Foreign Institutional Investors (FIIs) exhibited a Bullish Stance in the Bank Nifty Index Futures market by Buying 28941 contracts with a total value of 2310 crores. This activity led to a increase of 23909 contracts in the Net Open Interest.

Bank Nifty saw a decline of 400 points due to Kotak Bank fall based on Hinderburg Report , Tommrow Bank Nifty will open Gap up due to HDFC BANK MSCI Inflows of 3 Billion. We have multiple astro dates as discussed in below video, Bulls need a move above 52500 and Bears below 52000 for a trending move to come.

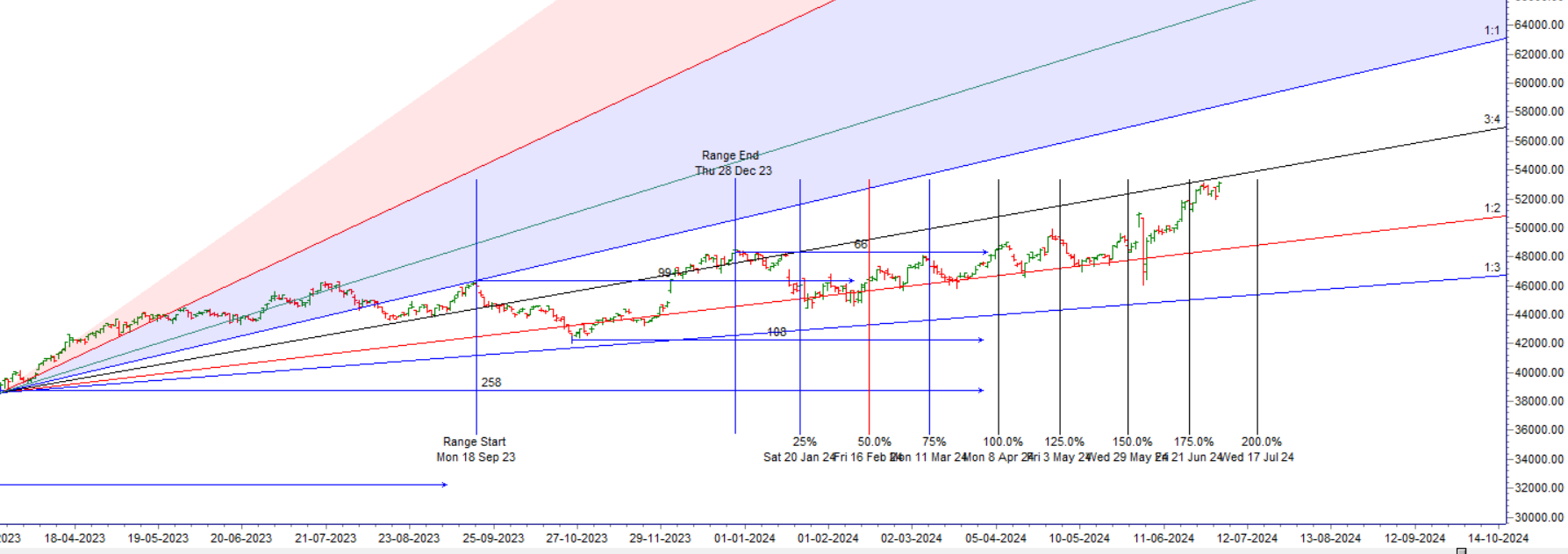

Bank NIfty made a fresh all time high today with HDFC Bank hitting all time high, Last year 03 JUl HDFC BANK made an 52 Week high and same cycle repeated again today with price making a fresh 52 week high. Break of 1760 can lead to price back to 1729 in HDFC BANK. Price is back to its 3×4 resistance zone @53408.

Bank Nifty Trade Plan for Positional Trade ,Bulls will get active above 53169 for a move towards 53399/53628. Bears will get active below 52940 for a move towards 52711/52482.

Traders may watch out for potential intraday reversals at 10:15,11:07,01:14,02:04,02:51 How to Find and Trade Intraday Reversal Times

Bank Nifty July Futures Open Interest Volume stood at 27.8 lakh, with addition of 3.3 lakh contracts. Additionally, the increase in Cost of Carry implies that there was a addition of LONG positions today.

Bank Nifty Advance Decline Ratio at 11:01 and Bank Nifty Rollover Cost is @52158 closed above it.

Bank Nifty Gann Monthly Trade level :52351 closed above it.

Bank Nifty closed above 20 SMA @50940 Trend is Buy on Dips

Traders who follow the musical octave trading path may find valuable insights in predicting Bank Nifty’s movements. According to this path, Bank Nifty may follow a path of 51724-53263-54081. This means that traders can take a position and potentially ride the move as Bank Nifty moves through these levels. Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable.

According to the Bank Nifty options chain, the call side has the highest open interest (OI) at the 53000 strike, followed by the 53500 strike. On the put side, the 52500 strike has the highest OI, followed by the 52000 strike.This indicates that market participants anticipate Bank Nifty to stay within the 52500-53500 range.

The Bank Nifty options chain shows that the maximum pain point is at 53000 and the put-call ratio (PCR) is at 1.23. Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound. PCR is on extreme end suggesting we can see sharp reversal .

If a trader is confused about what he is doing, the probable win ratio is zero and he might as well give up trading.

For Positional Traders, The Bank Nifty Futures’ Trend Change Level is At 52538. Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 53031, Which Acts As An Intraday Trend Change Level.

BANK Nifty Intraday Trading Levels

Buy Above 53125 Tgt 53250, 53400 and 53555 ( BANK Nifty Spot Levels)

Sell Below 53016 Tgt 52870, 52709 and 52555 (BANK Nifty Spot Levels)

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.