Finance Nifty broke the 15-minute high on the upside and witnessed a strong rally, achieving a fresh all-time high today. With tomorrow marking the weekly close, bulls are poised to conclude on a high note. Today marked the day when many shorts were flushed out of the system, boosted by positive macro news and a technical breakout. Remember the rule of the stock market: the expensive will become more expensive until the last bear has surrendered. Additionally, today marked the 5th gap from the rally that began on November 22. The next gap, when and if it occurs, will likely be filled.

Finance Nifty has formed an Inside Bar Pattern and formed multiple Inside Bar in last 2 trading session. Tommrow we have Bayers Rule Involving Venus and with Insdie bar today we can see an explosive expiry “Bayer Rule 15: VENUS HELIOCENTRIC LATITUDE AT EXTREME AND LEAST SPEEDS FOR MAJOR MOVES Imp Rule” Intraday trade can follow first 15 mins High and Low to capture trend of the day.

Finance Nifty Trade Plan for Positional Trade ,Bulls will get active above 21550 for a move towards 21594/21652/21711. Bears will get active below 21416 for a move towards 21359/21300/21242.

Traders may watch out for potential intraday reversals at 9:15,12:24,1:11,2:41 How to Find and Trade Intraday Reversal Times

Finance Nifty Nov Futures Open Interest Volume stood at 65040 with liquidation of 3760 contracts. Additionally, the increase in Cost of Carry implies that there was a liquidation of LONG positions today.

Finance Nifty Advance Decline Ratio at 06:13, Finance Nifty Rollover Cost is @20700 closed above it.

Bank Nifty Gann Monthly Trend Change Level : 20655

Finance Nifty has closed above its 20/50/100/200 DMA, TIll 21350 is held bulls have upper hand and trend is Buy on Dips.

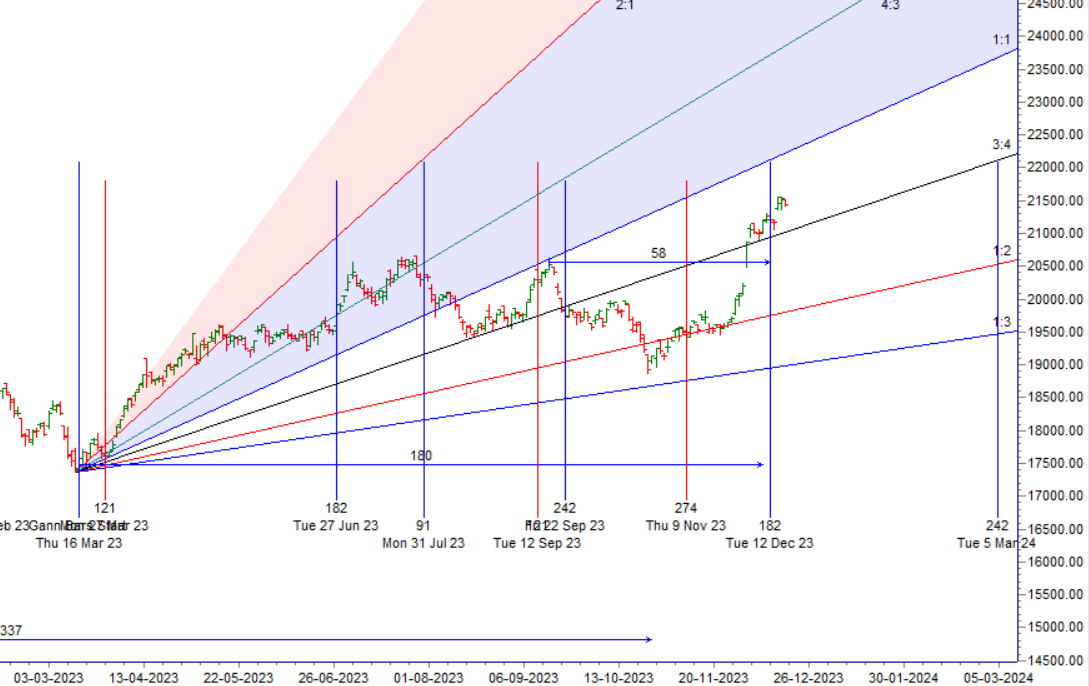

Traders who follow the musical octave trading path may find valuable insights in predicting Bank Nifty’s movements. According to this path, Finance Nifty may follow a path of 20587-21182-21812 . This means that traders can take a position and potentially ride the move as Bank Nifty moves through these levels. Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable.

According to the Finance Nifty options chain, the call side has the highest open interest (OI) at the 21500 strike, followed by the 21600 strike. On the put side, the 21300 strike has the highest OI, followed by the 21200 strike. This indicates that market participants anticipate Finance Nifty to stay within the 21300-21600 range.

The Finance Nifty options chain shows that the maximum pain point is at 21450 and the put-call ratio (PCR) is at 0.85. Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound.

My advice to any new traders is to seek a mentor who will offer you trading skills that will allow you to adapt to any market. What works one month may not work the next. But with fully developed trading skills, you can make the necessary adjustments.

For Positional Traders, The Finance Nifty Futures’ Trend Change Level is At 21150. Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 21444, Which Acts As An Intraday Trend Change Level.

Finance Nifty Expiry Range

Upper End of Expiry : 21600

Lower End of Expiry : 21287

Finance Nifty Intraday Trading Levels

Buy Above 21480 Tgt 21514, 21555 and 21600 ( Finance Nifty Spot Levels)

Sell Below 21420 Tgt 21390, 21348 and 21290 ( Finance Nifty Spot Levels)

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.