Swing trading is a trading strategy that focuses on profiting off changing trends in price action over relatively short timeframes. Swing traders will try to capture upswings and downswings in stock prices. Positions are typically held for one to six days, although some may last as long as a few weeks if the trade remains profitable.

The 52-week high/low levels, wherein the stock or index crosses one-year high/low, are considered vital indicators in markets as breaching these levels are seen as a confirmation that the trend is likely to continue, with ferocity, in the respective direction.

Investors and traders believe that the stock crossing the 52-week high or low level has a firm underlying strength / weakness, which may lead to a secular movement in the counter. In general, 52-week high represents a resistance level and 52-week low the support levels, and their breach is considered a key for trend to continue

52-Weeks High Effect in Stocks

The “52-week high effect” states that stocks with prices close to the 52-week highs have better subsequent returns than stocks with prices far from the 52–week highs. Investors use the 52-week high as an “anchor” which they value stocks against. When stock prices are near the 52-week high, investors are unwilling to bid the price all the way to the fundamental value. As a result, investors’ under-react when stock prices approach the 52-week high, and this creates the 52-week high effect.

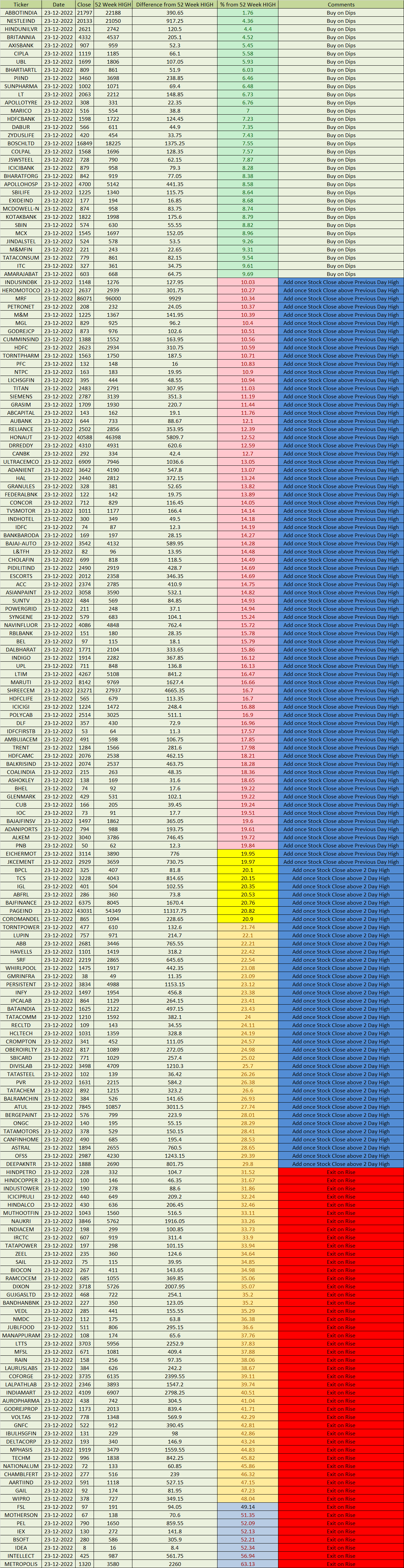

Below are the List of Stocks of Mid Cap Index and % away from their respective 52 Week High. Stocks which have seen dip till 10-15% should be added in the Portfolio.

Below are the List of Stocks which are part of F&O Stocks which are trading near its 52 Week High.