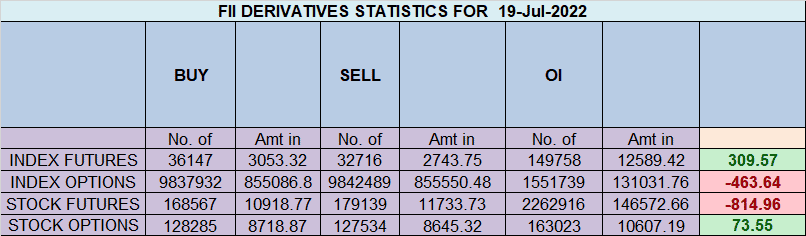

FII bought 3.4 K contract of Index Future worth 309 cores, Net OI has decreased by 5.5 K contract 4.4 K Long contract were added by FII and 1 K Shorts were added by FII. Net FII Long Short ratio at 0.25 so FII used rise to enter long and enter short in Index Futures.

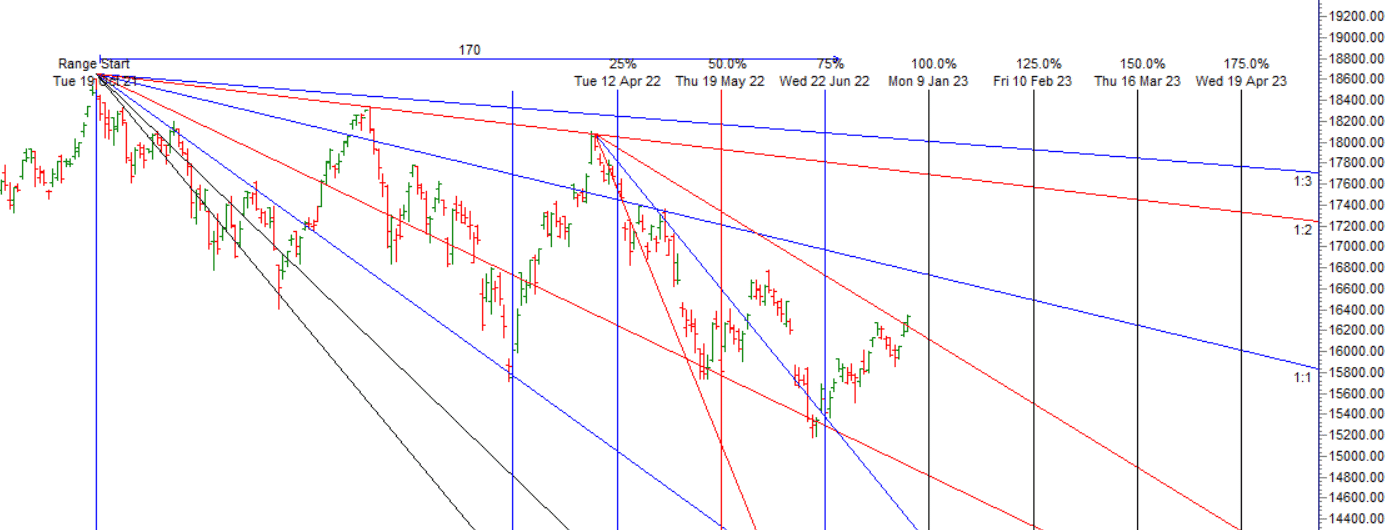

As Discussed in Last Analysis Bulls were able to move above 16236 and did 16299 and now waiting for 16361 where we will hit the gann angle. We have Mercury Ingress tommorow so Rally can continue towards 16594. 16361 done as Mercury Ingress showed its impast as gap down was bought into, now till we are holding today 16269 we are heading towards 16518/16594. Range of 16518-16534 will be a tricky range with lot of supply coming. For Swing Traders Bulls need to move above 16396 for a move towards 16459/16523/16586. Bears will get active below 16269 for a move towards 16205/16142.

Intraday time for reversal can be at 10:54/11:48/12:27/1:39/2:16 How to Find and Trade Intraday Reversal Times

MAX Pain is at 16300 PCR at 0.88 PCR below 0.87 and above 1.3 lead to trending moves, and in between leads to range bound markets.

Nifty July Future Open Interest Volume is at 1.09 Cores with addition of 0.50 Lakh with decrease in cost of carry suggesting Long positions were added today.

Nifty rollover cost @ 15801 and Rollover @66.1 % Closed above the rollover level suggesting bias is Bullish

Nifty Future have 73 Lakh OI added in range of 15933-15670 price zone out of today 1.19 Cores which is more than 60% and yesterday we have closed above 15933 suggesting we should see a move towards 16253 and any close above it Bears will be under water and will rally price towards 16500 by next week based on OI data. Closed above 16253 waiting for 16500.

Maximum Call open interest of 38 lakh contracts was seen at 16400 strike, which will act as a crucial resistance level and Maximum PUT open interest of 30 lakh contracts was seen at 16000 strike, which will act as a crucial Support level. There is total OI of 13.2 Cr on the Call side and 16.2 Cr on the Put side. So, the activity is more on PUT side indicating Option Writers are having BULLISH Bias.

FII’s bought 976 cores and DII’s sold 100 cores in cash segment.INR closed at 77.95

Retailers have bought 207 K CE contracts and 196 K CE contracts were shorted by them on Put Side Retailers bought 499 K PE contracts and 386 K shorted PE contracts were coveed by them suggesting having BEARISH outlook,On Flip Side FII bought 31.3 K CE contracts and 20 K CE were shorted by them, On Put side FII’s bought 51.3 K PE and 56 K PE were shorted by them suggesting they have a turned to BULLISH Bias.

Above 16108 rally towards 16573 as per Musical Octave. Closed above 16108 heading towards 16573.

Many traders think that once they recognize and understand something, they can immediately put it into action. Unfortunately, this is very rarely the case. The reason for this is our neural network. You have to reliably repeat a new behavior at least 400 times in a row.