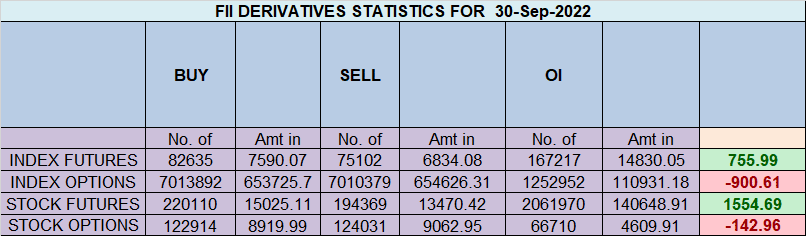

FII bought 7.5 K contract of Index Future worth 755 cores, Net OI has increased by 1.8 K contract 4.7 K Long contract were added by FII and 2.8 K Shorts were covered by FII. Net FII Long Short ratio at 0.18 so FII used rise to enter long and enter short in Index Futures.

Intraday time for reversal can be at 9:15/11:28/12:41/1:34/2:54 How to Find and Trade Intraday Reversal Times

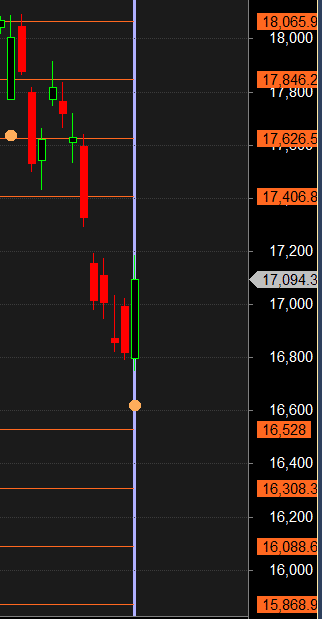

MAX Pain is at 17000 PCR at 0.78 PCR below 0.78 and above 1.3 lead to trending moves, and in between leads to range bound markets.

Maximum Call open interest of 22 lakh contracts was seen at 17200 strike, which will act as a crucial resistance level and Maximum PUT open interest of25 lakh contracts was seen at 16900 strike, which will act as a crucial Support level

Retailers have bought 565 K CE contracts and 613 K CE contracts were shorted by them on Put Side Retailers bought 114 K PE contracts and 101 K PE shorted contracts were added by them suggesting having BEARISH outlook.

FII bought 50.8 K CE contracts and 19.7 K CE were shorted by them, On Put side FII’s bought 73.7 K PE and 101 K PE were shorted by them suggesting they have a turned to Bullish Bias.

Nifty Oct Future Open Interest Volume is at 1.20 Cores with addition of 5.9 Lakh with increase in cost of carry suggesting Long positions were added today.

NIfty Rollover cost @ 17028 and Rollover is at 73.4 % closed above it.

FII’s sold 3599 cores and DII’s bought 3161 cores in cash segment.INR closed at 81.82

NIfty has formed an Outside Bar Pattern Break above 17187 target are 17406/17626/17846/18065. Break of 16747 target are 16528/16308/16008

The person with the smallest ego can take losses quickly. Also, the smaller position usually results in a smaller loss. The smaller the amount of pain the ego has to work through, the less time it will take to get it out of the way