Mercury and Jupiter both have turned direct as discuused in below video.Tommrow Mars is also moving to Capricon, IN last 1 Week Venus/Merucry/Mars has changed sign. As Multiple plannets change sign Market also trend to changes the direction. Mars is an energy plannet so tommrow we can see an explosive move. Till Below 21300 Bears have upperhand. Finance Nifty is fist major index to close below 20 SMA.

Mars has shown its impact we saw a big move in Finance Nifty, Finance Nifty opened above 21300 so bears were on backhand from the opening and Mars added fuel to fire. TIll Bulls are holding 21466 Finance Nifty is moving towards its all time high towards 21627/21666.Bears only have chance once below 21300.

Finance Nifty Trade Plan for Positional Trade ,Bulls will get active above 21580 for a move towards 21653/21726. Bears will get active below 21507 for a move towards 21435/21362.

Traders may watch out for potential intraday reversals at 10:17,11:40,1:05,2:12 How to Find and Trade Intraday Reversal Times

Finance Nifty Nov Futures Open Interest Volume stood at 76720 with liquidation of 280 contracts. Additionally, the idecrease in Cost of Carry implies that there was a closure of SHORT positions today.

Finance Nifty Decline Ratio at 17:02 and Finance Nifty Rollover Cost is @48411 closed below it.

Finance Nifty Rollover Cost is @21524 closed above it.

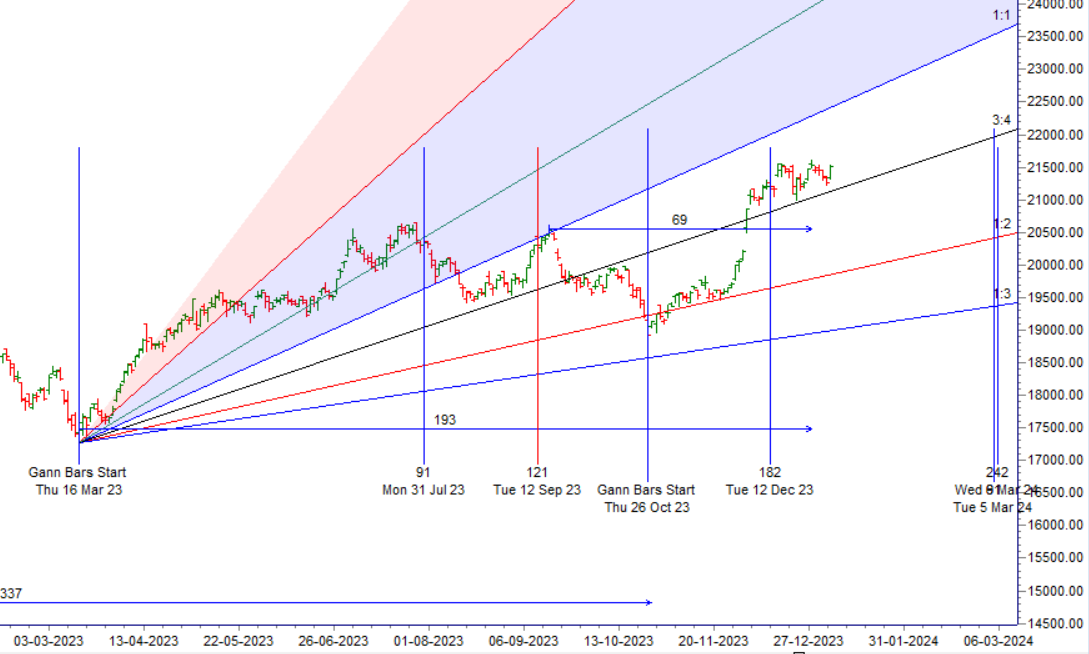

Finance Nifty Gann Monthly Trend Change Level : 21449

Finance Nifty has closed above its 20 SMA @21335

Traders who follow the musical octave trading path may find valuable insights in predicting Bank Nifty’s movements. According to this path, Finance Nifty may follow a path of 20587-21182-21812 . This means that traders can take a position and potentially ride the move as Bank Nifty moves through these levels. Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable.

According to the Finance Nifty options chain, the call side has the highest open interest (OI) at the 21600 strike, followed by the 21700 strike. On the put side, the 21400 strike has the highest OI, followed by the 21300 strike. This indicates that market participants anticipate Finance Nifty to stay within the 21300-21600 range.

The Finance Nifty options chain shows that the maximum pain point is at 21500 and the put-call ratio (PCR) is at 0.85. Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound.

Don’t be afraid to ask for help. If you’re struggling with trading, don’t be afraid to ask for help from a more experienced trader. There are many resources available to help you improve your trading skills.

For Positional Traders, The Finance Nifty Futures’ Trend Change Level is At 21557. Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 21572, Which Acts As An Intraday Trend Change Level.

Finance Nifty Intraday Trading Levels

Buy Above 21555 Tgt 21580, 21610 and 21636 ( Finance Nifty Spot Levels)

Sell Below 21490 Tgt 21465, 21440 and 21412 ( Finance Nifty Spot Levels)

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.