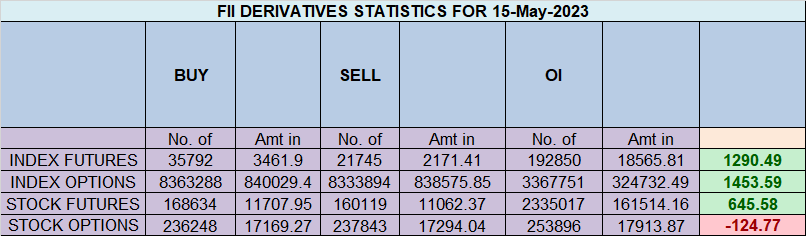

Foreign Institutional Investors (FIIs) displayed a Bullish approach in the Nifty Index Futures market by Buying 14268 contracts worth 1313 crores, resulting in a increase of 3376 contracts in the Net Open Interest. FIIs bought 10418 long contracts and covered 3629 short contracts, indicating a preference for adding new LOng positions .With a Net FII Long Short ratio of 0.99 , FIIs utilized the market rise to enter positions and exit short positions in NIFTY Futures.

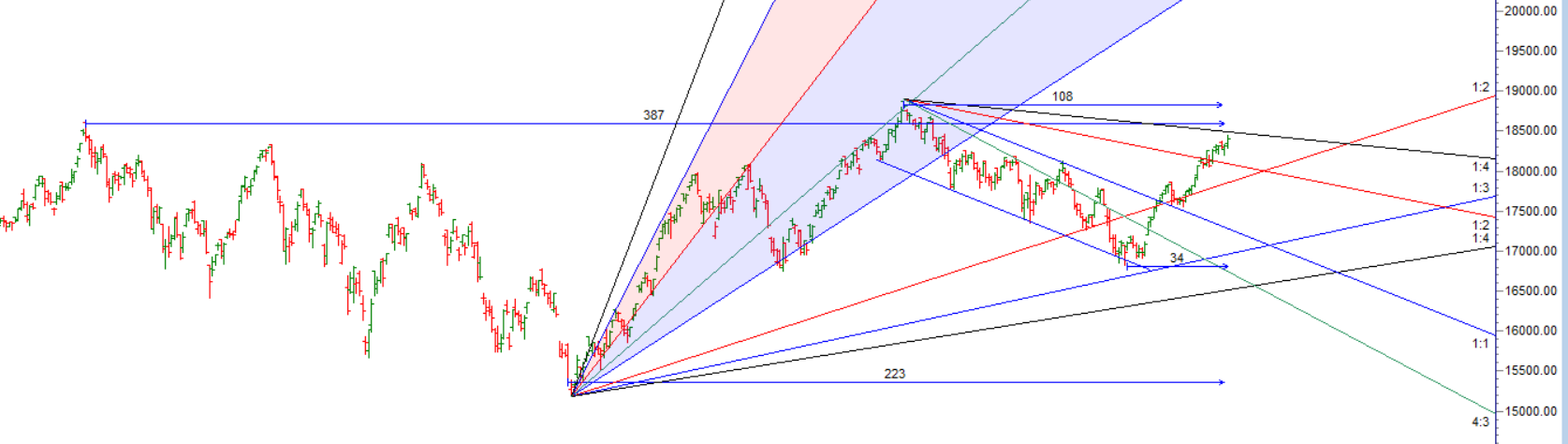

The last Karnataka Election Results were declared on May 15, 2015, and the BJP emerged as the winner. However, during that time, Nifty formed a Gravestone DOJI pattern and went through a short-term correction. It remains to be seen whether history will repeat itself. As of now, Nifty has completed 108 days from its top on December 1, 2022, and Monday will also mark the end of Mercury Retrograde, as discussed in the video below. The high and low of the first 15 minutes will provide guidance for the day. Nifty has also completed 7 week of rise from Mar 20 Low on Weekly time frame. 7 is important number as per gann studies.

Nifty made new high today @18460 All Karnataka Election Talk took a back seat and price contiune to move higher unabated, Price made a bottom on first 15 mins and saw a rally as we have dicussed. Tommrow HDFC and HDFC Bank will go ex-divident and Jupiter is going ingress.

Tommrow we can see selling in HDFC twins as traders who bought for dividend will try to book profits, Again watch for first 15 mins High and Low to get to know the trend of the day.

Lot of traders are looking for reversal but wait for price to give a confirmation there is no point in shorting a raging bull market. First Sign of reversal will come when Nifty break 1 hour below 21 EMA.

Price is also approching 1×4 Gann angle.

For Swing Traders Bulls need to move above 18464 for a move towards 18531/18599/18666. Bears will get active below 18329 for a move towards 18262/18194.

Traders may watch out for potential intraday reversals at 9:48,10:24,11:20,12:09,1:50,2:55 How to Find and Trade Intraday Reversal Times

Nifty May Futures Open Interest Volume stood at 1.15 lakh, witnessing a liquidation of 1.6 lakh contracts. Additionally, the decrease in Cost of Carry implies that there was a closure of SHORT positions today.

Nifty Advance Decline Ratio at 35:15 and Nifty Rollover Cost is @17885 and Rollover is at 58.7 %.

Nifty options chain shows that the maximum pain point is at 18400 and the put-call ratio (PCR) is at 0.97 . Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound.

According To Todays Data, Retailers Have bought 696 K Call Option Contracts And 626 K Call Option Contracts Were Shorted by them. Additionally, They bought 127 K Put Option Contracts And 106 K Put Shorted Option Contracts were added by them, Indicating A NEUTRAL Outlook.

In Contrast, Foreign Institutional Investors (FIIs) bought 106 K Call Option Contracts And 81.3 K Call Option Contracts Were Shorted by them. On The Put Side, FIIs bought 199 K Put Option Contracts And 194 K Put Option Contracts were Shorted by them, Suggesting They Have Turned To A NEUTRAL Bias.

Nifty 50 Options Chain Analysis

The Nifty 50 options chain indicates that the highest open interest (OI) on the call side is at the 18500 strike, followed by 18500 strikes. On the put side, the highest OI is at the 18200 strike, followed by 18100 strikes. This suggests that the market participants are expecting Nifty 50 to remain range between 18200-18400 levels.

In the cash segment, Foreign Institutional Investors (FII) bought 1685 crores, while Domestic Institutional Investors (DII) sold 191 crores.

Traders who follow the musical octave trading path may find valuable insights in predicting Nifty’s movements. According to this path, Nifty may follow a path of 17744-18272-18800 This means that traders can take a position and potentially ride the move as Nifty moves through these levels.Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable. Price has close above 18272

When in trade mind will always get distracted with news/views but as a Traders we need to remain in now moment to be profitable.

For Positional Traders, The Nifty Futures’ Trend Change Level is At 18230 . Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 18410 , Which Acts As An Intraday Trend Change Level.