Foreign Institutional Investors (FIIs) displayed a Bullish approach in the Bank Nifty Index Futures market by Buying 2124 contracts worth 245 crores, resulting in a increase of 1104 contracts in the Net Open Interest.

As Discussed in Last Analysis

Negotiators from the White House and the Republican Party came to a tentative agreement late on Saturday to raise the US debt ceiling and prevent a default that threatened to shake the world economy. During a 90-minute phone discussion, President Joe Biden and House Speaker Kevin McCarthy finalised the agreement. Markets have been rallying on the news can this be classic case of Buy rumuor and Sell NEws.

29 May Bayer Rule 27: Big tops and big major bottoms are when Mercury’s speed in Geocentric longitude is 59 minutes or 1 degree 58 minutes. will become active Watch for first 15 mins High and Low to get the trend of the day.

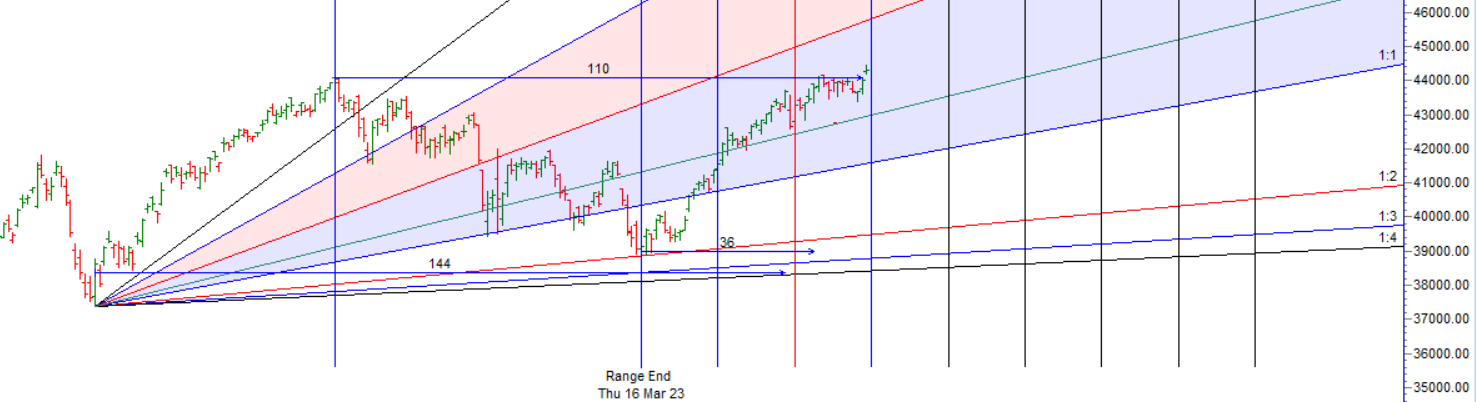

Bank Nifty traded with in the first 15 mins range through out the day. Tommrow again we have Bayers Date and also gann date coming as shown in below Gann angle CHart. Bank Nifty has hit all time high today but no Bank Nifty stocks has hit a all time high suggesting disconnect between Bank Nifty and Bank Nifty stocks. 44151 previous all time high will act as a strong support and bears will have chance below it.

Trade Plan based on Astro Date as discussed in above Video. For Swing Traders Bulls need to move above 44506 for a move towards 44651/44797/44942 . Bears will get active below 44170 for a move towards 44025/43897/43734

Traders may watch out for potential intraday reversals at 9:15,10:55,12:32,2,2:46 How to Find and Trade Intraday Reversal Times

Bank Nifty June Futures Open Interest Volume stood at 20.7 lakh, addition of 0.15lakh contracts. Additionally, the increase in Cost of Carry implies that there was a addition of LONG positions today.

Bank Nifty Advance Decline Ratio at 11:1 and Bank Nifty Rollover Cost is @43908 and Rollover is at 72.2%

Traders who follow the musical octave trading path may find valuable insights in predicting Bank Nifty’s movements. According to this path, Bank Nifty may follow a path of 40789-41967-43216 . This means that traders can take a position and potentially ride the move as Bank Nifty moves through these levels. Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable. Price is has broken 43216 Heading towards 44464 — 44464 done

According to the Bank Nifty options chain, the call side has the highest open interest (OI) at the 44300 strike, followed by the 44500 strike. On the put side, the 44000 strike has the highest OI, followed by the 43800 strike. This indicates that market participants anticipate Bank Nifty to stay within the 43800-44500 range.

The Bank Nifty options chain shows that the maximum pain point is at 44200 and the put-call ratio (PCR) is at 0.88. Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound. PCR is on extreme end suggesting we can see sharp reversal .

Don’t trade on emotion. Trading is a numbers game, and it’s important to make decisions based on logic and analysis, not emotion.

For Positional Traders, The Bank Nifty Futures’ Trend Change Level is At 43990 . Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 44411 , Which Acts As An Intraday Trend Change Level.