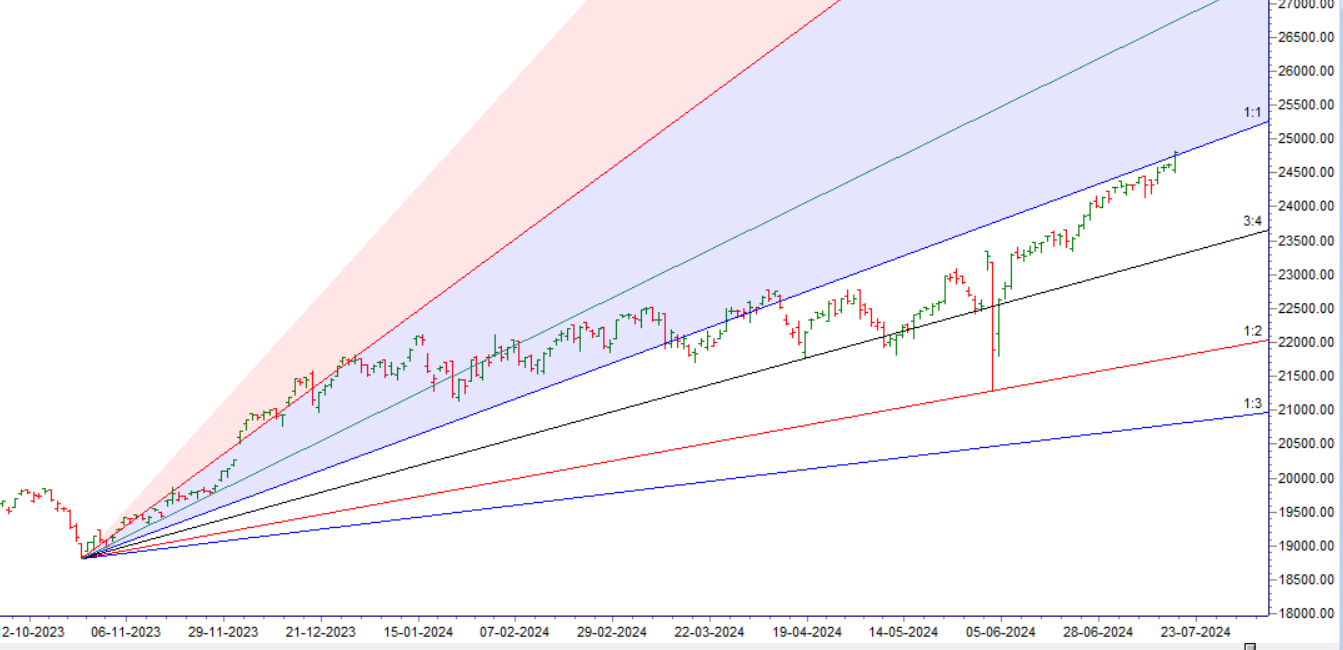

Nifty made another all time high today and with Infy results tommrow we can see touch of 25000, so we might see fastest 1000 point move in just 16 trading session, Even a small dip in market is getting bought into, Today Price has touched the 1×1 gann angle, Above 25000 heading towards 25694/27000.. Below 24389 heading towards 23170 .. in next 3 months, Based on our past studies its seen after Budget we see a trend resversal, so if till budget we are up after budget which is monthly expiry week we can see trend change so trade cautiously till 23 July.

Nifty Trade Plan for Positional Trade ,Bulls will get active above 24895 for a move towards 24974/25052. Bears will get active below 24739 for a move towards 24661/24582

Traders may watch out for potential intraday reversals at 09:29,11:08,12:43,02:28 How to Find and Trade Intraday Reversal Times

Nifty June Futures Open Interest Volume stood at 1.50 lakh cr , witnessing a addition of 7 Lakh contracts. Additionally, the increase in Cost of Carry implies that there was a addition of LONG positions today.

Nifty Advance Decline Ratio at 35:15 and Nifty Rollover Cost is @23839 closed above it.

Nifty Gann Monthly Trade level :23993 close above it.

Nifty closed above its 20SMA @24135Trend is Buy on Dips.

Nifty options chain shows that the maximum pain point is at 24600 and the put-call ratio (PCR) is at 0.85 Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound.

Nifty 50 Options Chain Analysis

The Nifty 50 options chain indicates that the highest open interest (OI) on the call side is at the 24900 strike, followed by 25000 strikes. On the put side, the highest OI is at the 24700 strike, followed by 24500 strikes. This suggests that the market participants are expecting Nifty 50 to remain range between 24500-25000 levels.

In the cash segment, Foreign Institutional Investors (FII) bought 5483 crores, while Domestic Institutional Investors (DII) sold 2904 crores.

Traders who follow the musical octave trading path may find valuable insights in predicting Nifty’s movements. According to this path, Nifty may follow a path of 23889-24600-25310 This means that traders can take a position and potentially ride the move as Nifty moves through these levels.Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable.

If a trader is confused about what he is doing, the probable win ratio is zero and he might as well give up trading.

For Positional Traders, The Nifty Futures’ Trend Change Level is At 24369. Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 24698 , Which Acts As An Intraday Trend Change Level.

Nifty Intraday Trading Levels

Buy Above 24848 Tgt 24888, 24920 and 24966 ( Nifty Spot Levels)

Sell Below 24757 Tgt 24714, 24671 and 24630 (Nifty Spot Levels)

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.