Analysis of FIIs’ behavior in the Nifty Index Futures market shows a Bullish approach as they displayed a preference for LONG positions. On a net basis, FIIs went LONG 15323 contracts worth 1520 crores, resulting in an decrease of 5615 contracts in the Net Open Interest.

Two Important Aspect are forming tommrow Mars YOD North Node and Venus YOD Jupiter, North Node will lead to volatlity in the market. We have arrived on this aspect and when examining the Mars North Node aspects, which are also referred to as the panic cycle, it typically does not result in an immediate shift in trend. There are instances where the opposition leads to a change in trend, but sometimes it takes a while before the downtrend takes hold. This is because there may be other factors contributing to the stock or index rising. It’s usually a combination of planetary cycles that can determine a change in market trend.

We saw a panic decline in market at 2:47 as discussed in below video and price forming a double top near last swing high of 19850, Tommrow also we have a MARS aspect as discussed in below video so expect another volatile move tommrow also.

Nifty Trade Plan for Positional Trade ,Bulls will get active above 19789 for a move towards 19859/19929. Bears will get active below 19719 for a move towards 19649/19579.

Traders may watch out for potential intraday reversals at 9:34, 10:30,11:18,2:37 How to Find and Trade Intraday Reversal Times

Nifty Nov Futures Open Interest Volume stood at 1.10 lakh cr , witnessing a liquidation of 3.7 lakh contracts. Additionally, the increase in Cost of Carry implies that there was a closeure of LONG positions today.

Nifty Advance Decline Ratio at 31 :19 and Nifty Rollover Cost is @19372 closed below it.

Nifty Gann Monthly Trend Change Level : 19224

Nifty has closed above all short term moving averges . Bulls need a daily close above 19683 for a move towards 19850. — 19850 done today

Nifty options chain shows that the maximum pain point is at 19700 and the put-call ratio (PCR) is at 0.95. Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound.

Nifty 50 Options Chain Analysis

The Nifty 50 options chain indicates that the highest open interest (OI) on the call side is at the 19600 strike, followed by 19700 strikes. On the put side, the highest OI is at the 19500 strike, followed by 19400 strikes. This suggests that the market participants are expecting Nifty 50 to remain range between 19300-19600 levels.

In the cash segment, Foreign Institutional Investors (FII) bought 957 crores, while Domestic Institutional Investors (DII) bought 705 crores.

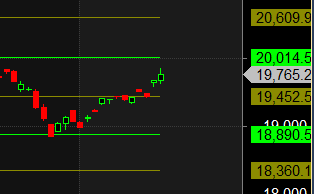

Traders who follow the musical octave trading path may find valuable insights in predicting Nifty’s movements. According to this path, Nifty may follow a path of 18890-19452-20014 This means that traders can take a position and potentially ride the move as Nifty moves through these levels.Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable.

“Years of practice at the game, of constant study, of always remembering, enable the trader to act on the instant when the unexpected happens as well as when the expected comes to pass.”

For Positional Traders, The Nifty Futures’ Trend Change Level is At 19373 . Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 19825 , Which Acts As An Intraday Trend Change Level.

Nifty Intraday Trading Levels

Buy Above 19799 Tgt 19824, 19848 and 19864 ( Nifty Spot Levels)

Sell Below 19743 Tgt 19636, 19601 and 19576 ( Nifty Spot Levels)

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.