Finance Nifty Bears were able to brerak 21132 but failed to close below 21132 as it closed at 21171, We will open gap up today with US FED Singalling Rate Cut in Feb 2024. The yield on 10-year U.S. Treasuries fall below 4% for the first time since August. Bulls need to sustain above 21344 for a move towards 21417/21489. Today Moon is going to extreme declination so first 15 mins will guide intraday traders.

Finance Nifty broke the 15-minute high on the upside and witnessed a strong rally, achieving a fresh all-time high today. With tomorrow marking the weekly close, bulls are poised to conclude on a high note. Today marked the day when many shorts were flushed out of the system, boosted by positive macro news and a technical breakout. Remember the rule of the stock market: the expensive will become more expensive until the last bear has surrendered. Additionally, today marked the 5th gap from the rally that began on November 22. The next gap, when and if it occurs, will likely be filled

Finance Nifty Trade Plan for Positional Trade ,Bulls will get active above 21490 for a move towards 21563/21635. Bears will get active below 21418 for a move towards 21345/21273/21200

Traders may watch out for potential intraday reversals at 9:18,11:55,12:46,2:52 How to Find and Trade Intraday Reversal Times

Finance Nifty Nov Futures Open Interest Volume stood at 68280 with addition of 2120 contracts. Additionally, the increase in Cost of Carry implies that there was a addition of LONG positions today.

Finance Nifty Advance Decline Ratio at 16:03, Finance Nifty Rollover Cost is @20700 closed above it.

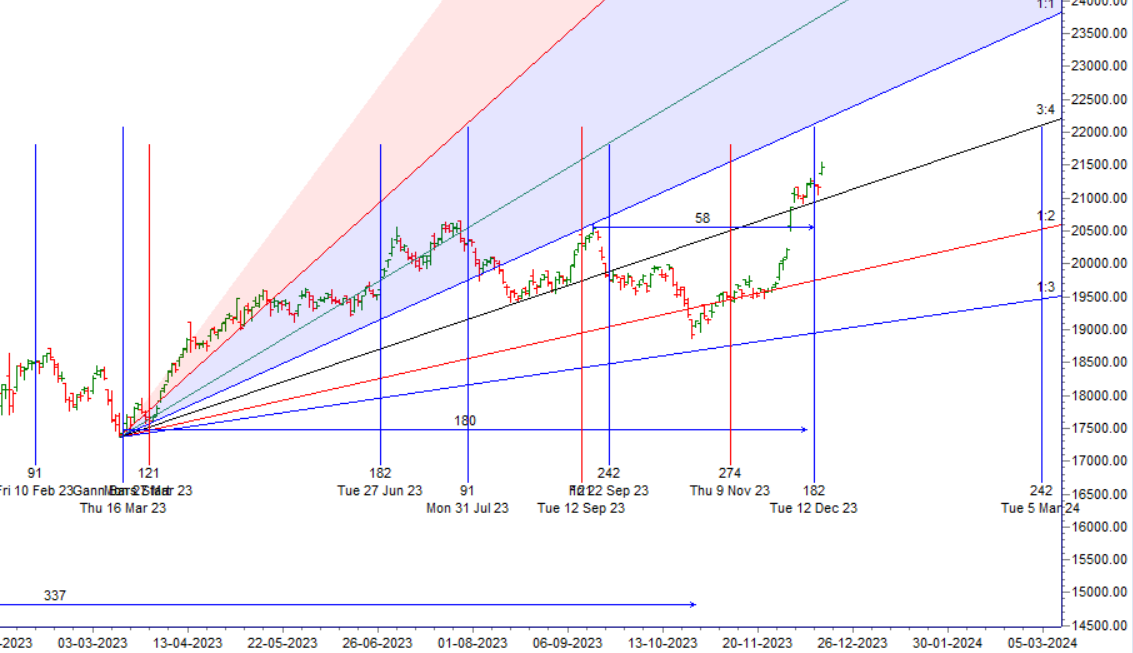

Bank Nifty Gann Monthly Trend Change Level : 20655

Finance Nifty has closed above its 20/50/100/200 DMA, TIll 21075 is held bulls have upper hand and trend is Buy on Dips.

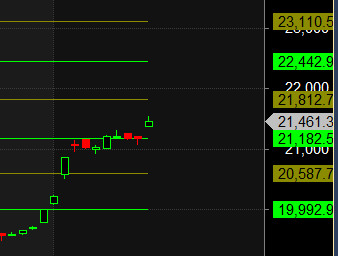

Traders who follow the musical octave trading path may find valuable insights in predicting Bank Nifty’s movements. According to this path, Finance Nifty may follow a path of 20587-21182-21812 . This means that traders can take a position and potentially ride the move as Bank Nifty moves through these levels. Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable.

According to the Finance Nifty options chain, the call side has the highest open interest (OI) at the 21500 strike, followed by the 21600 strike. On the put side, the 21300 strike has the highest OI, followed by the 21200 strike. This indicates that market participants anticipate Finance Nifty to stay within the 21300-21600 range.

The Finance Nifty options chain shows that the maximum pain point is at 21500 and the put-call ratio (PCR) is at 1.05. Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound.

My advice to any new traders is to seek a mentor who will offer you trading skills that will allow you to adapt to any market. What works one month may not work the next. But with fully developed trading skills, you can make the necessary adjustments.

For Positional Traders, The Finance Nifty Futures’ Trend Change Level is At 21082 . Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 21461 , Which Acts As An Intraday Trend Change Level.

Finance Nifty Intraday Trading Levels

Buy Above 21480 Tgt 21512, 21550 and 21585 ( Finance Nifty Spot Levels)

Sell Below 21444 Tgt 21420, 21385 and 21343 ( Finance Nifty Spot Levels)

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.