Foreign Institutional Investors (FIIs) displayed a Bullish approach in the Nifty Index Futures market by Buying 475 contracts worth ₹29 crores, resulting in a decrease of 4055 contracts in the net open interest. FIIs covered 4533 long contracts and covered 4088 short contracts, indicating a preference for closing long positions and closing of short positions. With a net FII long-short ratio of 3.9 , FIIs utilized the market rise to exit long positions and exit short positions in Nifty futures. Clients added 15008 long contracts and added 5393 short contracts.

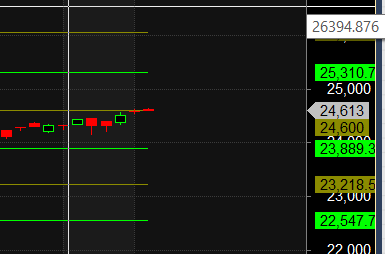

Nifty formed another DOJI on Mars Conjunct Uranus. Mars Uranus cycle — This cycle lasts about two years or 702.2 Earth days, during which Mars returns to the same position relative to Uranus. This cycle fascinating because it’s believed to be associated with changes in energy, innovation, and sudden shifts in the stock market. We have trading holiday on Wedneday break of 24635 will be favourable for bulls and Breakdown of 24522 will be in Bears favour, IN Between aviod trading.

Nifty has foremd 2 DOJI in last 2 trading session and price is holding 24520-24530 range which is Solar Degree level, Till Bulls are holding 24512 Trend stays up. Jupiter 72 Neptune Aspect today so Banking and Pharma shares should be kept on radar today.

Nifty Trade Plan for Positional Trade ,Bulls will get active above 24607 for a move towards 24685/24763. Bears will get active below 24530 for a move towards 24452/24374

Traders may watch out for potential intraday reversals at 09:32,10:09,12:22,02:28,02:58 How to Find and Trade Intraday Reversal Times

Nifty June Futures Open Interest Volume stood at 1.43 lakh cr , witnessing a addition of 0.78 Lakh contracts. Additionally, the increase in Cost of Carry implies that there was a addition of LONG positions today.

Nifty Advance Decline Ratio at 29:20 and Nifty Rollover Cost is @23839 closed above it.

Nifty Gann Monthly Trade level :23993 close above it.

Nifty closed above its 20SMA @24076Trend is Buy on Dips.

Nifty options chain shows that the maximum pain point is at 24600 and the put-call ratio (PCR) is at 0.85 Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound.

Nifty 50 Options Chain Analysis

The Nifty 50 options chain indicates that the highest open interest (OI) on the call side is at the 24600 strike, followed by 24700 strikes. On the put side, the highest OI is at the 24500 strike, followed by 24400 strikes. This suggests that the market participants are expecting Nifty 50 to remain range between 24400-24700 levels.

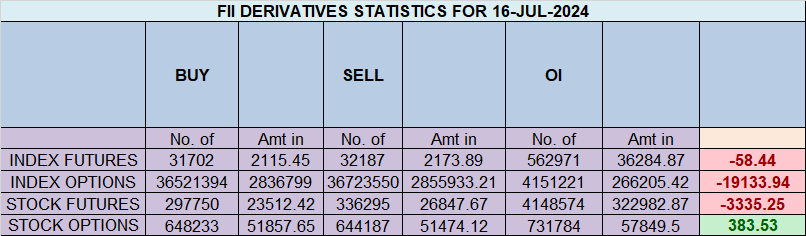

In the cash segment, Foreign Institutional Investors (FII) bought 1271 crores, while Domestic Institutional Investors (DII) sold 529 crores.

Traders who follow the musical octave trading path may find valuable insights in predicting Nifty’s movements. According to this path, Nifty may follow a path of 23889-24600-25310 This means that traders can take a position and potentially ride the move as Nifty moves through these levels.Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable.

If a trader is confused about what he is doing, the probable win ratio is zero and he might as well give up trading.

For Positional Traders, The Nifty Futures’ Trend Change Level is At 24346. Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 24650, Which Acts As An Intraday Trend Change Level.

Nifty Expiry Range

Upper End of Expiry : 24849

Lower End of Expiry : 24482

Nifty Intraday Trading Levels

Buy Above 24616 Tgt 24640, 24680 and 24729 ( Nifty Spot Levels)

Sell Below 24555 Tgt 24512, 24485 and 24420 (Nifty Spot Levels)

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.