Finance Nifty has formed an Inside Bar Pattern and formed multiple Inside Bar in last 2 trading session. Tommrow we have Bayers Rule Involving Venus and with Insdie bar today we can see an explosive expiry “Bayer Rule 15: VENUS HELIOCENTRIC LATITUDE AT EXTREME AND LEAST SPEEDS FOR MAJOR MOVES Imp Rule” Intraday trade can follow first 15 mins High and Low to capture trend of the day.

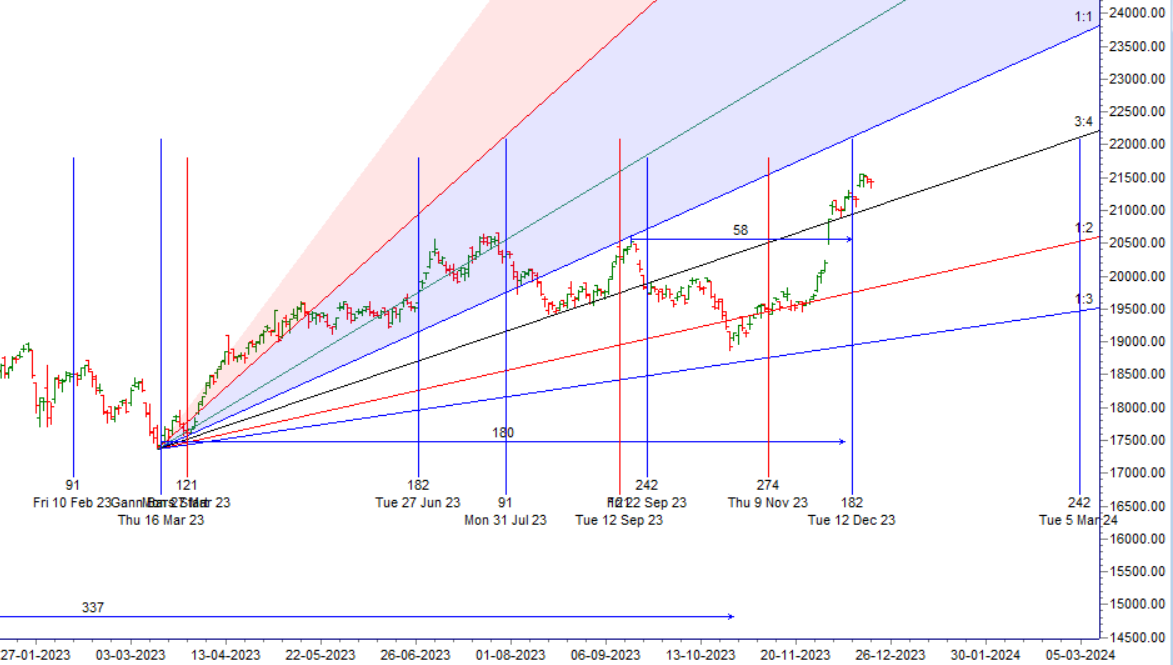

We have seen a volatile day yesterday and today will be another volatile day as we are seeing confluence of Gann and Astro cycle as discussed in below video. For Gann Students Observe price behaviour between 19-Dec to 21 Dec in 2021/2022.

Finance Nifty Trade Plan for Positional Trade ,Bulls will get active above 21550 for a move towards 21594/21652/21711. Bears will get active below 21416 for a move towards 21359/21300/21242.

Traders may watch out for potential intraday reversals at 9:47,11:51,1:02,1:33,2:37 How to Find and Trade Intraday Reversal Times

Finance Nifty Nov Futures Open Interest Volume stood at 74960 with addition of 9920 contracts. Additionally, the increase in Cost of Carry implies that there was a addition of LONG positions today.

Finance Nifty Advance Decline Ratio at 06:13, Finance Nifty Rollover Cost is @20700 closed above it.

Bank Nifty Gann Monthly Trend Change Level : 20655

Finance Nifty has closed above its 20/50/100/200 DMA, TIll 21350 is held bulls have upper hand and trend is Buy on Dips.

Traders who follow the musical octave trading path may find valuable insights in predicting Bank Nifty’s movements. According to this path, Finance Nifty may follow a path of 20587-21182-21812 . This means that traders can take a position and potentially ride the move as Bank Nifty moves through these levels. Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable.

According to the Finance Nifty options chain, the call side has the highest open interest (OI) at the 21500 strike, followed by the 21600 strike. On the put side, the 21300 strike has the highest OI, followed by the 21200 strike. This indicates that market participants anticipate Finance Nifty to stay within the 21300-21600 range.

The Finance Nifty options chain shows that the maximum pain point is at 21450 and the put-call ratio (PCR) is at 0.85. Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound.

We as a human programmed not to accept our defeat, that is the core our our evolution we are able to survive because of this mental coding. You might have seen so many people coming back to market after loosing everything in market. So due to this it is very hard for us to accept that we lost in a trade. So we keep on waiting for trade to return in our favour.

For Positional Traders, The Finance Nifty Futures’ Trend Change Level is At 21172. Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 21434, Which Acts As An Intraday Trend Change Level.

Finance Nifty Intraday Trading Levels

Buy Above 21505 Tgt 21529, 21555 and 21575 ( Finance Nifty Spot Levels)

Sell Below 2485 Tgt 21450, 21420 and 21400 ( Finance Nifty Spot Levels)

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.