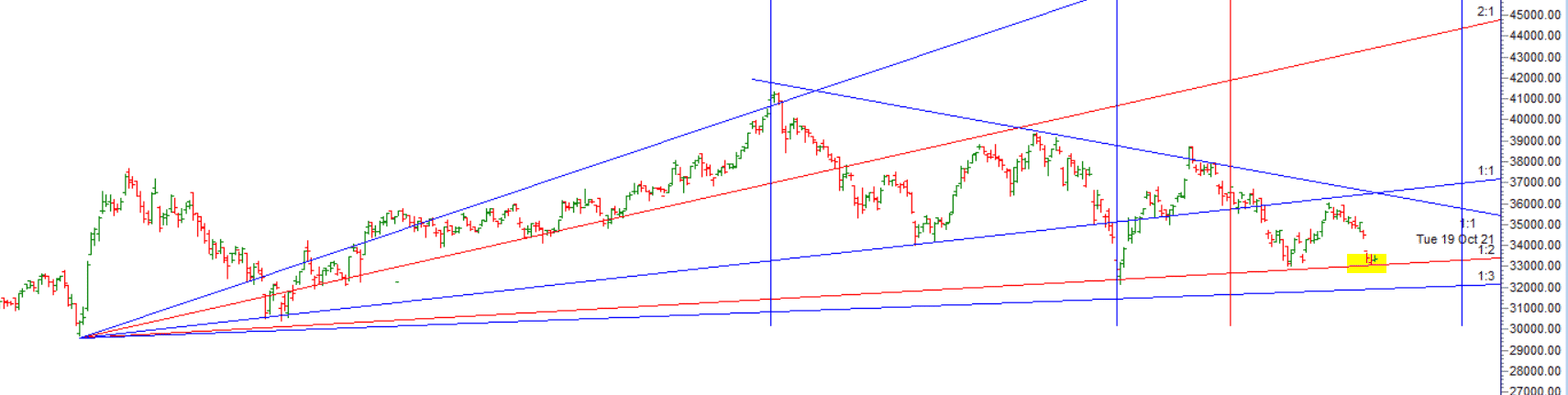

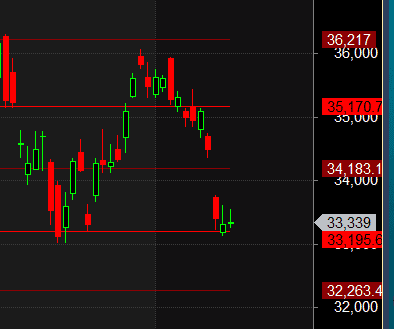

As discussed in Last Analysis Bulls were able to do 1 target on upside and we have formed double bottom and we saw good reversal based on our Astro dates as we will get FOMC decision so carrry expiry positions in Options with Hedge. For Swing traders Bulls need to move above 33487 for a move towards 33669/33851/34033. Bears will get active below 33222 for a move towards 33038/32865/32671. We have 7 important astro date tommrow suggesting it will be high intesity date as discuused in below video most important are the Bayers date Bayer Rule 6: The price is in bottom/top when Mars was in 16 degrees 35 minutes of some sign and plus 30 degrees.Bayer Rule 27: Big tops and big major bottoms are when Mercury’s speed in Geocentric longitude is 59 minutes or 1 degree 58 minutes. Bank Nifty is near gann angle and formed NR7 pattern today. For Swing traders Bulls need to move above 33487 for a move towards 33669/33851/34033. Bears will get active below 33222 for a move towards 33038/32865/32671.

Intraday time for reversal can be at 9:58/11:01/12:43/1:19/2:10 How to Find and Trade Intraday Reversal Times

Bank Nifty May Future Open Interest Volume is at 26 lakh with liquidation of 1.1 Lakh contract , with increase in Cost of Carry suggesting Short positions were closed today.

Bank Nifty rollover cost @ 34598 and Rollover @79.5 % Closed below it.

Below 33195 heading towards 32263 Holding 33195 heading towards 34183/35170 based on Musical Octave Numbers. Today were able to hold

Maximum Call open interest of 26 lakh contracts was seen at 33500 strike, which will act as a crucial resistance level and Maximum PUT open interest of 33 lakh contracts was seen at 33000 strike, which will act as a crucial Support level

MAX Pain is at 33500 and PCR @0.9. PCR below 0.9 and above 1.3 lead to trending moves, and in between leads to range bound markets. So, after all the mayhem, we are probably returning to sanity is what is indicated by the rising PCR.

The most common fault in trading is overthinking—dwelling on the past and not keeping to the trading plan. Besides thinking too much, a trader may believe he is always correct and will refuse to accept the reality of the market. Thus, he should make extra effort to understand more of himself and his emotion, so that he will trade better and feel better.