Analysis of FIIs’ behavior in the Nifty Index Futures market shows a Bulish approach as they displayed a preference for LONG positions. On a net basis, FIIs went LONG 5686 contracts worth 558 crores, resulting in an decrease of 12662 contracts in the Net Open Interest. Additionally, they bought 3756 long contracts and covered 18122 short contracts, indicating a strategy of adding long positions and closing of short positions.

We have 3 Bayers Rule as discussed below and Nifty formed DOJI today so price is getting ready for big move with levels as mentioned.

Bayer Rule 6: The price is in bottom when Mars was in 16 degrees 35 minutes of some sign and plus 30 degrees.

Bayer Rule 7: There are changes on market when Venus or Mars goes over its Aphelium Perihelium (Geocentric).

Bayer Rule 27: Big tops and big major bottoms are when Mercury’s speed in Geocentric longitude is 59 minutes or 1 degree 58 minutes.

Jupiter Square Sun Aspect

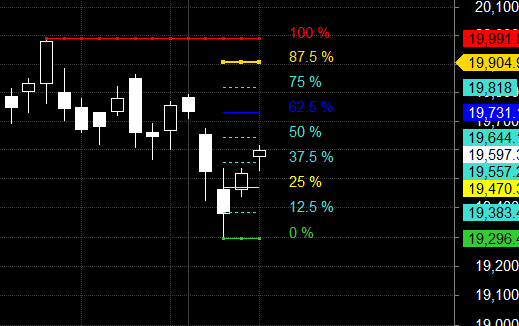

Nifty Bulls need to move above 19644 which is Octave point , Unable to do that fall can extend of 19557/19470/19383.

Traders may watch out for potential intraday reversals at 9:25,11:27,12:39,2:23 How to Find and Trade Intraday Reversal Times

Nifty July Futures Open Interest Volume stood at 1.11 lakh, witnessing a liquidation of 2.2 lakh contracts. Additionally, the increase in Cost of Carry implies that there was a addition of LONG positions today.

Nifty Advance Decline Ratio at 35:14 and Nifty Rollover Cost is @19860 and Rollover is at 73.9 %.

Nifty has broken its 20 SMA support and heading towards 50 SMA @19161

Nifty options chain shows that the maximum pain point is at 19550 and the put-call ratio (PCR) is at 0.94. Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound.

Nifty 50 Options Chain Analysis

The Nifty 50 options chain indicates that the highest open interest (OI) on the call side is at the 19700 strike, followed by 19800 strikes. On the put side, the highest OI is at the 19500 strike, followed by 19400 strikes. This suggests that the market participants are expecting Nifty 50 to remain range between 19400-19700 levels.

According To Todays Data, Retailers Have bought 229 K Call Option Contracts And 239 K Call Option Contracts Were Shorted by them. Additionally, They bought 258 K Put Option Contracts And 245 K Put Option Contracts were Shorted by them, Indicating A BULISH Bias.

In Contrast, Foreign Institutional Investors (FIIs) bought 45.6 K Call Option Contracts And 38 K Call Option Contracts Were Shorted by them. On The Put Side, FIIs bought 49.2 K Put Option Contracts And 52.3 K Put Option Contracts were Shorted by them, Suggesting They Have Turned To NEUTRAL Bias.

In the cash segment, Foreign Institutional Investors (FII) sold 1892 crores, while Domestic Institutional Investors (DII) sold 1080 crores.

Traders who follow the musical octave trading path may find valuable insights in predicting Nifty’s movements. According to this path, Nifty may follow a path of 18890-19452-20014 This means that traders can take a position and potentially ride the move as Nifty moves through these levels.Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable.Price has bounced from 19452

To make One Good Trade you must prepare properly, work hard, and have patience

For Positional Traders, The Nifty Futures’ Trend Change Level is At 19687. Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 19631, Which Acts As An Intraday Trend Change Level.

Intraday Trading Levels

Buy Above 19636 Tgt 19676, 19714 and 19743 (Nifty Spot Levels)

Sell Below 19570 Tgt 19529, 19500 and 19466 (Nifty Spot Levels)

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.