Foreign Institutional Investors (FIIs) displayed a Bullish approach in the Bank Nifty Index Futures market by Buying 3609 contracts worth 240 crores, resulting in a increase of 7727 contracts in the Net Open Interest.

Mars is in Libra from August 27-October 12, 2023. Mars is a plannet of energy and Hopefully it will give energy to either bULLS OR bears to get Bank FInance out of this range and lead to a trending move. DOJI formnation before an Astro event is always a good sign for a trending move. Also we are entering 5 Week of the MOnthly expiry which generally leads to trending move.

Bank Nifty saw a decent bounce back today showing Impact of Mars Ingress as shown in below video, Tommrow Uranus is turing Direct should Impact IT stocks and will have oppsoite Impact on Banking Stock which could act volatlity in the Bank Nifty. Also we have “Bayer Rule 15: VENUS HELIOCENTRIC LATITUDE AT EXTREME AND LEAST SPEEDS FOR MAJOR MOVES Imp Rule” so expect a volatile move tommrow.

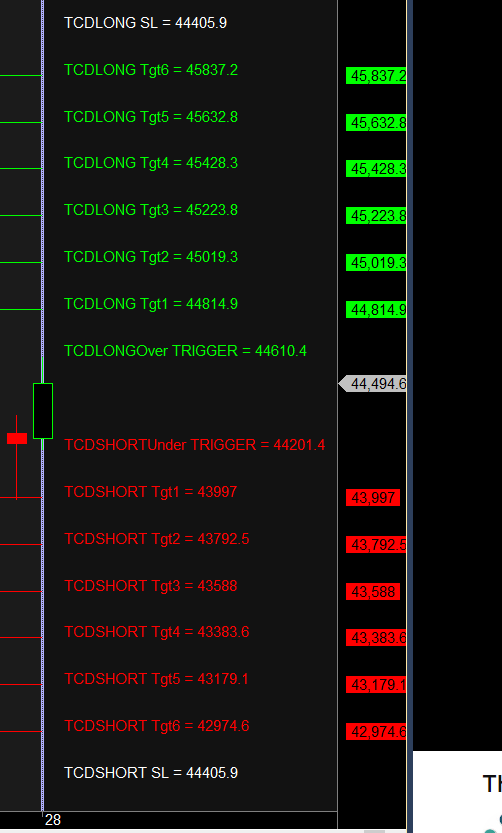

Bank Nifty Trade Plan based on Astro Date Bulls will get active above 44610 for a move towards 44814/45019. Bears will get active below 44200 for a move towards 44000/43796/43600.

Traders may watch out for potential intraday reversals at 10:39,11:31,12:35,1:26,2:11 How to Find and Trade Intraday Reversal Times

Bank Nifty June Futures Open Interest Volume stood at 14.4 lakh, liquidation of 0.67 lakh contracts. Additionally, the increase in Cost of Carry implies that there was a closeure of SHORT positions today.

Bank Nifty Advance Decline Ratio at 10:02 and Bank Nifty Rollover Cost is @46143 and Rollover is at 70.3%

Bank Nifty has reacted from from 20 SMA @44526, Now 43900 @100 DMA can it hold support from 3 time needs to be seen.

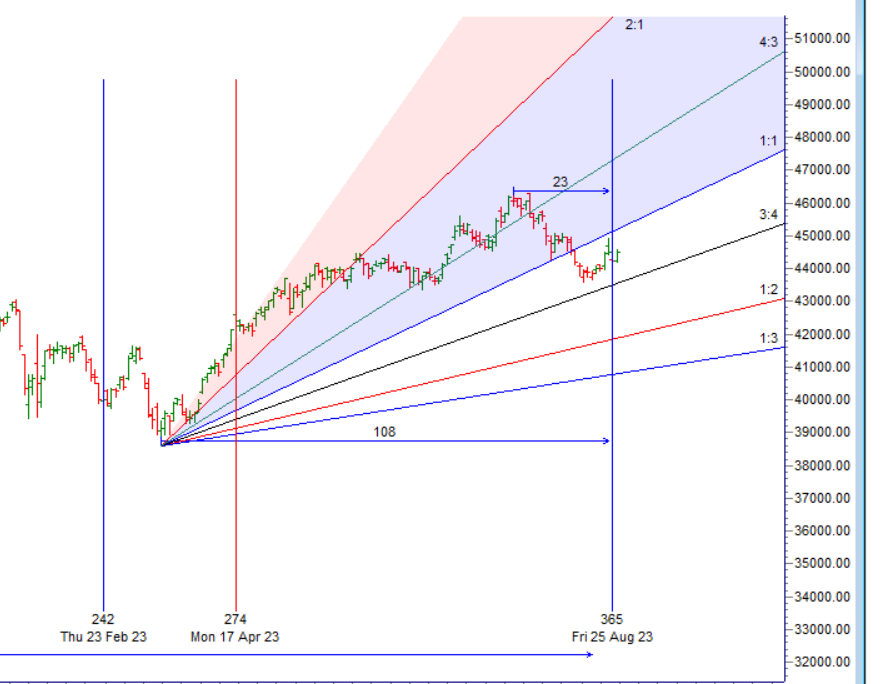

Traders who follow the musical octave trading path may find valuable insights in predicting Bank Nifty’s movements. According to this path, Bank Nifty may follow a path of 43444-44634-45923 . This means that traders can take a position and potentially ride the move as Bank Nifty moves through these levels. Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable. Price again reacted from 44634

According to the Bank Nifty options chain, the call side has the highest open interest (OI) at the 44800 strike, followed by the 45000 strike. On the put side, the 44300 strike has the highest OI, followed by the 44000 strike.This indicates that market participants anticipate Bank Nifty to stay within the 44300-44800 range.

The Bank Nifty options chain shows that the maximum pain point is at 44500 and the put-call ratio (PCR) is at 0.85. Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound. PCR is on extreme end suggesting we can see sharp reversal .

Many people have a need to be right. That makes it difficult to quickly accept losses, and it makes it especially difficult to flip one’s views. The best traders don’t have a need to be right, and in fact they readily admit that there’s many times they’re wrong.

For Positional Traders, The Bank Nifty Futures’ Trend Change Level is At 44761 . Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 44440, Which Acts As An Intraday Trend Change Level.

Intraday Trading Levels

Buy Above 44525 Tgt 44666, 44824 and 45000 (Bank Nifty Spot Levels)

Sell Below 44400 Tgt 44275, 44108 and 44000 (Bank Nifty Spot Levels)

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.

Sell Below 44000 Tgt 44275, 44108 and 44000 (Bank Nifty Spot Levels)

Looks wrong.

If you could change your template a bit and put positional and intraday levels in table format will be really helpful.

Thanks much for sharing your analysis

its 44400 sure will work on it