Analysis of FIIs’ behavior in the Nifty Index Futures market shows a Bullish approach as they displayed a preference for LONG positions. On a net basis, FIIs went LONG 4515 contracts worth 435 crores, resulting in an increase of 15235 contracts in the Net Open Interest. Additionally, they bought 15541 long contracts and added 7444 short contracts, indicating a strategy of adding long positions and of adding short positions. Till Date FII’s are covered 15528 Long and added 6362 SHORT and Retailers are long 28742 contracts and covered 35031 contracts.

- Mars Ingress

- Moon Declination

- “Bayer Rule 2: Trend goes down within 3 days when the speed difference between Mars and Mercury is 59 minutes. Leads to Big Move “

- Saturn Earth Maxium Distance

- Sun Opposition Saturn

Nifty formed a perfect DOJI Impact of Mars Ingress as shown in below video, Tommrow Uranus is turing Direct should Impact IT stocks . Also we have “Bayer Rule 15: VENUS HELIOCENTRIC LATITUDE AT EXTREME AND LEAST SPEEDS FOR MAJOR MOVES Imp Rule” so expect a volatile move tommrow. Venus also having a powerful impact on NIfty.

Nifty Trade Plan Bulls will get active above 19366 for a move towards 19425/19484/19542. Bears will get active below 19250 for a move towards 19191/19132/19074

Traders may watch out for potential intraday reversals at 10:43,11:30,12:39,1:32,2:13 How to Find and Trade Intraday Reversal Times

Nifty July Futures Open Interest Volume stood at 0.85 lakh, witnessing a liquidation of 10.1 lakh contracts. Additionally, the increase in Cost of Carry implies that there was a covering of SHORT positions today.

Nifty Advance Decline Ratio at 29:21 and Nifty Rollover Cost is @19860 and Rollover is at 73.9 %.

Nifty has finally close below 50 SMA with a gap down now 19375-19400 is zone of resistance , Any break of 19234 fast fall towards 18888

Nifty options chain shows that the maximum pain point is at 19300 and the put-call ratio (PCR) is at 0.85 . Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound.

Nifty 50 Options Chain Analysis

The Nifty 50 options chain indicates that the highest open interest (OI) on the call side is at the 19400 strike, followed by 19500 strikes. On the put side, the highest OI is at the 19200 strike, followed by 19100 strikes. This suggests that the market participants are expecting Nifty 50 to remain range between 19200-19400 levels.

According To Todays Data, Retailers Have bought 265 K Call Option Contracts And 450 K Call Option Contracts Were Shorted by them. Additionally, They bought 155 K Put Option Contracts And 128 K Put Option Contracts were Shorted by them, Indicating A BULLISH Bias.

In Contrast, Foreign Institutional Investors (FIIs) bought 167 K Call Option Contracts And 51 K Call Option Contracts Were Shorted by them. On The Put Side, FIIs bought 211 K Put Option Contracts And 218 K Put Option Contracts were Shorted by them, Suggesting They Have Turned To BEARISH Bias.

In the cash segment, Foreign Institutional Investors (FII) sold 1393 crores, while Domestic Institutional Investors (DII) bought 1264 crores.

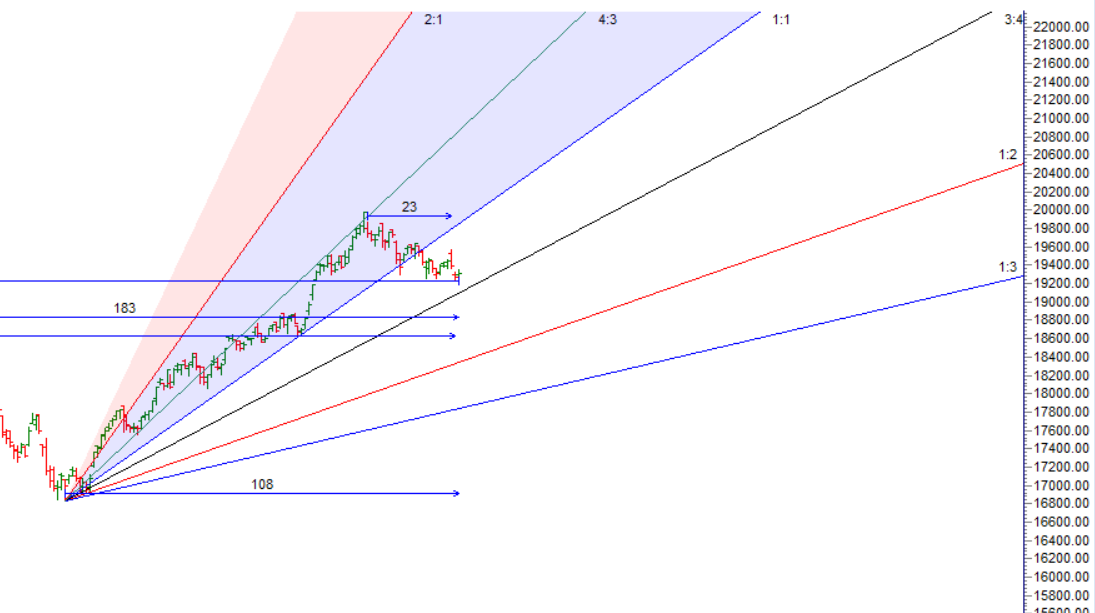

Traders who follow the musical octave trading path may find valuable insights in predicting Nifty’s movements. According to this path, Nifty may follow a path of 18890-19452-20014 This means that traders can take a position and potentially ride the move as Nifty moves through these levels.Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable.Price has closed below 19452 5 days in a row

Many people have a need to be right. That makes it difficult to quickly accept losses, and it makes it especially difficult to flip one’s views. The best traders don’t have a need to be right, and in fact they readily admit that there’s many times they’re wrong.

For Positional Traders, The Nifty Futures’ Trend Change Level is At 19530 . Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 19310 , Which Acts As An Intraday Trend Change Level.

Intraday Trading Levels

Buy Above 19343 Tgt 19385, 19410 and 19444 (Nifty Spot Levels)

Sell Below 19250 Tgt 19225, 19185 and 19144 (Nifty Spot Levels)

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.