Foreign Institutional Investors (FIIs) exhibited a bearish stance in the Bank Nifty Index Futures market by shorting 8,069 contracts with a total value of 538 crores. This activity led to a reduction of 1,621 contracts in the Net Open Interest.

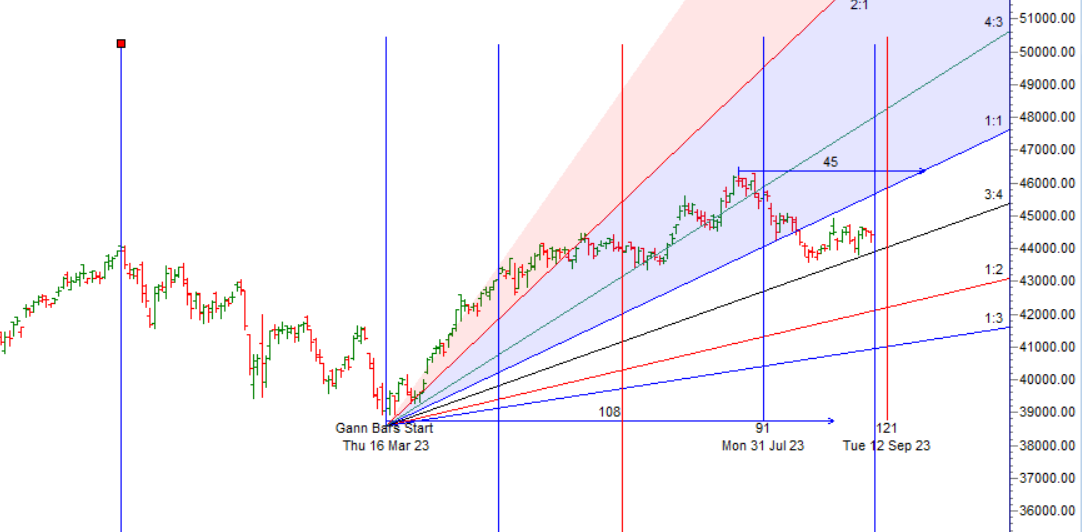

Bank Nifty has once again bounced from its 100-day moving average (DMA), and the price is approaching the time cycle date mentioned on the Gann angle chart for September 7th. As long as the price remains below the range of 44666-44700, the bears, especially with Jupiter in retrograde, have the upper hand. If the price closes below 44300 , this could lead to a sharp decline toward the 44000/43800 level.

Bulls, on the other hand, have an opportunity for a bullish scenario if the price manages to close above 44729 . However, within the range of 44300-44700 , expect choppy and volatile market moves.

Bank Nifty Trade Plan for Positional Trade Bulls will get active above 44458 for a move towards 44668/44877/45086. Bears will get active below 44249 for a move towards 44040/43830.

Traders may watch out for potential intraday reversals at 10:04,11:34,1:24,2:21 How to Find and Trade Intraday Reversal Times

Bank Nifty Sep Futures Open Interest Volume stood at 20.7 lakh, addition of 11.9 lakh contracts. Additionally, the increase in Cost of Carry implies that there was a addition of SHORT positions today.

Bank Nifty Advance Decline Ratio at 2:10 and Bank Nifty Rollover Cost is @44639 closed above it.

Bank Nifty 100 DMA @ 44187 and bounced from it for 6th time in last 1 month.

Traders who follow the musical octave trading path may find valuable insights in predicting Bank Nifty’s movements. According to this path, Bank Nifty may follow a path of 43444-44634-45923 . This means that traders can take a position and potentially ride the move as Bank Nifty moves through these levels. Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable. Price again reacted from 44634

According to the Bank Nifty options chain, the call side has the highest open interest (OI) at the 44500 strike, followed by the 45000 strike. On the put side, the 44000 strike has the highest OI, followed by the 43500 strike.This indicates that market participants anticipate Bank Nifty to stay within the 44200-44700 range. Total Call OI is 56.78 and Total Put OI is 57.73

The Bank Nifty options chain shows that the maximum pain point is at 44400 and the put-call ratio (PCR) is at 0.9. Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound. PCR is on extreme end suggesting we can see sharp reversal .

Trading requires discipline, humility, and a willingness to learn from others, and disrespecting the market would only result in the market not respecting him back.

For Positional Traders, The Bank Nifty Futures’ Trend Change Level is At 44625 . Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 44603, Which Acts As An Intraday Trend Change Level.

Intraday Trading Levels

Buy Above 44444 Tgt 44555, 44666 and 44777 (Bank Nifty Spot Levels)

Sell Below 44385 Tgt 44225, 44108 and 44000 (Bank Nifty Spot Levels)

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.