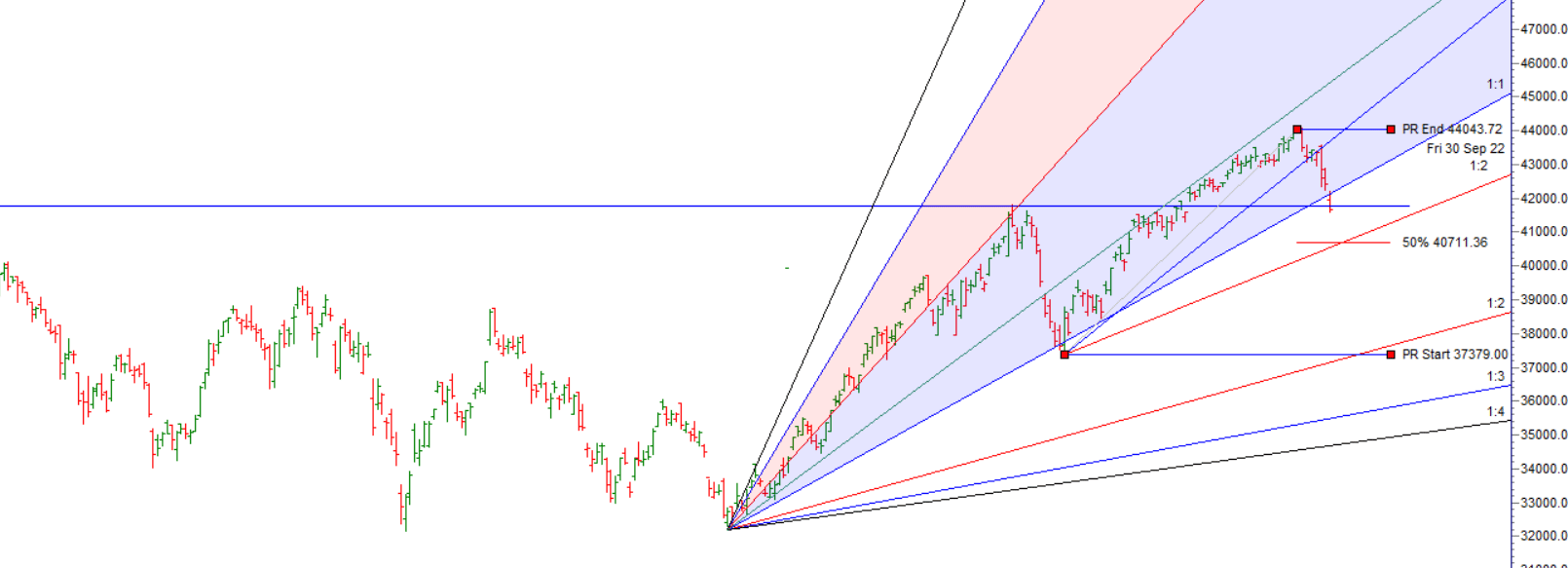

Bayer Rule 31: The trend changes when Venus in declination reached an extreme beyond 23 degrees 26 minutes 51 seconds and we have New Moon also. we are approaching 41840 important zone of support as per below gann chart from where we can see a small bounce.

Bayer Rule 30: The trend changes when Venus in declination passes the extreme declination of the Sun.

Bayer Rule 7: There are changes on market when Venus or Mars goes over its Aphelium Perihelium (Geocentric).

2 Important Bayer Rules are again coming, We have seen fast fall in market reversal will be fast and swift. Bulls need to move above 41801 for a move towards 42005/42413. Bears will get active below 41610 for a move towards 41404/41999.

Intraday time for reversal can be at 9:59/10:49/12:20/1:58/2:45 How to Find and Trade Intraday Reversal Times

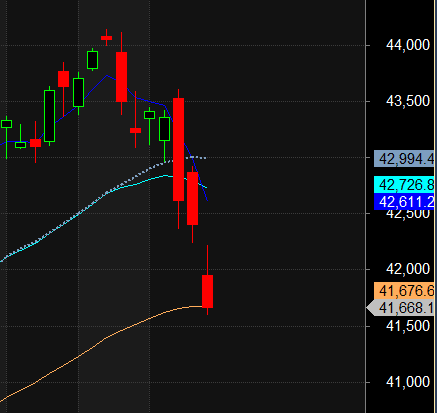

Bank Nifty Dec Future Open Interest Volume is at 20.5 lakh with liquidation of 2.1 Lakh contract , with decrease in Cost of Carry suggesting Short positions were closed today.

Bank Nifty Rollover cost @42828 and Rollover % @81.3 Closed below it,

Bank Nifty above 41676 on closing basis can lead to relief rally till 42611.

Maximum Call open interest of 45 lakh contracts was seen at 43000 strike, which will act as a crucial resistance level and Maximum PUT open interest of 50 lakh contracts was seen at 42000 strike, which will act as a crucial Support level.

MAX Pain is at 41500 and PCR @0.90 . Markets tend be range-bound when PCR OI (Open Interest) ranges between 0.90 and 1.05.

In leveraged trades, it is how you manage risk that eventually decides if you hang on to your profits or proceed to lose it all.

For Positional Traders Trend Change Level is 43388 on Futures go long and short above/below it That will help you stay on the side of Institutions and which has a greater risk-reward ratio. For Intraday Traders 41964 will act as a Intraday Trend Change Level.